Endeavour Silver (EXK) Q3 Earnings & Revenues Miss Estimates

Endeavour Silver Corporation EXK reported a loss per share of four cents for third-quarter 2023, which missed the Zacks Consensus Estimate of a loss of two cents per share. Lower production at the Guanacevi mine and a stronger Mexican Peso impacted earnings in the quarter. Elevated costs associated with additional operating development, maintenance and repairs at Guanacevi also led to the loss. EXK had reported a loss per share of two cents in the third quarter of 2022.

Endeavour Silver’s revenues surged 25% year over year to $49.5 million but missed the Zacks Consensus Estimate of $60 million. The year-over-year improvement in revenues was mainly due to higher silver sales during the quarter.

EXK sold 1.37 million ounces of silver in the quarter (up 3% year over year) and 8,760 ounces of gold (down 1% year over year).

Endeavour Silver Corporation Price, Consensus and EPS Surprise

Endeavour Silver Corporation price-consensus-eps-surprise-chart | Endeavour Silver Corporation Quote

The average realized silver price was $23.99 per ounce in the quarter, up 25% year over year. The average realized gold price increased 16% year over year to $1,948 per ounce in the quarter.

Total production in the third quarter of 2023 was 1.88 million silver equivalent ounces, consisting of 1.15 million ounces of silver and 9,089 ounces of gold. Compared with the prior-year quarter, production was down 14%.

Endeavour Silver reported the lowest quarterly production in over two years mainly due to lower output at Guanacevi. This was as a result of mine sequencing changes, which were initiated to improve access and ventilation, and led to a significant reduction in ore grades.

Operational Update

Endeavour Silver recorded cash costs per silver ounce of $17.94, up 74% from the year-ago quarter. Consolidated all-in sustaining costs of $29.64 per silver equivalent ounce marked a 46% surge from the year-ago quarter.

Costs were significantly impacted by lower production at the Guanacevi mine and increased operating development resulting from mine sequencing changes required to focus on improved access and ventilation as well as plant maintenance required during the last week of September. Cost inflation and a strengthened Mexican Peso also led to higher costs.

EXK reported a mine-operating profit of $ 2.7 million in the quarter under review compared with $5.1 million in the third quarter of 2022. EBITDA was $8.8 million, indicating an 11% improvement from $7.9 million in the year-ago quarter.

Financial Position

Endeavour Silver ended the third quarter of 2023 with $41 million cash in hand, down from $83 million held at the end of 2022. Cash generated from operating activities was around $5.1 million in the first nine-month period of 2023 compared with $10.6 million in the prior-year comparable period.

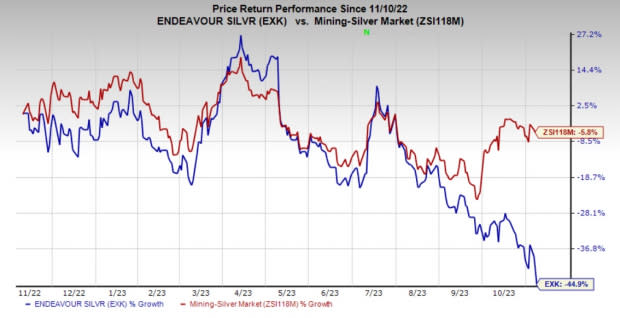

Price Performance

Shares of EXK have fallen 44.9% over the past year compared with the industry's 5.8% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Endeavour Silver currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Universal Stainless & Alloy Products, Inc. USAP and The Andersons Inc. ANDE. While CRS and USAP currently sport a Zacks Rank #1 (Strong Buy), ANDE carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 14.3%. The Zacks Consensus Estimate for CRS’ fiscal 2024 earnings is pegged at $3.57 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days. Its shares have gained 62% in a year’s time.

Universal Stainless & Alloy Products has an average trailing four-quarter earnings surprise of 44.4%. The Zacks Consensus Estimate for USAP’s 2023 earnings is pegged at 27 cents per share. Earnings estimates have been unchanged in the past 60 days. USAP’s shares have gained 89% in the last year.

The consensus estimate for ANDE's current-year earnings has been revised 3.3% upward over the past 60 days. Andersons beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average. ANDE shares have rallied around 25% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Endeavour Silver Corporation (EXK) : Free Stock Analysis Report