Endeavour Silver (EXK) Completes Sale of Cozamin Royalty

Shares of Endeavour Silver Corp. EXK have fallen 6.7% since it announced on Aug 30 that its 100% owned subsidiary, Minera Plata Adelante SA de CV ("MPA"), completed the royalty sale transaction with Gold Royalty Corp. GROY.

On Jul 31, 2023, the company announced that it entered an agreement with Gold Royalty Corp to sell all of MPA's interest in the 1% Cozamin royalty for a total cash consideration of $7,500,000.

The Royalty applies to two concessions, which are Calicanto and Vicochea on Capstone's Cozamin copper-silver mine. The mine is located 3.6 kilometers north-northwest of Zacatecas City in the Mexican state of Zacatecas. Cozamin is a copper and silver producing mine, which is owned and operated by Capstone Copper.

Endeavour Silver obtained the royalty through a concession division agreement signed in 2017 on seven fully owned concessions for a purchase price of $445,000. The Cozamin Mine is located on two of the seven concessions.

As a part of the transaction, Gold Royalty Corp was granted the option to acquire any additional royalties which may be granted on the five remaining concessions under the 2017 concession division agreement.

Gold Royalty Corp is a gold-focused royalty corporation, which provides metals and mining companies with innovative financing solutions. It intends to purchase royalties, streams, and similar assets to build a portfolio that attracts investors.

Endeavour Silver maintains a healthy balance sheet. At the end of the second quarter of 2023, the company had a cash position of $43.5 million and working capital of $78.2 million.

The company reported quarterly earnings 1 cent per share in the second quarter of 2023, missing the Zacks Consensus Estimate of earnings of 2 cents per share. This compares favorably to a loss of 2 cents per share a year ago.

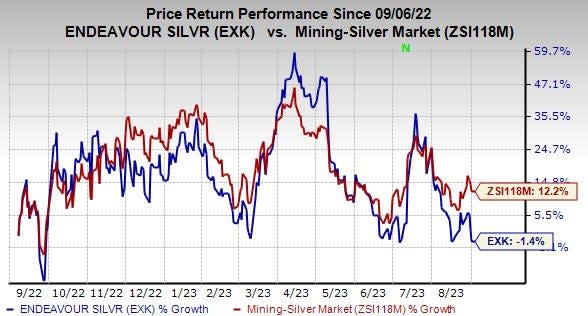

Price Performance

Shares of the company have lost 1.4% over the past year against the industry's 12.2% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Endeavour Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Hawkins, Inc. HWKN and L.B. Foster Company FSTR. HWKN sports a Zacks Rank #1 (Strong Buy) at present and FSTR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Hawkins has an average trailing four-quarter earnings surprise of 25.5%. The Zacks Consensus Estimate for HWKN’s fiscal 2024 earnings is pegged at $3.40 per share. The consensus estimate for 2024 earnings has moved 38% north in the past 60 days. Its shares have gained 35.7% in the last year.

L.B. Foster has an average trailing four-quarter earnings surprise of 134.5%. The Zacks Consensus Estimate for FSTR’s 2023 earnings is pegged at 53 cents per share. Earnings estimates have been unchanged in the past 60 days. FSTR’s shares have gained 30.2% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Endeavour Silver Corporation (EXK) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

Gold Royalty Corp. (GROY) : Free Stock Analysis Report