Emerson Electric: Balancing Dividend Growth and Market Valuations

In my series analyzing Dividend Aristocratscompanies known for consistently increasing their dividends over many decadesI have covered Dover (NYSE:DOV), Procter & Gamble (NYSE:PG), American States Water (NYSE:AWR) and Genuine Parts (NYSE:GPC). Each of these corporations has a remarkable track record of annual dividend increases for a minimum of 67 years.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

This analysis focuses on another dividend champion: Emerson Electric Co. (NYSE:EMR). Like the other four companies, Emerson Electric also has a 67-year history of dividend growth. Its shareholders have the dual benefit of experiencing long-term growth in dividend payments and appreciating share prices.

Navigating through change and innovation

Emerson Electric stands as a global provider of cutting-edge software solutions and intelligent devices, catering to a diverse range of industries, including process industries (power, chemicals and renewables), hybrid industries (metals & mining, life sciences, food & beverages) and discrete industries (automotive, medical and semiconductor). Emerson Electric operates through two primary business units: Intelligent Devices and Software and Control. The Intelligent Devices unit is the major revenue earner, generating $11.59 billion in sales and $2.62 billion in earnings, while the Software and Control unit contributes $3.65 billion in revenue and $422 million in earnings.

Tracing its origins back to 1890, Emerson Electric began as a manufacturer of electric fans and motors and has since evolved into a global technology solutions powerhouse. Recognizing the critical role of portfolio management in driving growth and creating value, the company has undergone a transformation in the last two years. This transformation involved strategic acquisitions and the divestiture of non-core businesses, reshaping the company's focus and structure.

Cash flow and dividend dynamics

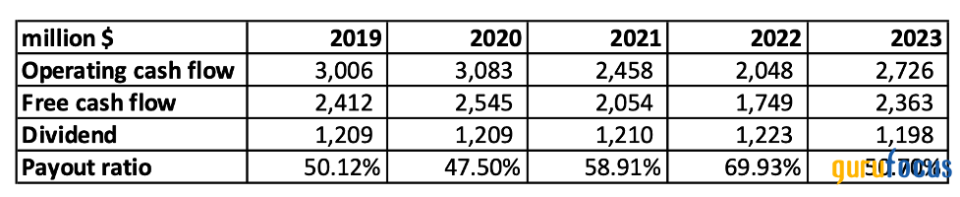

At first glance, the substantial drop in Emerson Electric's operating cash flow in 2023 might concern investors. The operating cash flow increased from $3 billion in 2019 to approximately $3.58 billion in 2021, but sharply declined to $637 million in 2023. This decrease was primarily due to $2.3 billion paid in income taxes, related to the gains from the Copeland and InSinkErator transactions. However, focusing solely on this year's operating cash flow does not provide a complete picture. The income taxes were recorded under operating cash flow, while the $12.5 billion in proceeds from the transactions were recorded under investing cash flow. After adjusting for cash from those discontinued operations, the cash flow from continuing operations in 2023 was around $2.73 billion, and the free cash flow came in at $2.36 billion. The adjusted operating cash flow and free cash flow from 2019 to 2023 are illustrated in the table below:

Emerson Electric's robust free cash flow generation has enabled it to maintain consistent dividend payments over the years, with a payout ratio varying between 47.50% and nearly 70%. In 2023, there was a slight decrease in total dividend payments, but the dividend per share actually increased. This is attributed to the company's ongoing share repurchase strategy, which has reduced the number of outstanding shares. Specifically, the diluted shares outstanding decreased from 601.8 million in 2021 to 577.3 million in 2023, effectively increasing the dividend per share from $2.02 to $2.08 over the same period, even as total dividend payments slightly declined.

Strong balance sheet

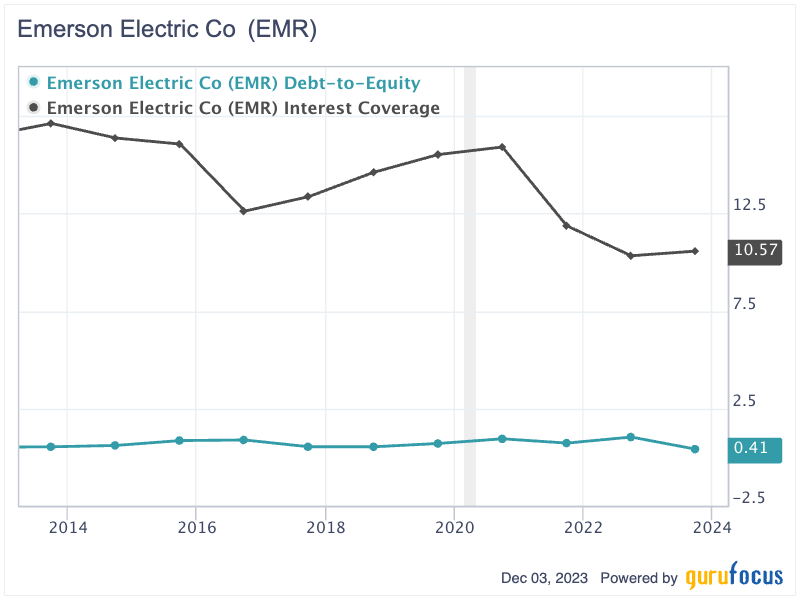

Emerson Electric's balance sheet as of September 2023 demonstrates robust financial stability, highlighted by a significant shareholder's equity of nearly $20.69 billion, including $8.05 billion in cash. The company's interest-bearing debt is manageable at $8.16 billion, leading to a relatively low net debt of just $106 million. Over the past decade, the company has consistently maintained a reasonable debt-to-equity ratio, fluctuating between 0.4 and 1. Additionally, its interest coverage ratio has remained impressively high, with the lowest point in the past 10 years being 10.3 times, reflecting the company's solid financial footing and resilience.

Dividend trends and stock valuation discrepancies

In the past decades, the company has grown the dividend per share from $1.64 to $2.08, translating into 2.4% compounded annual growth. The Gordon Growth Model, ideal for companies with consistent dividend growth, fits well with Emerson Electric considering its remarkable history of nearly seven decades of dividend increases. Projecting the company will maintain its historical dividend growth rate of approximately 2.4%as seen in the previous 10 yearsand apply a discount rate of 8%, the intrinsic value of Emerson Electric is calculated as follows:

P = Expected Dividend for 2024 / (Required Rate of Return - Dividend Growth Rate)

= 2.08 *(1+2.4%) / (8%-2.4%)

= $38

Using the Gordon Growth Model, the company's intrinsic value is calculated to be around $38 per share. This figure contrasts significantly with its current market price of $90 per share, indicating Emerson Electric might be overvalued by approximately 2.4 times. This substantial discrepancy suggests the market price might be reflecting factors beyond the company's dividend growth potential.

Key takeaway

Emerson Electric exemplifies the strengths of a Dividend Aristocrat with its remarkable legacy of consistent dividend growth and financial resilience. The company's evolution from a modest electric fan and motor manufacturer to a global technology solutions leader reflects its adaptability and strategic vision. Despite recent fluctuations in revenue and operating cash flow, Emerson Electric has maintained a robust free cash flow, enabling steady dividend payments and share repurchases, thereby enhancing shareholder value. However, the disparity between its intrinsic value, as suggested by the Gordon Growth Model, and its current market price raises questions about potential overvaluation.

This article first appeared on GuruFocus.