Enerpac Tool Group Corp (EPAC) Affirms Full-Year Guidance Amidst Q2 Fiscal 2024 Earnings Release

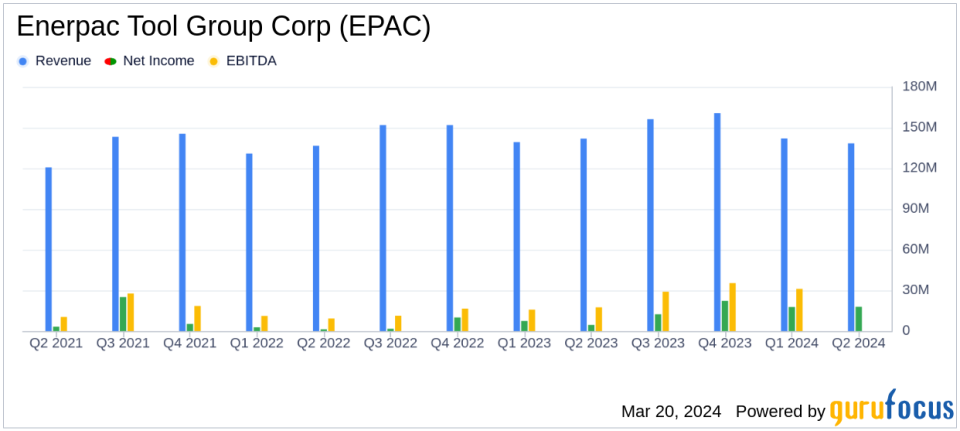

Net Sales: $138 million, a 2% decline year-over-year, impacted by the disposition of Cortland Industrial.

Organic Sales Growth: Increased 2% year-over-year, indicating underlying business strength.

Gross Margin: Expanded to 51.6%, a significant 200 basis point improvement from the previous year.

Operating Margin: Grew to 21.3%, with adjusted operating margin reaching 22.8%.

Net Earnings and EPS: Reported at $18 million and $0.33 per share, with adjusted figures slightly higher.

Adjusted EBITDA: Increased by 6% to $34 million, with margin expansion to 24.8%.

Cash Flow: Operating activities generated $13.3 million, improving from a prior-year deficit.

On March 20, 2024, Enerpac Tool Group Corp (NYSE:EPAC) released its 8-K filing, detailing the financial outcomes for the second quarter of fiscal year 2024. Enerpac Tool Group, a leading provider of high-precision tools and solutions for heavy lifting, operates through its industrial tools and services segment, with a significant portion of revenue generated from product sales. The company's global presence is marked by operations across the United States, Asia, Europe, and other regions, with the U.S. being the largest contributor to revenue.

Performance Highlights and Challenges

Enerpac's second quarter saw a slight decline in net sales, attributed to the disposition of Cortland Industrial. However, organic sales, which exclude the impact of foreign exchange rates, acquisitions, and divestitures, grew by 2%. This growth, alongside a robust expansion in gross margin to 51.6%, reflects the company's ability to improve operating efficiency and manage costs effectively. The operating margin also saw a notable increase to 21.3%, with an adjusted figure of 22.8%.

Despite these achievements, the overall slowdown in the industrial sector poses challenges for Enerpac. The company's President & CEO, Paul Sternlieb, acknowledged the broader macro environment but remained optimistic about the company's margin expansion and organic sales growth, particularly in the Industrial Tools & Services (IT&S) segment.

Financial Achievements and Importance

The financial achievements of Enerpac during the quarter are significant for the industrial products industry. A 200 basis point expansion in gross margin and a 210 basis point increase in adjusted EBITDA margin are indicative of the company's strategic pricing actions, favorable sales mix, and operational efficiencies. These improvements are critical for maintaining competitiveness and profitability in a challenging market.

Net earnings for the quarter stood at $18 million, or $0.33 per share, with adjusted net earnings slightly higher at $20 million, or $0.36 per share. Adjusted EBITDA increased by 6% to $34 million, demonstrating the company's ability to grow earnings despite a challenging sales environment.

Key Financial Metrics and Commentary

Key financial metrics from the income statement, balance sheet, and cash flow statement highlight Enerpac's financial health and operational performance. The company's net cash provided by operating activities improved significantly, turning a prior-year deficit into a $13.3 million inflow. This is primarily due to better management of working capital and inventory efficiency.

Paul Sternlieb commented on the results, stating:

"Enerpac posted solid second quarter results despite the broader macro environment and an overall slowdown in the industrial sector. We were particularly pleased with the margin expansion, as we made further progress improving operating efficiency and SG&A productivity."

Furthermore, the company's balance sheet remains strong, with a cash balance of $153.7 million and a net debt to adjusted EBITDA ratio of 0.7x, indicating a healthy leverage position.

Analysis and Outlook

Enerpac's performance in the second quarter of fiscal 2024 reflects a resilient business model capable of delivering growth in organic sales and profitability, even as it navigates market headwinds. The company's reaffirmation of its full-year guidance, with projected net sales between $590 million to $605 million and adjusted EBITDA in the range of $142 million to $152 million, signals confidence in its strategic initiatives and market position.

The company's focus on operational efficiency, pricing strategy, and working capital management is expected to continue driving margin expansion and cash flow generation. With a targeted adjusted EBITDA margin of at least 25% in fiscal 2025, Enerpac is positioning itself for sustainable growth and shareholder value creation.

For a detailed analysis of Enerpac Tool Group Corp's financials and future prospects, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Enerpac Tool Group Corp for further details.

This article first appeared on GuruFocus.