Endeavour Mining PLC Anchors Azvalor Internacional FI's Q4 Portfolio with a 5.55% Stake

Insight into Azvalor Internacional FI (Trades, Portfolio)'s Latest Investment Moves and Strategic Adjustments

Azvalor Internacional FI (Trades, Portfolio), a fund committed to the principles of Value Investment, has disclosed its fourth-quarter transactions for 2023. The fund, which specializes in undervalued global equities, particularly European companies, seeks long-term value for its investors by purchasing stocks below their intrinsic value. The latest report reveals a series of strategic buys, sells, and position adjustments that reflect the fund's ongoing pursuit of value in the market.

Summary of New Buys

Azvalor Internacional FI (Trades, Portfolio) expanded its portfolio with 7 new stocks, highlighted by:

Endeavour Mining PLC (TSX:EDV), acquiring 4,532,060 shares, which now comprise 5.55% of the portfolio, valued at C$92.24 million.

Canadian Natural Resources Ltd (NYSE:CNQ), with 683,930 shares, making up about 2.44% of the portfolio, worth $40.53 million.

Imperial Brands PLC (LSE:IMB), adding 1,519,156 shares, accounting for 1.93% of the portfolio, with a total value of 32.05 million.

Key Position Increases

The fund also bolstered its holdings in 14 stocks, notably:

Barrick Gold Corp (NYSE:GOLD), with an additional 3,631,815 shares, increasing the total to 8,432,018 shares. This represents a 75.66% increase in share count, impacting the portfolio by 3.57%, and valued at $137.97 million.

British American Tobacco PLC (LSE:BATS), with an additional 759,562 shares, bringing the total to 2,472,009 shares. This adjustment marks a 44.36% increase in share count, valued at 66.28 million.

Summary of Sold Out Positions

Azvalor Internacional FI (Trades, Portfolio) exited 2 holdings in the fourth quarter of 2023:

Bayer AG (XTER:BAYN), selling all 796,527 shares, impacting the portfolio by -2.97%.

Howden Joinery Group PLC (LSE:HWDN), liquidating all 669 shares, with a negligible impact on the portfolio.

Key Position Reductions

Reductions were made in 10 stocks, with significant changes in:

Compania de Minas Buenaventura SAA (NYSE:BVN), reduced by 4,145,673 shares, a -91.91% decrease, impacting the portfolio by -2.04%. The stock traded at an average price of $9.65 during the quarter.

Cash (^CASH), reduced by 21,458,000 shares, a -4.79% reduction, impacting the portfolio by -1.58%. The average price during the quarter was not applicable.

Portfolio Overview

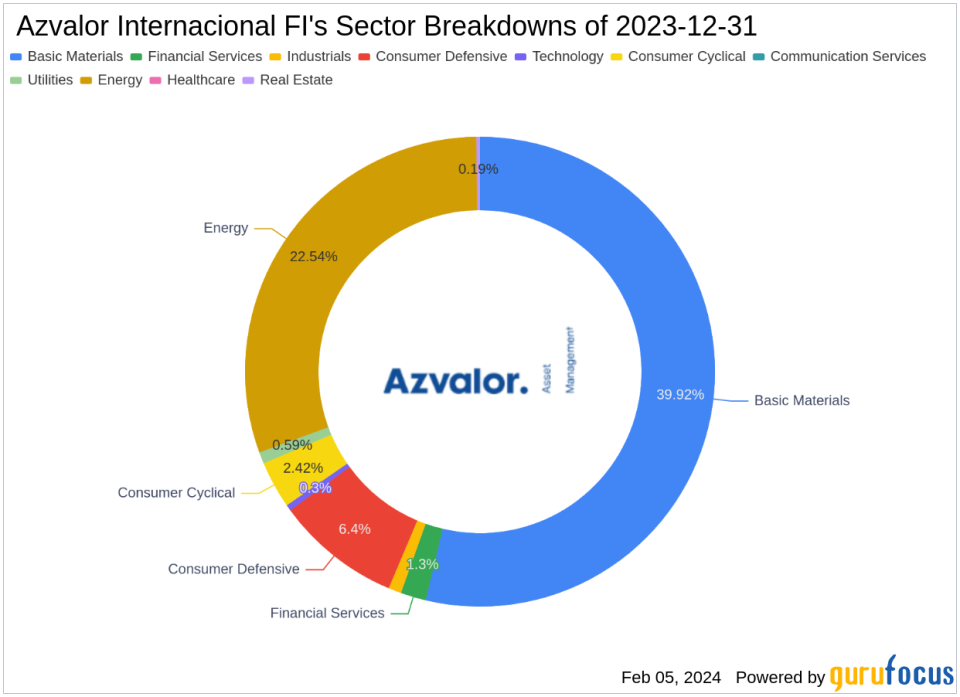

As of the fourth quarter of 2023, Azvalor Internacional FI (Trades, Portfolio)'s portfolio consisted of 31 stocks. The top holdings were 25.68% in Cash (^CASH), 8.3% in Barrick Gold Corp (NYSE:GOLD), 6.11% in NOV Inc (NYSE:NOV), 5.55% in Endeavour Mining PLC (TSX:EDV), and 4.5% in PrairieSky Royalty Ltd (TSX:PSK). The investments span across 9 industries, including Basic Materials, Energy, Consumer Defensive, and more, reflecting a diverse approach to value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.