Energy Drink Demand to Aid Monster Beverage's (MNST) Sales

Monster Beverage Corporation MNST is a stock to watch, given the robust demand trends for its energy drinks, effective pricing actions, product innovations and a healthy balance sheet. The company’s steady lineup of product launches is likely to help retain its business momentum. It is anticipated to reap gains from its strong distribution network in international markets and investments in growth opportunities.

Backed by these trends, Monster Beverage’s top and bottom lines improved year over year in second-quarter 2023. Monster Beverage’s earnings advanced 50% year over year, while sales improved 12%. Results gained from the expansion of the energy drinks category and product launches.

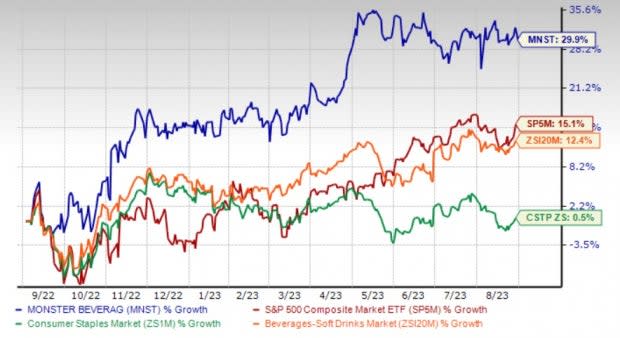

The Zacks Rank #3 (Hold) company has a market capitalization of $60.9 billion. In the past year, shares of the company have gained 29.9% compared with the industry’s growth of 12.4%. The stock also outpaced the sector and the S&P 500’s growth of 0.5% and 15.1%, respectively, in the same period.

The Zacks Consensus Estimate for Monster Beverage’s 2023 sales and earnings suggests growth of 13.7% and 37.5%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Factors Driving Growth

Monster Beverage’s continued momentum in the energy drinks category remains a key growth driver. We note that the company offers a wide range of energy drink brands, such as Monster Energy, Java Monster, Cafe Monster, Espresso Monster, Monster Energy Mule, Juice Monster Pipeline Punch, Juice Monster Pacific Punch, Juice Monster Mango Loco, Monster Ultra Paradise, and Monster Hydra Sport. In second-quarter 2023, the Monster Energy Drinks segment's net sales increased 9.7% year over year to $1.7 billion.

Product innovation plays a significant role in the company's success. Monster Beverage remains committed to product launches and innovation to boost growth. In second-quarter 2023, the company launched many products and expanded distribution in the international markets.

In the second quarter, Monster Beverage continued with the roll-out of its first flavored malt beverage alcohol product, The Beast Unleashed, in the United States and received positive feedback. Consequently, MNST is on track with the expansion of the distribution of The Beast Unleashed into additional markets, with plans for nationwide distribution by the end of the year. It intends to launch a hard iced tea extension of The Beast Unleashed, named Nasty Beast Hardcore Tea, later this year or early next year, with a target of nationwide distribution in the first half of 2024. The brand will be available in four flavors — Original, Half & Half, Razzleberry and Green.

Moreover, Monster Energy is on track with price increases to wean the ongoing cost pressures. It has been implementing price hikes from the first half of 2022. It continued to implement price hikes in the second quarter of 2023, with additional price hikes planned in many other markets through the remainder of 2023. In some markets, this rise was in addition to price increases implemented in 2022.

In the United States, management implemented an additional price increase on its 18.6 oz and 24 oz energy drinks, effective Apr 1, 2023.

The company’s pricing actions, along with reduced freight costs, have been aiding the gross and operating margins. In second-quarter 2023, Monster Beverage’s gross margin expanded 540 basis points (bps) to 52.5%, driven by pricing actions, lower freight-in costs and reduced aluminum can costs. The operating margin expanded 570 bps to 28.2% on an improved gross margin. The persistence of this trend may contribute to the company’s profitability.

What Holds MNST Back?

Monster Beverage has been witnessing rising SG&A expenses due to increased payroll expenses. Also, the persistence of certain supply-chain headwinds has been a deterrent. Operating expenses grew 10.7% year over year in the second quarter mainly due to increased payroll expenses. Selling expenses, as a percentage of net sales, expanded 20 bps year over year to 9.3%. General and administrative expenses, as a percentage of net sales, expanded 40 bps year over year to 10.6%.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Fomento Economico Mexicano FMX, Ambev ABEV and PepsiCo Inc. PEP.

Fomento Economico Mexicano, alias FEMSA, currently sports a Zacks Rank #1 (Strong Buy). The company has an expected EPS growth rate of 22.4% for three to five years. Shares of FMX have rallied 72.6% in the past year. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FEMSA’s current financial year’s sales and earnings per share suggests growth of 31.9% and 58.3%, respectively, from the year-ago period’s reported figures. FMX has a trailing four-quarter earnings surprise of 6.1%, on average.

Ambev has a trailing four-quarter earnings surprise of 20.8%, on average. It currently carries a Zacks Rank #2 (Buy). Shares of ABEV have declined 5.4% in the past year.

The Zacks Consensus Estimate for Ambev’s current financial-year sales suggests growth of 4.5% from the year-ago period's reported figure. Meanwhile, the consensus estimate for earnings indicates a decline of 5.6% from the year-ago quarter’s reported figure. ABEV has an expected EPS growth rate of 7% for three to five years.

PepsiCo has a trailing four-quarter earnings surprise of 6.3%, on average. It currently carries a Zacks Rank #2. Shares of PEP have gained 4.2% in the past year.

The Zacks Consensus Estimate for PepsiCo’s current financial-year sales and earnings suggests growth of 6.7% and 10.2%, respectively, from the year-ago period's reported figures. PEP has an expected EPS growth rate of 8.1% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report