Energizer Holdings Inc (ENR) Faces Headwinds as Q1 Sales Dip

Net Sales: Reported a decrease of 6.3% to $716.6 million in Q1 FY24.

Adjusted Gross Margin: Improved by 50 basis points to 39.5% due to cost-saving initiatives.

Free Cash Flow: Represented 21.3% of Net sales, with significant debt paydown.

Earnings Per Share: Adjusted diluted EPS at $0.59, compared to $0.72 in the prior year.

Debt Reduction: Long-term debt reduced by $78 million in Q1; additional $58 million post-quarter.

Project Momentum: Savings estimate increased to $160-$180 million, with higher expected cash costs.

Energizer Holdings Inc (NYSE:ENR), a leading manufacturer and distributor of household batteries, specialty batteries, and lighting products, released its 8-K filing on February 6, 2024, detailing the financial results for the first fiscal quarter ended December 31, 2023. The company, known for its Energizer, Rayovac, Varta, and Eveready brands, operates primarily in the Americas and International segments, with the majority of its revenue stemming from the Americas.

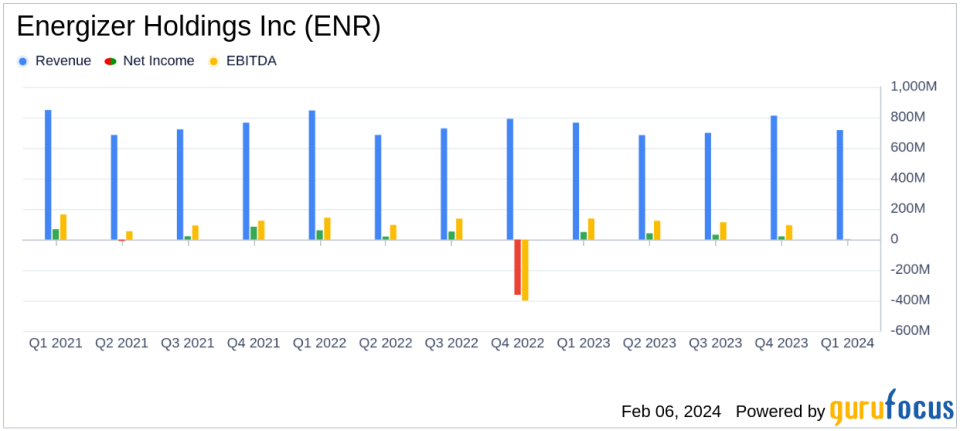

The report indicated a challenging start to the fiscal year with net sales declining by 6.3% to $716.6 million, attributed to a 7.4% drop in organic net sales. This was primarily due to volume declines in the battery business and flat pricing. Despite the sales downturn, ENR achieved a 50 basis point improvement in adjusted gross margin, reaching 39.5%, largely driven by the benefits of Project Momentum, a cost-saving initiative.

Financial Performance and Challenges

ENR's financial achievements in the quarter were overshadowed by a significant decrease in net earnings to $1.9 million, down from $49.0 million in the prior year, with diluted net earnings per common share plummeting to $0.03 from $0.68. Adjusted net earnings and adjusted EBITDA also experienced declines to $42.5 million and $132.9 million, respectively. The company's performance was impacted by currency exchange losses in Argentina due to economic reform and a decrease in organic net sales, coupled with higher SG&A expenses.

However, ENR's commitment to improving its financial health is evident in its capital allocation strategy. The company reported robust operating cash flow of $178.1 million and free cash flow of $152.6 million, which represented 21.3% of net sales. This strong cash generation enabled ENR to continue its debt reduction efforts, paying down $78 million in long-term debt during the quarter and an additional $58 million subsequently.

Outlook and Strategic Initiatives

Looking ahead, ENR reaffirmed its fiscal year outlook, expecting organic revenue to be flat to down low single digits, with adjusted EBITDA projected to be between $600 million and $620 million, and adjusted earnings per share in the range of $3.10 to $3.30. The company also increased its Project Momentum savings estimate to $160 million to $180 million, reflecting confidence in its cost-saving measures despite increased cash costs to achieve these savings.

CEO Mark LaVigne commented on the results, stating,

Execution against our strategies yielded results in line with our expectations and provides a solid start to the fiscal year. We improved adjusted gross profit margin and delivered outstanding free cash flow, which has enabled us to meaningfully reduce debt for the sixth consecutive quarter."

ENR's strategic focus remains on optimizing its cost structure and simplifying operations to leverage its global scale. The expansion of Project Momentum is a testament to this approach, with the company actively seeking opportunities to strengthen its position and return to growth over the balance of the year.

Investors and stakeholders can access a live webcast of the company's investor conference call, which will discuss the first fiscal quarter earnings and recent business trends, on ENR's website under the "Investors" and "Events and Presentations" tabs.

Value investors may find ENR's cost-saving initiatives and debt reduction efforts appealing, as the company navigates through the current challenges while setting the stage for future growth. The full earnings report and supplemental materials can be accessed through the provided 8-K filing link for a more detailed analysis.

Explore the complete 8-K earnings release (here) from Energizer Holdings Inc for further details.

This article first appeared on GuruFocus.