Endeavour Silver's (EXK) Q2 Silver Production Rises 10% Y/Y

Endeavour Silver Corporation EXK produced 2.3 million silver equivalent ounces in the second quarter of 2023, which was 9.5% higher year over year. Consolidated silver production was up 10% year over year to 1,494,000 ounces, owing to increased silver production at the Guanacevi mine.

Overall gold production in the quarter rose 6% year over year to 9,819 ounces, driven by increased throughput at the Guanacevi and Bolanitos mines.

Total production for the six months ended Jun 30, 2023, was 4.7 million silver equivalent ounces. Supported by this performance, the company anticipates 8.6-9.5 million silver equivalent ounces for the year.

At Guanacevi, silver and gold productions were in line with the guidance, owing to higher tons milled and partially offset by lower grades than anticipated. Changes in mine sequencing during the quarter resulted in lower grades. However, the grades are expected to improve in the third quarter of 2023.

Meanwhile, at Bolanitos, solid gold production, higher gold grades and improved throughput were offset by the impacts of lower silver production and silver grades.

Endeavour Silver sold 1,299,672 ounces of silver and 9,883 ounces of gold in the quarter. At the quarter-end, the company held 637,439 ounces of silver and 854 ounces of gold in bullion inventory, and 16,213 ounces of silver and 665 ounces of gold in concentrate inventory.

EXK also announced that its board of directors approved the construction of an underground mine and a mill at Terronera.

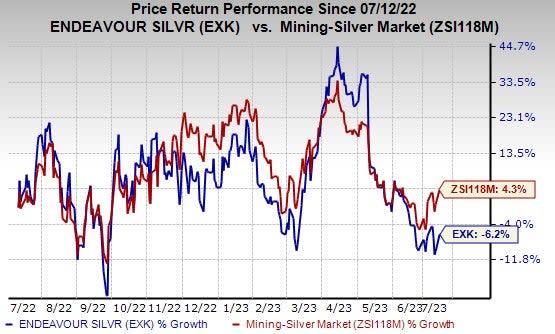

Price Performance

Shares of the company have lost 6.2% over the past year against the industry's growth of 4.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Endeavour Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Orla Mining Ltd. ORLA and Osisko Gold Royalties Ltd OR. CRS and ORLA flaunt a Zacks Rank #1 (Strong Buy) at present, and OR has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 30.9%. The Zacks Consensus Estimate for CRS’s fiscal 2023 earnings is pegged at $1.04 per share. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. Its shares gained 111.9% in the last year.

Orla Mining has an average trailing four-quarter earnings surprise of 85.4%. The Zacks Consensus Estimate for ORLA’s 2023 earnings is pegged at 15 cents per share. The consensus estimate for 2023 earnings has moved 87.5% north over the past 60 days. ORLA’s shares gained 48% in the last year.

The Zacks Consensus Estimate for Osisko Gold Royalties’ fiscal 2023 earnings per share is pegged at 47 cents. Earnings estimates have moved 6.8% north in the past 60 days. OR’s shares have gained 50.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Endeavour Silver Corporation (EXK) : Free Stock Analysis Report

Osisko Gold Royalties Ltd (OR) : Free Stock Analysis Report

Orla Mining Ltd. (ORLA) : Free Stock Analysis Report