Why the end of a bull market can be a nightmare for bears

Some of the greatest gains in the stock market occurred just before bull markets became bear markets. For market bears, it really is darkest before the dawn.

“Equity returns in the last years of a bull market have historically been very strong, making it very painful to sell too early,” Bank of America Merrill Lynch’s Savita Subramanian said in a May 16 note to clients. This is a point she’s been telegraphing to clients for over a year.

Bears have to be incredibly patient as many of the market’s major warning signs will flash red for months or even years before things turn. And the granddaddy of warning signs is Robert Shiller’s cyclically-adjusted price-earnings (CAPE) ratio, which is at levels seen prior only to history’s great stock market crashes.

But while the CAPE ratio seems to be at a very worrisome level, it is an entirely different thing to conclude that it’s saying to sell. In fact, even Shiller warns against abandoning the stock market while CAPE is at elevated levels.

“[The S&P 500] could go up 50% from here,” Shiller said to CNBC on Wednesday. “That’s what it did around 2000. After it reached this level, it went up another 50%.”

The end is the worst time to be out of the market

While it may be tempting to predict the market’s peak, almost every interpretation of the historical data shows that this is a reliable way to miss out on gains or even lose money.

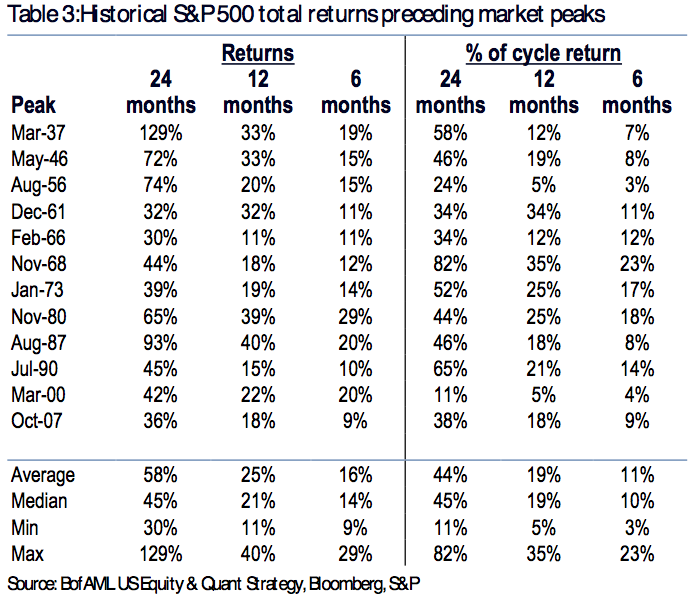

Subramanian’s work shows that the average return in just the six months before past market peaks was a whopping 16%. Over the 12 months and 24 months before peaks, average returns were 25% and 58%, respectively.

In other words, if you had sold too early, you would’ve missed out on above-average returns.

“The end of the cycle is often the best,” Morgan Stanley’s Michael Wilson said in April. “Think 1999 or 2006-07. In a low-return world, investors cannot afford to miss it.”

“Experience has taught us not to miss the end of an expansive period,” Third Point’s Daniel Loeb said in a recent letter to clients.

Don’t trade in and out of the market

Let’s add some psychology to this discussion. During this period when you see above average returns, you’ll probably see a lot of above average single-day moves to the upside and to the downside. And with these moves, you might find yourself tempted to chase gains or sell in a panic. Unfortunately, this is a recipe for underperformance.

“This strategy underperforms the market on a cumulative basis since 1960 both overall and during every decade, given the best days typically follow the worst days,” Subramanian observed in a different note. Her colleagues at the bank offered some similar analysis and drew the same conclusions.

“Investors often think they should move in and out of financial markets, trying to time the buying/selling of stocks based on a series of events or increasing/decreasing their bond exposure depending on expectations for interest rates,” Bank of America Merrill Lynch strategists Martin Mauro and Cheryl Rowan wrote last year. “History shows the value of staying invested in bonds for the income generated regardless of rates and proves the rewards of staying invested in stocks despite periodic market declines.”

Mauro and Rowan demonstrated their point by showing what would’ve happened to returns had you missed the 10 best days for the market in any given decade. Just 10 days.

What now?

The market continues to break records. On Wednesday, the S&P 500 (^GSPC) closed at an all-time high of 2,404.39 despite stretched valuations, the prospect for tighter monetary policy, and an elevated sense of geopolitical uncertainty.

“There is a constant theme in the financial media that this Bull Market is about to end any day now,” Zor Capital’s Joe Fahmy wrote in April. “I believe it still has a long way to go. It’s not going to continue straight up and we’ll experience plenty of corrections along the way. Ultimately, it will end with a ‘blow off’ move to the upside where everyone just throws in the towel. I don’t know if this will happen three months or three years from now, but I am leaning towards the latter because it will take a long time for investors to change their mentality.”

Even the gloomier investment pros like GMO’s Jeremy Grantham acknowledge that the best gains to be had in the market are near the end.

“The ability of the market to hurt eager bears some more is probably not exhausted,” Grantham said in early 2016. “I still believe that, with the help of the Fed and its allies, the U.S. market will rally once again to become a fully-fledged bubble before it breaks.” (Though he now believes that break will look more like a whimper than a bang.)

To be clear, we’re not suggesting that the top is near and we’re certainly not suggesting now’s a great time pour money into stocks. Rather, if there is a lesson to be learned it’s that the stock market is best-suited for investors with long-time horizons. Long-time horizons enable investors to wait out the downturns while reaping in the upturns. Indeed, the most important lesson we’ve learn from the past year of violent market swings is that the best strategy is to just stay invested.

—

Sam Ro is managing editor at Yahoo Finance.

Read more: