Enanta Pharmaceuticals Inc (ENTA) Reports Fiscal Q1 2024 Results: Royalty Revenue Declines Amid ...

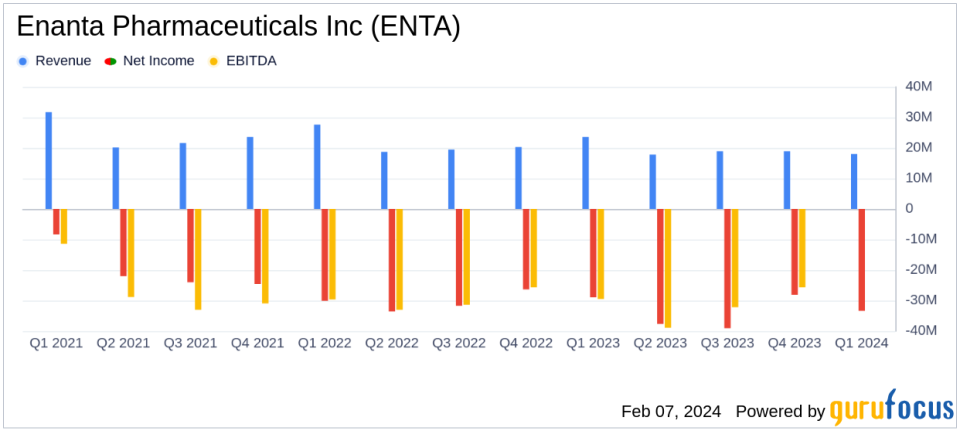

Revenue: Royalty revenue decreased to $18.0 million in Q1 2024 from $23.6 million in Q1 2023.

Net Loss: Net loss widened to $33.4 million, or $1.58 per diluted share, compared to a net loss of $29.0 million, or $1.39 per diluted share in the prior year.

R&D Expenses: Research and development expenses decreased to $36.4 million from $40.9 million year-over-year.

G&A Expenses: General and administrative expenses increased to $16.5 million, up from $12.7 million in the same period last year.

Cash Position: Cash and marketable securities totaled $337.2 million, with sufficient funding projected through fiscal year 2027.

Pipeline Update: Progress in RSV Phase 2 studies and expansion into immunology with a new KIT inhibitor program.

On February 7, 2024, Enanta Pharmaceuticals Inc (NASDAQ:ENTA) released its 8-K filing, detailing the financial results for its fiscal first quarter ended December 31, 2023. The company, known for its innovative approach to developing molecule drugs for viral infections and liver diseases, reported a decrease in royalty revenue and a widened net loss compared to the same quarter in the previous year.

Financial Performance

ENTA's total revenue for the quarter was $18.0 million, a decline from the $23.6 million reported in the previous year's first quarter. This revenue primarily consisted of royalties from MAVYRET/MAVIRET, AbbVies treatment for chronic hepatitis C virus (HCV). The decrease in revenue is partly due to a royalty sale transaction with OMERS, resulting in 54.5% of ongoing royalties being paid to the pension plan.

Research and development expenses saw a decrease to $36.4 million, down from $40.9 million in the prior year, primarily due to reduced costs in the company's COVID-19 program. Conversely, general and administrative expenses rose to $16.5 million, up from $12.7 million, driven by increased stock compensation expense and legal fees related to a patent infringement suit against Pfizer.

ENTA recorded a net loss of $33.4 million, or $1.58 per diluted share, for the quarter, compared to a net loss of $29.0 million, or $1.39 per diluted share, in the same period last year. The company's cash reserves, including cash equivalents and short-term marketable securities, stood at $337.2 million, positioning it to fund its operations and development programs through fiscal year 2027.

Strategic Developments and Pipeline Progress

ENTA's President and CEO, Jay R. Luly, Ph.D., highlighted the company's focus on execution and value creation across its pipeline. The company is preparing for multiple catalysts, particularly in its RSV program, with anticipated topline data from Phase 2 studies expected in the third quarter of 2024. Additionally, ENTA has expanded into immunology with a new discovery program of oral KIT inhibitors for the treatment of chronic spontaneous urticaria (CSU), aiming to select a development candidate in 2024.

The company's RSV portfolio includes zelicapavir, an oral N-protein inhibitor, and EDP-323, an oral L-protein inhibitor, both of which are progressing through Phase 2 studies. ENTA also plans to introduce a second immunology program in 2024, further diversifying its research endeavors.

Conclusion

While ENTA faces challenges with a decrease in royalty revenue and a net loss, the company's strategic advancements in its RSV and immunology pipelines demonstrate a commitment to addressing unmet medical needs. Investors and stakeholders will be watching closely as ENTA progresses towards its anticipated catalysts in the coming year.

For more detailed information and analysis on Enanta Pharmaceuticals Inc (NASDAQ:ENTA)'s financials and prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Enanta Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.