As Emerging Markets Outperform, Check Out ROAM

This article was originally published on ETFTrends.com.

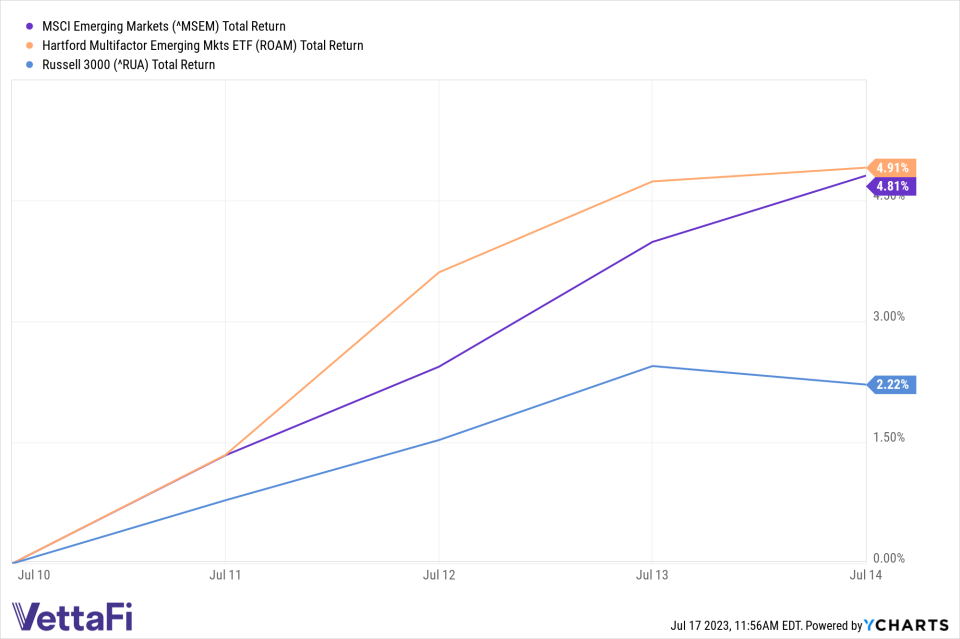

Emerging markets outpaced the U.S. market last week, highlighting the importance of challenging home country bias in client portfolios.

The benchmark MSCI Emerging Markets index outpaced the broad U.S. market, measured by the Russell 3000, by nearly 260 basis points last week. International stocks are also compelling from a valuation standpoint, as they are trading at more attractive multiples than U.S. equities.

“Advisors are increasingly turning to emerging markets that are growing faster than developed international markets. These markets are more likely to have tighter monetary policies setting them up for faster growth.

International equities are currently cheaper than they’ve been 75% of the time over the past 30 years, according to Hartford Funds, making now an ideal time to create or add to an emerging markets allocation.

See more: “ROAM Performance Edge Is in the Details”

Why Many Investors Underallocate to Emerging Markets

Volatility is a key reason why many investors have historically avoided emerging markets. Price swings are generally more extreme in emerging markets than developed markets.

It is possible to access emerging markets with less volatility, however. A multifactor emerging markets ETF like the Hartford Multifactor Emerging Markets ETF (ROAM) targets lower volatility securities.

ROAM offers broad exposure to emerging market equities while also seeking to reduce volatility by targeting a 15% volatility reduction over a complete market cycle.

See more: “Multifactor Emerging Markets ETF ‘ROAM’ Handily Outpaces Benchmark YTD”

ROAM outpaced the emerging markets benchmark by 10 basis points last week, gaining 4.9%. Meanwhile, the U.S. total market benchmark climbed 2.2%, each on a total return basis. Year to date as of July 14, ROAM has climbed 14.5% while the emerging markets benchmark has gained 9.7%.

The return gap is even more significant over longer durations. Over a one-year period, ROAM is up 19.7% while the emerging markets benchmark is up 10.5%. Over three years, ROAM is up 24.4% while the emerging markets benchmark is up 7.1, nonannualized.

For more news, information, and analysis, visit the Multifactor Channel.

Investing involves risk, including the possible loss of principal.

This article was prepared as part of Hartford Funds paid sponsorship with VettaFi. Hartford Funds is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, a recommendation for any product or as investment advice.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM