Energy Recovery Inc Reports Record Revenue Growth in Q4 and FY 2023

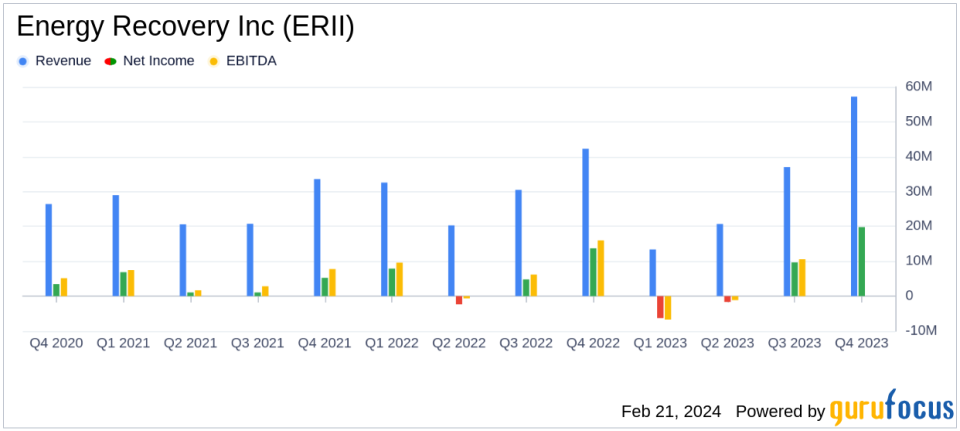

Annual Revenue: Achieved a record $128.3 million, marking the ninth consecutive year of growth.

Quarterly Revenue: Record Q4 revenue of $57.2 million, a 35% increase year-over-year.

Net Income: Reported $21.5 million for the year, although down by 11% from the previous year.

Gross Margin: Maintained at 67.8%, above the company's guidance.

Operating Cash Flow: More than doubled over the year, largely due to improved customer collections and inventory management.

Adjusted EBITDA: Reached $31.2 million for the fiscal year.

Product Development: The PX Q400 expected to achieve roughly 50% of sales in the megaproject channel.

On February 21, 2024, Energy Recovery Inc (NASDAQ:ERII) released its 8-K filing, announcing financial results for the fourth quarter and the full year ended December 31, 2023. The company, known for its engineering-driven technology solutions that enhance industrial efficiency and sustainability, operates primarily in the Water segment, with a growing presence in Emerging Technologies and Corporate segments. Energy Recovery Inc's products, including energy recovery devices and pumps, serve the global reverse osmosis desalination market, with the majority of revenue generated from the Water segment.

Fiscal Year 2023 Performance

Energy Recovery Inc reported a record annual revenue of $128.3 million, which includes a significant 79% growth in the wastewater sector and marks the ninth consecutive year of revenue growth. The fourth quarter revenue stood at a record $57.2 million, a 35% increase compared to the same period last year. This growth was driven by strong performance in the company's primary desalination business and rapid expansion in the wastewater sector. However, the Water revenue was slightly below guidance due to the delayed shipment of a single project, which is now expected to ship in 2024a risk previously noted in the Q3 earnings call.

The company's gross margin was reported at 67.8%, which is within the company's expectations and above the guidance provided. Operating expenses were managed at $68.0 million, aligning with the company's expectations. The income from operations was $19.1 million, with a net income of $21.5 million and adjusted EBITDA of $31.2 million. The operating cash flow for the year more than doubled, primarily due to strong customer collections and strategic efforts to optimize raw inventory turnover rates.

Financial Achievements and Challenges

Energy Recovery Inc's financial achievements are particularly noteworthy in the context of the Industrial Products industry, where efficiency and sustainable growth are key. The record revenue and the sustained growth trajectory underscore the company's ability to innovate and expand into new markets, such as wastewater treatment. The challenges faced, such as the delayed project shipment, highlight the importance of supply chain and project management in maintaining revenue streams.

David Moon, President and CEO of Energy Recovery Inc, commented on the results:

We achieved record annual and fourth quarter revenue in 2023, which represents our ninth consecutive year of revenue growth despite a shift of $8 million revenue associated with a single project that was pushed from the fourth quarter into 2024."

Moon also emphasized the company's diversified growth strategy and commitment to shareholder value.

Looking Ahead

As Energy Recovery Inc looks to the future, the company is focused on defending its leadership position in the desalination business, investing in new market opportunities in CO2 and wastewater, and managing expenses and cash with discipline. With the introduction of the PX Q400 and the expansion into the CO2 refrigeration business, the company is poised for continued growth and innovation.

For detailed financial tables and a reconciliation of non-GAAP financial measures, please refer to the full 8-K filing.

Value investors and potential GuruFocus.com members interested in Energy Recovery Inc's growth story and financial health can find more in-depth analysis and data on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Energy Recovery Inc for further details.

This article first appeared on GuruFocus.