Encore Wire Corp Reports Record Copper Shipments in Q4, Despite Lower Annual Net Sales and Net ...

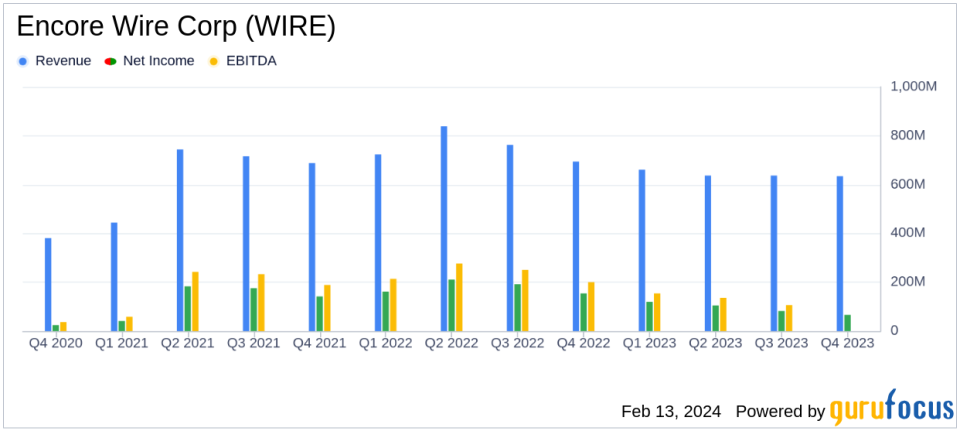

Net Sales: $2.568 billion for FY 2023, down from $3.018 billion in FY 2022.

Net Income: $372.4 million for FY 2023, a decrease from $717.8 million in FY 2022.

Earnings Per Share: $21.62 for FY 2023, compared to $36.91 in FY 2022.

Gross Profit Margin: 25.5% for FY 2023, down from 36.9% in FY 2022.

Copper Unit Volumes: Increased by 6.7% in FY 2023 compared to FY 2022.

Capital Expenditures: $164.5 million in 2023, with future projections for 2024-2026.

Share Repurchases: 2,661,792 shares repurchased in FY 2023, with a total cash outlay of $460.2 million.

On February 13, 2024, Encore Wire Corp (NASDAQ:WIRE) released its 8-K filing, detailing the financial performance for the fourth quarter and the full year ended December 31, 2023. The company, a leading manufacturer of electrical building wire and cable, reported a record number of copper pounds shipped in the fourth quarter, marking the strongest volume quarter of 2023. Despite this, the company faced a decrease in net sales and net income for the year.

Encore Wire Corp's net sales for the year ended December 31, 2023, were $2.568 billion, a decrease from $3.018 billion for the year ended December 31, 2022. The decrease in net sales dollars was primarily due to a reduction in the average selling prices in 2023 compared to 2022, which was partially offset by increased volumes. The company's gross profit percentage for the year was 25.5%, a decline from 36.9% during the same period in 2022. The average selling price of wire per copper pound sold decreased by 17.8% in 2023 versus 2022, while the average cost of copper per pound purchased decreased by 3.7%.

Net income for the year ended December 31, 2023, was $372.4 million, compared to $717.8 million in the same period in 2022. Fully diluted net earnings per common share were $21.62 for the year, versus $36.91 in the previous year. The company also reported capital expenditures of $164.5 million in 2023 and repurchased 476,300 shares in the fourth quarter of 2023, with a total cash outlay for share repurchases of $85.1 million in the fourth quarter and $460.2 million for the full year.

Financial Performance and Strategic Initiatives

Encore Wire Corp's Chairman, President, and CEO, Daniel L. Jones, commented on the results, highlighting the record shipment of copper pounds due to strong demand for the company's products. He emphasized the company's competitive advantage through its single-site, build-to-ship model and operational excellence. Jones also noted the company's strong balance sheet, commitment to returning capital to shareholders, and ongoing investments in increasing capacity, efficiency, and vertical integration.

The company's balance sheet remains robust, with $560.6 million in cash as of December 31, 2023. The company has no long-term debt, and its revolving line of credit remains untapped. The share repurchase reauthorization by the Board of 2,000,000 shares of the Company's common stock through March 31, 2025, demonstrates the company's commitment to shareholder value.

Looking Ahead

Encore Wire Corp plans to continue its investment in the business, with capital expenditures expected to range from $130 - $150 million in 2024, $130 - $150 million in 2025, and $100 - $120 million in 2026. These investments are expected to be funded with existing cash reserves and operating cash flows. The company's focus on operational agility, speed to market, and deep supplier relationships are seen as competitive advantages in serving customers' needs and capturing market share in the current economic environment.

Encore Wire Corp will host a conference call to discuss the fourth quarter and full year results on February 14, 2024, providing an opportunity for investors and analysts to gain further insights into the company's performance and strategic direction.

For value investors and potential GuruFocus.com members interested in the industrial products sector, Encore Wire Corp's latest financial results provide a comprehensive overview of the company's current position and future outlook. The company's ability to navigate market challenges while maintaining a strong balance sheet and investing in growth initiatives may offer potential opportunities for investment consideration.

Explore the complete 8-K earnings release (here) from Encore Wire Corp for further details.

This article first appeared on GuruFocus.