Emerson (EMR), CRT Collaborate to Boost Hydrogen Deployment

Emerson Electric Co. EMR recently partnered with Cavendish Renewable Technology (“CRT”), an Australia Based startup company that specializes in hydrogen technologies. The deal between the two companies is aimed at advancing the deployment of CRT’s innovative hydrogen production solutions by leveraging Emerson’s automation and software portfolio.

Hydrogen is rapidly emerging as the most promising option as the world continues to advance toward sustainable energy targets. Hydrogen technologies have caught the attention of researchers, industries and governments globally due to their potential in reducing greenhouse gas emissions.

Per the deal, EMR will leverage its expertise in automation, together with its portfolio of software, instrumentation, control systems, valves and safety solutions to aid CRT’s hydrogen electrolysers and ammonia processing tools. EMR’s automation technology will also enhance safety and reliability by digitalizing CRT’s operations while speeding up the deployment of hydrogen-based products and solutions.

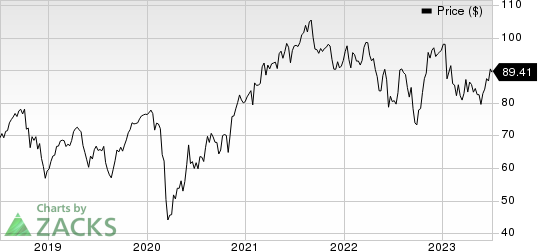

Emerson Electric Co. Price

Emerson Electric Co. price | Emerson Electric Co. Quote

The EMR-CRT collaboration is expected to boost the global deployment of hydrogen technologies to meet the overall energy needs while reducing the carbon footprint.

Zacks Rank & Other Stocks to Consider

EMR currently carries Zacks Rank #2 (Buy). Some other top-ranked companies from the Industrial Products sector are discussed below:

Alamo Group Inc. ALG currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average. In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has increased 29.3% in the year-to-date period.

Axon Enterprise AXON sports a Zacks Rank of 1, at present. The company has a trailing four-quarter earnings surprise of 44.4%, on average.

In the past 60 days, estimates for Axon’s 2023 earnings have increased 12.6%. The stock has rallied 16.7% in the year-to-date period.

A. O. Smith Corporation AOS presently carries a Zacks Rank of 2. AOS’ earnings surprise in the last four quarters was 8%, on average.

In the past 60 days, estimates for A. O. Smith’s 2023 earnings have increased 0.6%. The stock has gained 24.2% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report