Enel Chile SA (ENIC): A Comprehensive Analysis of Its Market Value

Enel Chile SA (NYSE:ENIC) recorded a daily gain of 4.76% and a three-month gain of 1.08% with an Earnings Per Share (EPS) (EPS) of 1.11. The question on investors' minds is, is the stock fairly valued? Our valuation analysis aims to answer this question. Let's delve into the details.

Company Overview

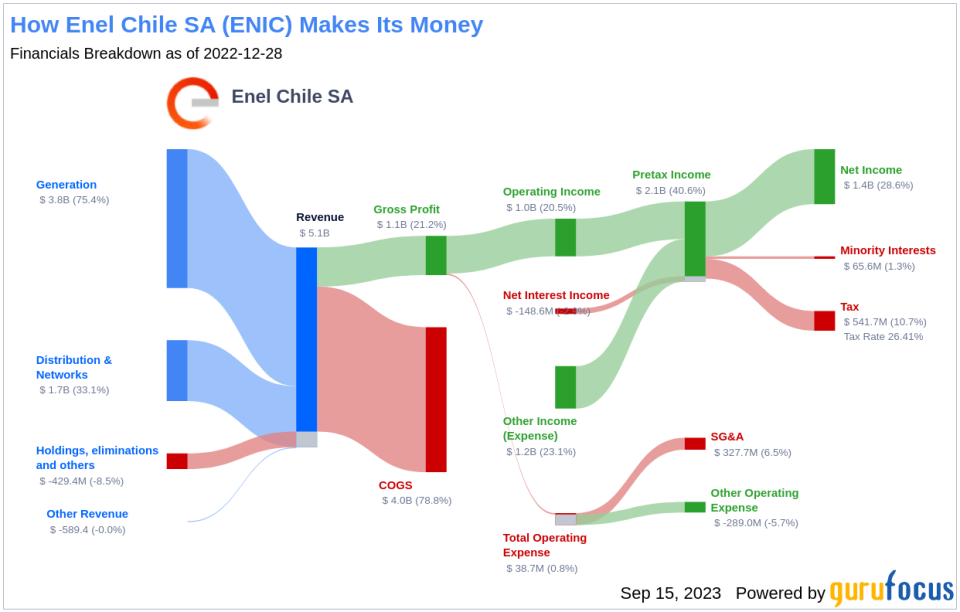

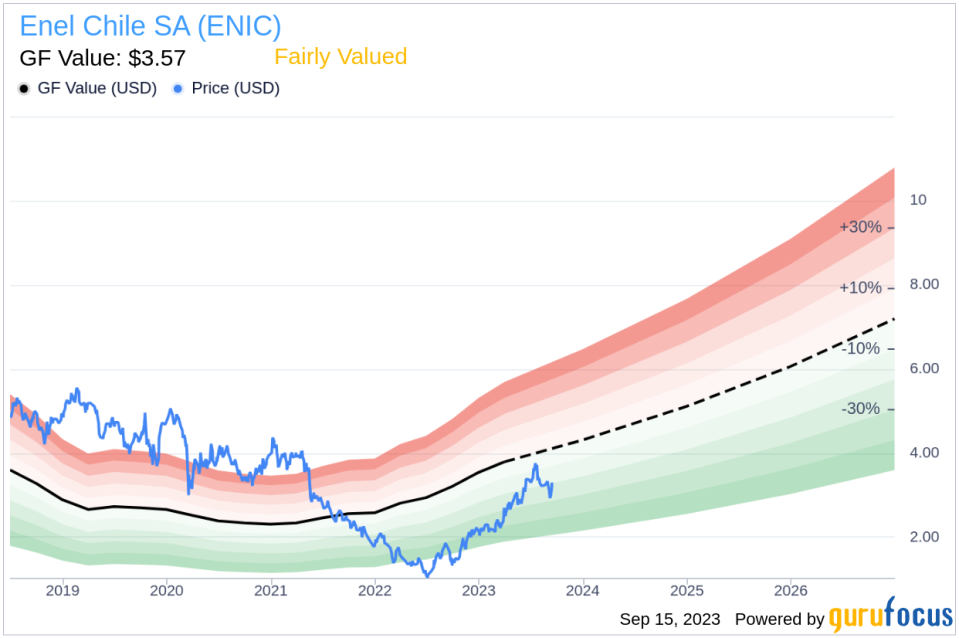

Enel Chile SA is an electricity utility company, engaged in the generation, transmission, and distribution of electricity businesses in Chile through its subsidiaries and affiliates. It operates through two segments: Generation Business and Distribution and Network Business. The Generation Business Segment consists of electricity companies that own electricity generating plants, whose energy is transmitted and distributed to end customers. The Distribution and Network Reportable Segment comprises electricity companies operating under a public utility concession. Currently, the stock is trading at $3.3 per share with a market cap of $4.60 billion. The GF Value, our proprietary estimate of fair value, is $3.57, indicating that the stock appears to be fairly valued.

Understanding GF Value

The GF Value is our unique calculation of a stock's intrinsic value, based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides an overview of the stock's fair trading value. It's computed considering:

Historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

Our analysis shows that Enel Chile SA (NYSE:ENIC) appears to be fairly valued. Given this, the long-term return of its stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

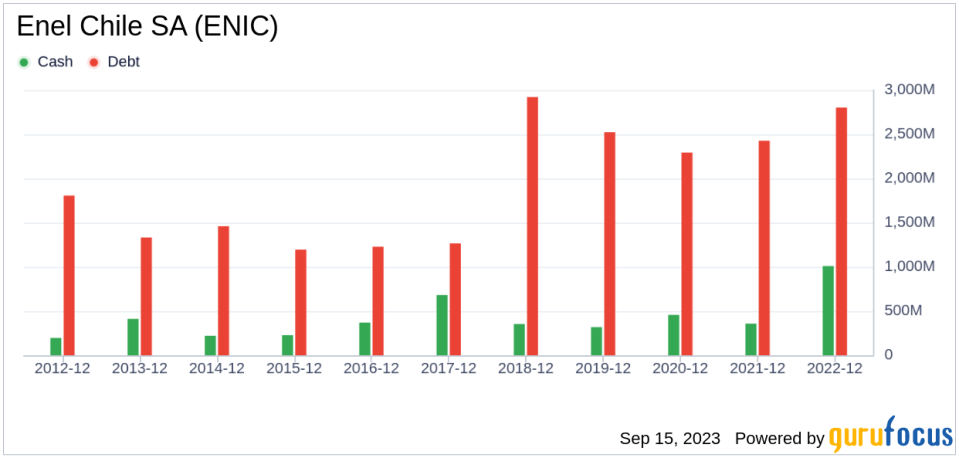

Financial Strength

Before investing, it's crucial to assess a company's financial strength. Companies with poor financial strength pose a higher risk of permanent loss. The cash-to-debt ratio and interest coverage are reliable indicators of a company's financial strength. Enel Chile SA has a cash-to-debt ratio of 9999, which is worse than 0% of 482 companies in the Utilities - Regulated industry. Its overall financial strength is 6 out of 10, indicating fair financial health.

Profitability and Growth

Investing in profitable companies carries less risk. A company with high profit margins often offers better performance potential than a company with low profit margins. Enel Chile SA has been profitable 9 years over the past 10 years. It had revenues of $5.30 billion and an Earnings Per Share (EPS) of $1.11 in the past 12 months. Its operating margin of 21.67% is better than 75.2% of 500 companies in the Utilities - Regulated industry. Overall, we rank Enel Chile SA's profitability as fair.

Growth is a critical factor in the valuation of a company. Our research has found that growth is closely correlated with the long-term performance of a company's stock. The faster a company is growing, the more likely it is to be creating value for shareholders, especially if the growth is profitable. The 3-year average annual revenue growth rate of Enel Chile SA is 18.6%, which ranks better than 82.82% of 483 companies in the Utilities - Regulated industry. The 3-year average EBITDA growth rate is 43.3%, which ranks better than 94.99% of 459 companies in the same industry.

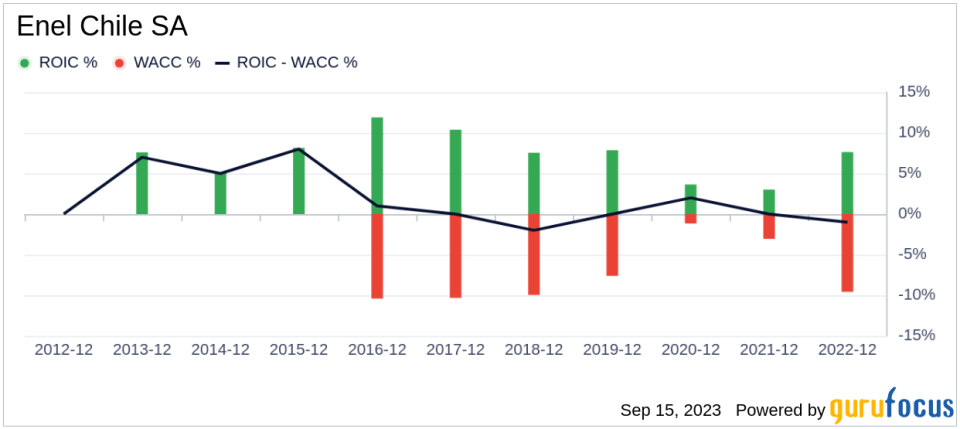

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Enel Chile SA's ROIC was 6.57, while its WACC came in at 7.18.

Conclusion

In conclusion, the stock of Enel Chile SA (NYSE:ENIC) appears to be fairly valued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 94.99% of 459 companies in the Utilities - Regulated industry. To learn more about Enel Chile SA stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.