Energy Stocks Holding Up in a Weak Market: 3 Top Ranked Stocks to Buy Now

After exploding higher in the second quarter of this year, the broad market is taking a much-needed breather. The S&P 500 has corrected by about -6% and the Nasdaq 100 by -9%. These are pretty standard pull backs in a bull market, so I am not too concerned about the health of the market.

Of note, energy stocks have remained quite strong over these last three weeks, while most sectors are down along with the market. Even while the price of oil itself has sold off from recent highs, energy stocks look encouraging. A few promising names have recently jumped up on the Zacks Rank, and the stocks I highlight here have also formed compelling bullish technical chart patterns.

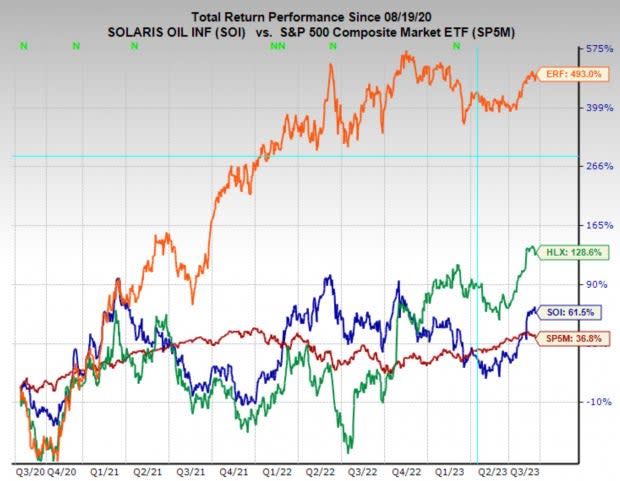

Enerplus ERF, Solaris Oil Infrastructure SOI, and Helix Energy Solutions Group HLX all enjoy top Zacks Ranks, and market beating performance over the last three years. And with the US economy seemingly firing on all cylinders, the price of oil should remain bid through year end, further improving these stocks profitability.

Image Source: Zacks Investment Research

Enerplus

Enerplus Corporation is a Canadian energy company engaged in the exploration, development, and production of oil and natural gas resources. With a diversified portfolio of assets across North America, Enerplus focuses on optimizing production and capitalizing on growth opportunities in both conventional and unconventional resource plays. The company's strategic approach, combined with its commitment to operational efficiency and sustainability, positions it as a significant player in the energy sector, poised to leverage evolving market dynamics.

Enerplus has recently seen some significant revisions higher in its earnings estimates, giving it a Zacks Rank #1 (Strong Buy) rating. Current quarter earnings estimates have been revised higher by 35% over just the last week, while FY23 estimates have been boosted by 5%.

Image Source: Zacks Investment Research

The technical setup forming on ERF stock looks like a prototypical bull flag. If ERF can breakout above the $17 level, it should initiate the next leg higher in the stock. However, if the price loses the $16.20 level, the setup is invalid, and investors will want to wait for another opportunity.

Image Source: TradingView

Enerplus is trading at a one year forward earnings multiple of 8.1x, which is below the industry average of 10.9x, and above its two-year median of 6x. ERF also offers a divided yield of 1.3% and has raised the payout by an average of 23.6% annually over the last five years.

Image Source: Zacks Investment Research

Solaris Oilfield Infrastructure

Solaris Oil Infrastructure is a company that focuses on providing critical infrastructure solutions to the energy industry, particularly in the oil and gas sector. Through its strategic assets and partnerships, SOI offers a range of services including transportation, storage, and processing of crude oil. By facilitating efficient and reliable logistics, Solaris Oil Infrastructure plays a vital role in supporting the energy supply chain and enabling the seamless movement of resources from production to market.

Solaris Oil Infrastructure stock is also building a very tight bull flag from which to measure a trade from. If SOI stock can break out above the $11.30 level, it should initiate another move higher. Alternatively, if it can’t hold the $10.70 level of support, it may be worth looking for other trades, or waiting for another setup.

Image Source: TradingView

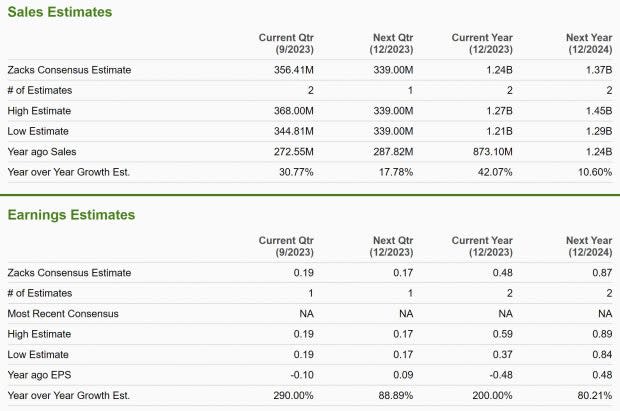

SOI has a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions. FY23 earnings estimates have increased by 10.5% over the last two months and are forecast to grow 25% YoY to $0.95. Additionally, FY24 earnings have been boosted by 10.2% and are projected to climb 105% YoY to $1.94.

Solaris Energy Infrastructure also pays a dividend yield of 4% and has raised the payment by an average of 1.6% annually over the last five years.

Image Source: Zacks Investment Research

Helix Energy Solutions Group

Helix Energy Solutions Group is a company that specializes in providing innovative offshore energy solutions to the oil and gas industry. With a focus on subsea technologies, well intervention, and robotics, HLX offers a range of services aimed at optimizing exploration, production, and development activities in challenging offshore environments. Through its cutting-edge technologies and expertise, Helix Energy Solutions Group contributes to enhancing operational efficiency and safety in the offshore energy sector.

Like the other two, Helix Energy Solutions Group has formed a very nice bull flag, while many other stocks in the market trend lower. You can see that price broke out above the upper bound a few times already but was never able to close above it. If HLX can break out above $9.80 and close above it, it should start to rally. But if the price is unable to hod the $9.20 support it may fill that gap below before moving higher again.

Image Source: TradintgView

Along with a Zacks Rank #1 (Strong Buy) rating, HLX also has very impressive expectations for sales and earnings growth over the next couple of years. FY23 earnings estimates have been raised by 4.4% over the last two months and are projected to grow 200% YoY. FY24 estimates have been upgraded by 4.8% and are expected to climb 80% YoY.

Image Source: Zacks Investment Research

Helix Energy Solutions Group is trading at a one year forward earnings multiple of 17.9x, which is just above the industry average of 17.3x, and below its 10-year median of 25x.

Conclusion

As you can see, the energy market and energy stocks are showing considerable relative strength compared to the broader market. While some of the market's leading stocks are experiencing more significant sell offs, energy stocks are building bullish chart patterns, signaling more bull moves going forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enerplus Corporation (ERF) : Free Stock Analysis Report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

Solaris Oilfield Infrastructure, Inc. (SOI) : Free Stock Analysis Report