Empire State Realty OP LP (ESBA)'s True Worth: A Comprehensive Analysis of Its Market Value

The stock of Empire State Realty OP LP (ESBA) experienced a daily loss of -5.33%, but with a 3-month gain of 13.52%, and an Earnings Per Share (EPS) of 0.29. The question is, is the stock modestly undervalued? This article delves into a valuation analysis to answer this question. Keep reading to learn more.

Company Introduction

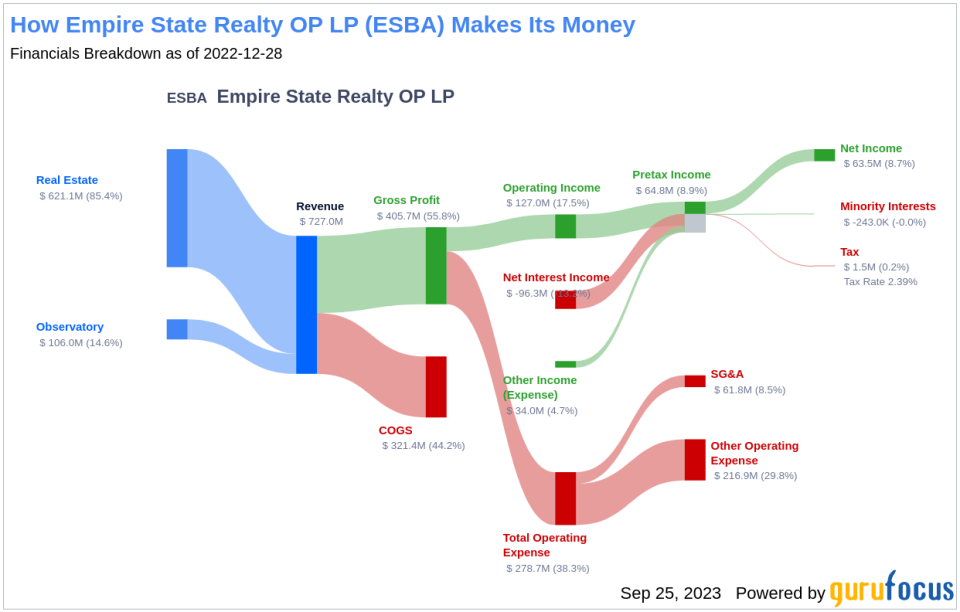

Empire State Realty OP LP is the operating partner of Empire State Realty Inc. The company, along with its partner, manages, operates, acquires, and repositions properties in Manhattan and the greater New York metropolitan area. The firm operates in two segments: Real Estate and Observatory. The Real Estate segment offers services related to the ownership, management, operation, acquisition, repositioning, and disposition of its real estate assets. The Observatory segment operates the two observatories of the Empire State Building. The company generates maximum revenue from the Real Estate segment.

At its current price of $7.63 per share, Empire State Realty OP LP has a market cap of $2.10 billion. The stock's GF Value, an estimation of fair value, is $9.76. This suggests that the stock is modestly undervalued.

GF Value Summary

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. This value is based on historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance.

Empire State Realty OP LP's stock appears to be modestly undervalued based on GuruFocus' valuation method. As the company is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

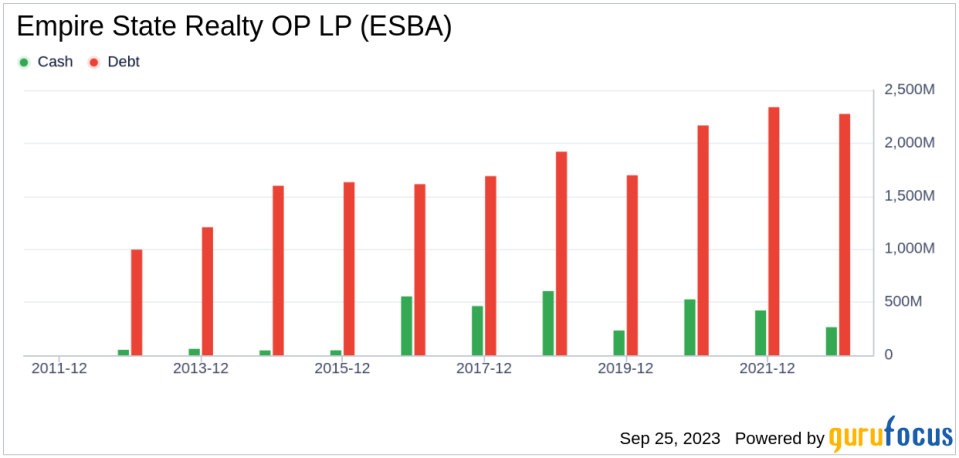

Investing in companies with low financial strength could result in permanent capital loss. Therefore, it's important to carefully review a company's financial strength before deciding whether to buy shares. Empire State Realty OP LP has a cash-to-debt ratio of 0.14, which ranks better than 71.06% of 729 companies in the REITs industry. Based on this, GuruFocus ranks Empire State Realty OP LP's financial strength as 4 out of 10, suggesting a poor balance sheet.

Profitability and Growth

Investing in profitable companies, especially those that have demonstrated consistent profitability over the long term, poses less risk. Empire State Realty OP LP has been profitable 8 over the past 10 years. Over the past twelve months, the company had a revenue of $720.20 million and Earnings Per Share (EPS) of $0.29. Its operating margin is 19.18%, which ranks worse than 81.86% of 689 companies in the REITs industry. Overall, GuruFocus ranks the profitability of Empire State Realty OP LP at 7 out of 10, indicating fair profitability.

One of the most important factors in the valuation of a company is growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. The average annual revenue growth of Empire State Realty OP LP is 3.1%, which ranks better than 60.22% of 636 companies in the REITs industry. The 3-year average EBITDA growth is 6.9%, which ranks better than 64.3% of 535 companies in the REITs industry.

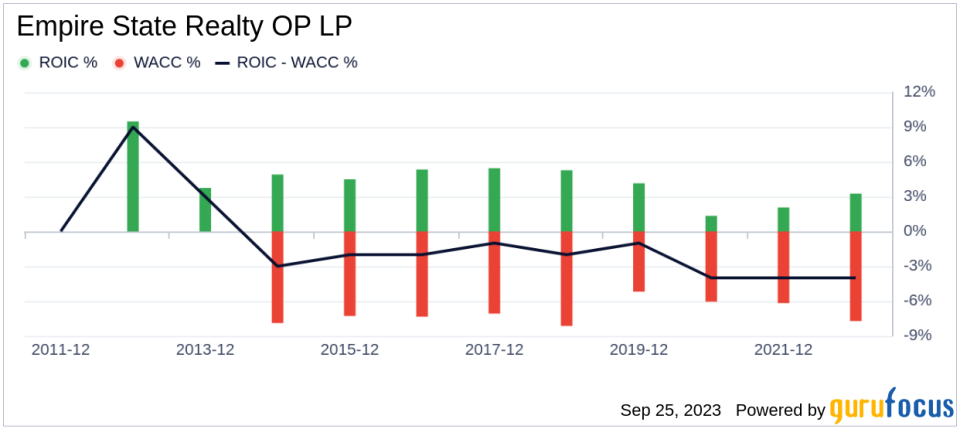

ROIC vs WACC

Another method of determining the profitability of a company is to compare its return on invested capital (ROIC) to the weighted average cost of capital (WACC). When the ROIC is higher than the WACC, it implies the company is creating value for shareholders. For the past 12 months, Empire State Realty OP LP's return on invested capital is 3.54, and its cost of capital is 10.17.

Conclusion

Overall, Empire State Realty OP LP (ESBA) stock appears to be modestly undervalued. The company's financial condition is poor and its profitability is fair. Its growth ranks better than 64.3% of 535 companies in the REITs industry. To learn more about Empire State Realty OP LP stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.