Is Energy Fuels (UUUU) Too Good to Be True? A Comprehensive Analysis of a Potential Value Trap

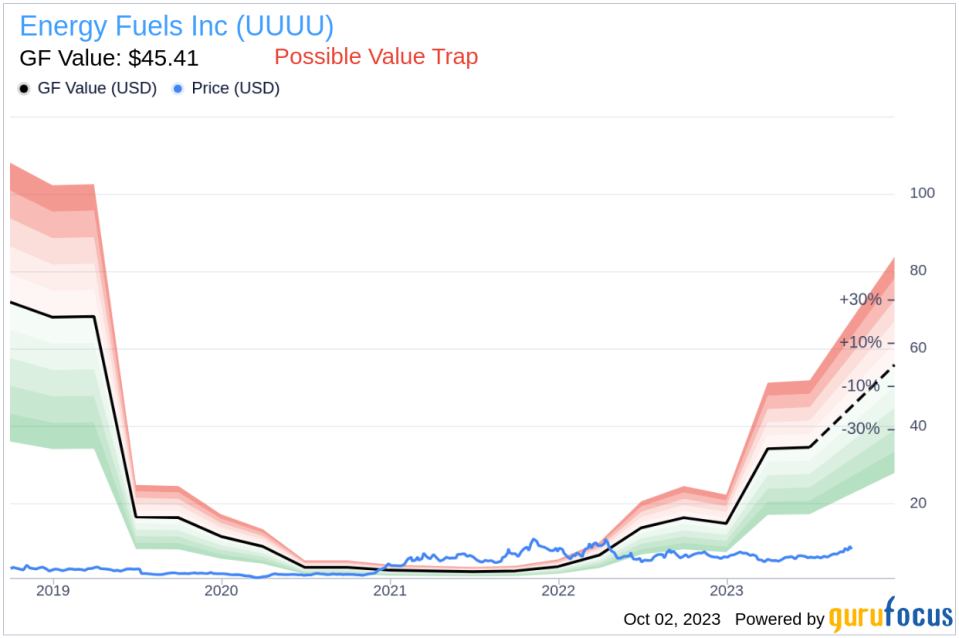

Value-focused investors are always on the hunt for stocks that are priced below their intrinsic value. One such stock that merits attention is Energy Fuels Inc (UUUU). The stock, which is currently priced at 7.72, recorded a loss of 6.04% in a day and a 3-month increase of 25.96%. The stock's fair valuation is $45.41, as indicated by its GF Value.

The GF Value Explained

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at. It is calculated based on three factors:

Historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow) that the stock has traded at.

GuruFocus adjustment factor based on the company's past returns and growth.

Future estimates of the business performance.

We believe the GF Value Line is the fair value that the stock should be traded at. The stock price will most likely fluctuate around the GF Value Line. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

The Beneish M-Score: A Risk Indicator

However, investors need to consider a more in-depth analysis before making an investment decision. Despite its seemingly attractive valuation, certain risk factors associated with Energy Fuels should not be ignored. These risks are primarily reflected through its low Piotroski F-score and a Beneish M-Score of -1.61 that exceeds -1.78, the threshold for potential earnings manipulation.

Developed by Professor Messod Beneish, the Beneish M-Score is based on eight financial variables that reflect different aspects of a company's financial performance and position. These are Days Sales Outstanding (DSO), Gross Margin (GM), Total Long-term Assets Less Property, Plant and Equipment over Total Assets (TATA), change in Revenue (?REV), change in Depreciation and Amortization (?DA), change in Selling, General and Admin expenses (?SGA), change in Debt-to-Asset Ratio (?LVG), and Net Income Less Non-Operating Income and Cash Flow from Operations over Total Assets (?NOATA).

Company Snapshot: Energy Fuels Inc (UUUU)

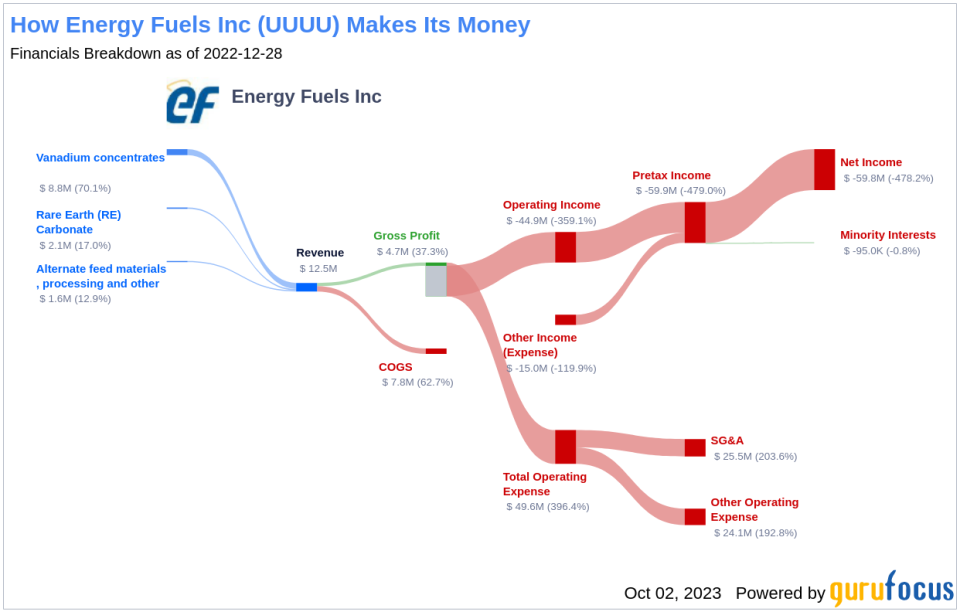

Energy Fuels Inc is a United States-based critical minerals company. The Company mines uranium and produces natural uranium concentrates that are sold to nuclear utilities for the production of carbon-free nuclear energy. It holds two of America's key uranium production centers: The White Mesa Mill in Utah, and the Nichols Ranch ISR Facility in Wyoming. Its producing White Mesa Mill is the only conventional uranium mill in the United States and has a licensed capacity of approximately 8 million pounds of U3O8 per year. Nichols Ranch is in production and has a licensed capacity of approximately 2 million pounds of U3O8 per year. It also produces vanadium. Energy Fuels also owns several licensed and developed uranium and vanadium mines on standby and other projects in development.

Conclusion: A Potential Value Trap?

Given the declining revenues and earnings, the low Piotroski F-score, and the high Beneish M-Score, Energy Fuels (UUUU) appears to be a potential value trap. Despite its seemingly attractive GF Value, the company's fundamental indicators point to significant risks. Therefore, investors should exercise caution and conduct thorough due diligence before considering an investment in Energy Fuels.

To find out the high quality companies that may deliver above average returns, please check out GuruFocus High Quality Low Capex Screener.Investors can find stocks with good revenue and earnings growth using GuruFocus' Peter Lynch Growth with Low Valuation Screener.

This article first appeared on GuruFocus.