Endeavor (NYSE:EDR) Beats Q4 Sales Targets

Global talent agency and entertainment company Endeavor (NYSE:EDR) reported Q4 FY2023 results exceeding Wall Street analysts' expectations , with revenue up 25.6% year on year to $1.58 billion. It made a GAAP loss of $0.03 per share, down from its profit of $1.03 per share in the same quarter last year.

Is now the time to buy Endeavor? Find out by accessing our full research report, it's free.

Endeavor (EDR) Q4 FY2023 Highlights:

Revenue: $1.58 billion vs analyst estimates of $1.52 billion (4.4% beat)

EPS: -$0.03 vs analyst estimates of $0.03 (-$0.06 miss)

Gross Margin (GAAP): 59.2%, down from 63.2% in the same quarter last year

Market Capitalization: $7.34 billion

“2023 was a transformational year for Endeavor as we strengthened our positions in sports and entertainment through many of our industry-leading assets,” said Ariel Emanuel, CEO of Endeavor.

Owner of the UFC, WWE, and a client roster including Christian Bale, Endeavor (NYSE:EDR) is a diversified global entertainment, sports, and content company known for its talent representation and involvement in the entertainment industry.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

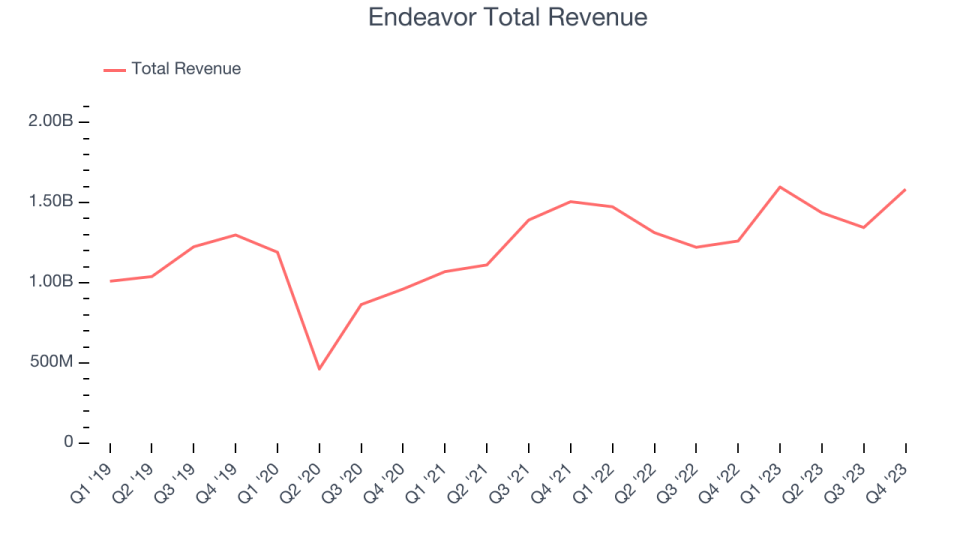

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Endeavor's annualized revenue growth rate of 6.9% over the last four years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Endeavor's annualized revenue growth of 8.3% over the last two years is above its four-year trend, suggesting some bright spots.

We can better understand the company's revenue dynamics by analyzing its three largest segments: Events and Rights, Sports, and Representation, which are 26.2%, 40.6%, and 27% of revenue. Over the last two years, Endeavor's Events and Rights (live events) and Sports (UFC, Euroleague) revenues averaged year-on-year growth of 3.1% and 29.4% while Representation (WME talent agency, IMG Models) averaged 3% declines.

This quarter, Endeavor reported remarkable year-on-year revenue growth of 25.6%, and its $1.58 billion of revenue topped Wall Street estimates by 4.4%. Looking ahead, Wall Street expects sales to grow 25.4% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

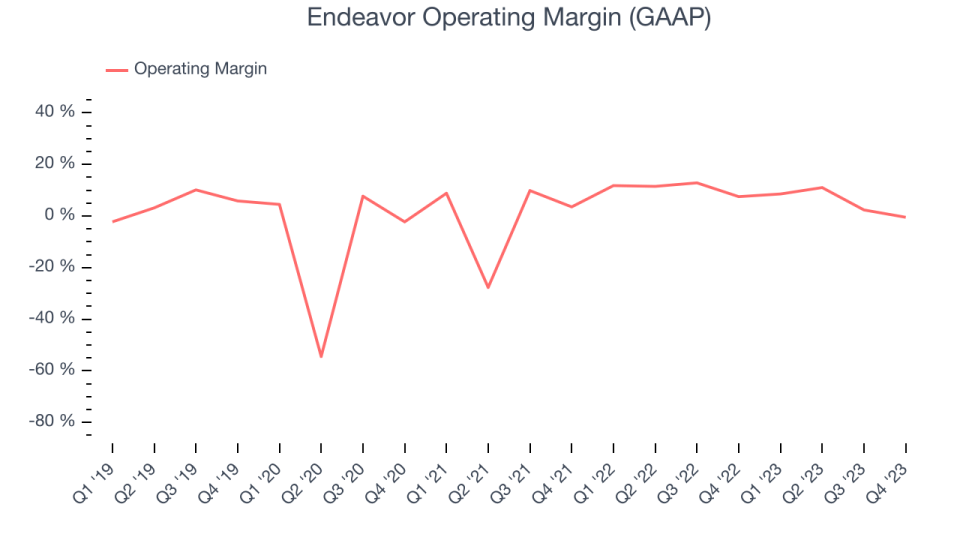

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Endeavor was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8%.

In Q4, Endeavor generated an operating profit margin of negative 0.5%, down 8 percentage points year on year.

Over the next 12 months, Wall Street expects Endeavor to become more profitable. Analysts are expecting the company’s LTM operating margin of 5.4% to rise to 12.4%.

Key Takeaways from Endeavor's Q4 Results

We enjoyed seeing Endeavor exceed analysts' revenue expectations this quarter, driven by strong outperformance in its Representation segment ($427 million of revenue vs estimates of $648 million). The company noted that "the impact on segment revenue by the WGA and SAG-AFTRA strikes [for the full year] was more than offset by growth in WME’s music, sports, and fashion divisions, as well as increases at 160over90, licensing, and nonscripted content production deliveries". On the other hand, its operating margin and EPS fell short of Wall Street's estimates. Overall, this was a mixed quarter for Endeavor. The company is down 1.9% on the results and currently trades at $24 per share.

Endeavor may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.