Enbridge (ENB) Looking to Increase Mainline Pipeline Capacity

Enbridge Inc. ENB is considering increasing its Mainline system capacity by 200,000 barrels per day (bpd) to reach 3.2 million bpd.

Enbridge’s Mainline system ships the bulk of Canada crude to the United States. It is one of the largest and most important crude oil pipeline systems in North America.

Enbridge will consider advancing the expansion plans only after the government-owned Trans Mountain expansion (“TMX”) project becomes operational. Once completed, TMX will introduce an additional 590,000 bpd of pipeline capacity to Canada’s Pacific Coast, positioning it as a competitor to the Mainline.

The project, which has experienced significant delays, is encountering further setbacks due to a last-minute route deviation request in British Columbia. The project has an initial operational start date scheduled for the first quarter of 2024.

Once TMX comes online, western Canada will possess more export capacity. However, oil companies are already ramping up production in anticipation of the additional pipeline capacity. The longer TMX experiences delays, the greater the risk of western Canada export pipelines reaching their maximum capacity.

Per Enbridge, the capacity for transporting crude oil on the system will be limited in October due to the increased demand surpassing the available capacity. As a result, light crude volumes will see a 7% cut, whereas heavy crude volumes will face a 10% reduction in allocation.

Enbridge’s plan to expand the Mainline oil pipeline capacity aims to address the growing demand for oil transportation services, support increased oil production and maintain its competitive position in the market.

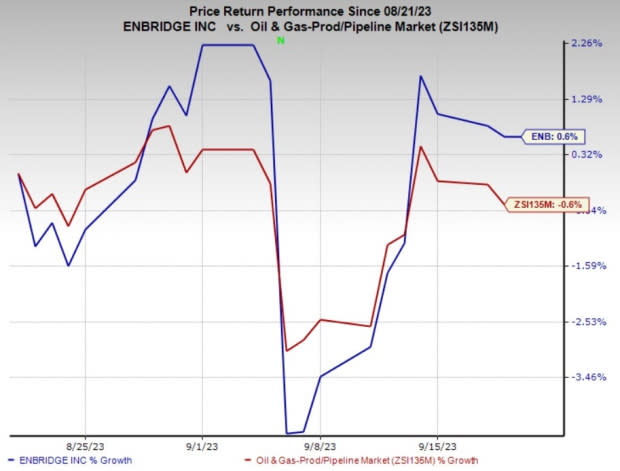

Price Performance

Shares of Enbridge have outperformed the industry in the past month. The stock has gained 0.6% against the industry’s 0.6% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Enbridge currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

USA Compression Partners, LP USAC is one of the largest independent natural gas compression service providers across the United States in terms of fleet horsepower.

USA Compression Partners has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for USAC’s 2023 and 2024 earnings per share is pegged at 30 cents and 58 cents, respectively.

Enerplus Corporation ERF is an independent oil and gas production company with resources across Western Canada and the United States.

Enerplus has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 30 days. The consensus estimate for ERF’s 2023 and 2024 earnings per share is pegged at $2.26 and $2.66, respectively.

Helix Energy Solutions Group, Inc. HLX is an international offshore energy company that provides specialty services to the offshore energy industry, with a focus on their growing well intervention and robotics operations. HLX has witnessed upward earnings estimate revisions for 2023 and 2024 over the past 60 days.

The Zacks Consensus Estimate for Helix Energy’s 2023 and 2024 earnings per share is pegged at 48 cents and 87 cents, respectively. HLX currently has a Zacks Style Score of A for Momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enbridge Inc (ENB) : Free Stock Analysis Report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report