Employers Holdings' (EIG) Shares Rise 4% on Q4 Earnings Beat

Shares of Employers Holdings, Inc. EIG have risen 3.9% since it reported better-than-expected fourth-quarter 2023 results on Feb 15. The quarterly results were aided by sound growth in premiums written, robust audit premium recognition and favorable underwriting results. A slight year-over-year increase in overall expenses partly negated the results.

EIG reported fourth-quarter adjusted earnings per share (EPS) of $1.40, which surpassed the Zacks Consensus Estimate by 40%. The bottom line improved 12% year over year.

Total revenues grew 1.8% year over year to $225.7 million. The top line beat the consensus mark by 5.8%.

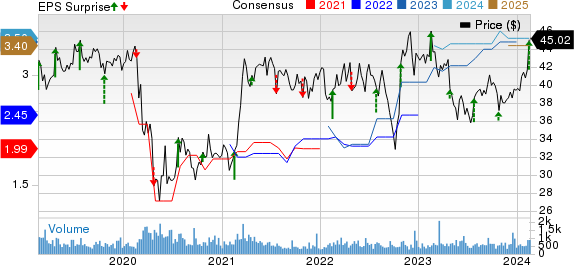

Employers Holdings Inc. Price, Consensus and EPS Surprise

Employers Holdings Inc. price-consensus-eps-surprise-chart | Employers Holdings Inc. Quote

Q4 Update

Gross premiums written of $178.2 million advanced 3% year over year in the quarter under review on the back of new business growth and higher renewal rates. Net premiums written of $176.4 million increased 3% year over year.

Net premiums earned of Employers Holdings amounted to $187.5 million, which improved 4% year over year but lagged the Zacks Consensus Estimate of $190 million.

Net investment income slipped 3% year over year to $26.2 million in the fourth quarter due to a decline in invested balances of fixed maturity securities, short-term investments and cash and cash equivalents. Yet, the metric beat the consensus mark of $25.6 million.

Total expenses of $167.5 million inched up 1% year over year. Losses and loss adjustment expenses recorded a 2% year-over-year rise due to growth in net premiums earned. Commission expenses, underwriting, and general and administrative expenses remained consistent year over year.

EIG reported an adjusted net income of $36.1 million in the quarter under review, which grew 5% year over year.

Policies in force were a record level of 126,409 as of Dec 31, 2023, which increased 4.2% year over year.

The combined ratio improved 250 basis points (bps) year over year to 88.1% and also came lower than the Zacks Consensus Estimate of 95%. Underwriting and general and administrative expense ratio improved 120 bps year over year to 24.6%.

Segmental Update

Employers Holdings integrated the operations of the Cerity segment within the Employers unit during the fourth quarter and as a result, has returned to being a reporter of a single unit. This integration is likely to fetch significant fixed underwriting expense savings for the company in the days ahead.

Financial Update (as of Dec 31, 2023)

Employers Holdings exited the fourth quarter with investments, cash and cash equivalents of $2.5 billion, which fell 5.8% from the 2022-end level.

Total assets of $3.6 billion declined 4.5% from the figure at 2022 end.

Total stockholders’ equity improved 7.4% from the 2022-end level to $1 billion.

Adjusted book value per share was $47.26 as of Dec 31, 2023, which rose 8% year over year.

Annualized adjusted return on stockholders’ equity of 12.2% improved 60 bps year over year in the quarter under review.

Capital Deployment Update

Employers Holdings bought back shares worth $77.1 million in 2023. It had a leftover capacity of $16.2 million under its repurchase authorization as of Feb 15, 2024.

Management paid out regular quarterly dividends of $29.4 million last year.

Full-Year Update

EIG’s adjusted EPS climbed 31% year over year to $3.83 in 2023. Total revenues of $850.9 million improved 19.3% year over year.

Gross premiums written rose 7% year over year to $767.7 million. Net premiums written of $760.6 million grew 8% year over year.

Net premiums earned advanced 7% year over year to $721.9 million. Net investment income of $106.5 million climbed 19% year over year in 2023.

Adjusted net income grew 26% year over year to $101.7 million.

The combined ratio of 95% improved 190 bps year over year.

Zacks Rank

Employers Holdings currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have reported fourth-quarter 2023 results so far, the bottom-line results of RLI Corp. RLI, RenaissanceRe Holdings Ltd. RNR and Kinsale Capital Group, Inc. KNSL beat their respective Zacks Consensus Estimate.

RLI reported fourth-quarter 2023 operating earnings of $1.54 per share, beating the Zacks Consensus Estimate by 6.9%. The bottom line improved 0.6% from the year-ago quarter. Operating revenues for the reported quarter were $378.4 million, up 15% year over year. The top line, however, missed the consensus estimate by 2%.

Gross premiums written increased 13% year over year to $434.4 million. Net investment income of RLI increased 14.4% year over year to $32.5 million. The investment portfolio’s total return was 6.4%. Underwriting income of $59.8 million increased 10.9%. The combined ratio deteriorated 60 bps year over year to 82.7%.

RenaissanceRe’s fourth-quarter 2023 operating income of $11.77 per share beat the Zacks Consensus Estimate by 44.8%. The bottom line increased 60.6% year over year. Total operating revenues increased 42.5% year over year to $2.6 billion in the fourth quarter. The top line outpaced the consensus mark by 19.6%.

RNR’s net premiums earned improved 38.5% year over year to $2.2 billion. The net investment income amounted to $377 million, which increased 11.6% year over year in the quarter under review. It reported an underwriting income of $541 million, which surged 71% year over year. The combined ratio improved 450 bps year over year to 76% in the fourth quarter.

Kinsale Capital delivered fourth-quarter 2023 net operating earnings of $3.87 per share, which outpaced the Zacks Consensus Estimate by 12.5%. The bottom line increased 48.8% year over year. Operating revenues jumped 41.5% year over year to about $351.2 million. Revenues beat the consensus estimate by 3.8%. Gross written premiums of $395.2 million rose 33.8% year over year.

Net written premiums of KNSL climbed 26.5% year over year to $306.3 million. Its underwriting income was $84.8 million, which grew 42.6% year over year. The combined ratio improved 100 bps to 72.1% in the quarter under review. While the expense ratio improved 190 bps to 19.9% in the quarter, the loss ratio deteriorated 90 bps to 52.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report