Enersys (ENS) Beats on Q1 Earnings, Hikes Dividend by 29%

Enersys ENS reported first-quarter fiscal 2024 (ended Jul 2, 2023) adjusted earnings (excluding 29 cents from non-recurring items) of $1.89 per share, which surpassed the Zacks Consensus Estimate of $1.80. The bottom line surged 64.4% year over year due to lower cost of sales.

Enersys’ total revenues of $908.6 million missed the Zacks Consensus Estimate of $953 million. The top line inched up 1.1% year over year due to a 9% increase in price/mix. Organic sales in the quarter decreased 8%.

Segmental Discussion

The Energy Systems segment’s sales (accounting for 46.7% of total sales) were $424.6 million, up 3.9% year over year. This compares with the Zacks Consensus Estimate of $467.50 million. Segmental revenues increased due to higher pricing, partly offset by lower volumes in Europe and Asia. Foreign currency translation had a negative impact of 1%, while organic revenues decreased 7%.

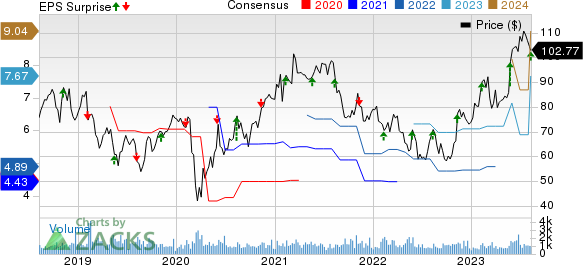

Enersys Price, Consensus and EPS Surprise

Enersys price-consensus-eps-surprise-chart | Enersys Quote

The Motive Power segment generated revenues of $350.8 million (accounting for 38.6% of total sales), down 4.6% year over year. The Zacks Consensus Estimate for segmental revenues was $341.31 million. The downside was due to a 14% decrease in organic sales, partly offset by an 8% increase in pricing. Acquisitions contributed 1% to segmental revenues, while foreign currency translation had an adverse impact of 1%.

The Specialty segment’s sales were $133.2 million (accounting for 14.7% of total sales), up 8.7% year over year. The Zacks Consensus Estimate for the same was $132.07 million. A 7% increase in pricing/mix and a 1% rise in organic volume contributed to the higher segmental revenues. Foreign currency translation had a favorable impact of 1%.

Margin Profile

In the reported quarter, EnerSys' cost of sales decreased 7.6% year over year to $587.20 million. Gross profit in the quarter increased 29.5% year over year to $240.3 million, while the gross margin increased 580 basis points (bps) year over year to 26.4%.

Operating expenses increased 13.8% year over year to $144.6 million. Adjusted operating earnings surged 65.4% year over year to $107.2 million. The margin increased 460 bps year over year to 11.8%.

Balance Sheet and Cash Flow

At the end of the first quarter of fiscal 2024, EnerSys had cash and cash equivalents of $258.34 million compared with $346.67 million at the end of fiscal 2023. Long-term debt (net of unamortized debt issuance costs) was $907.77 million compared with $1,042 million at the fiscal 2023-end.

EnerSys generated net cash of $74.95 million from operating activities in the fiscal first quarter against $71.89 million used in the year-ago period. Capital expenditure totaled $16.09 million compared with $23.01 million in the previous year’s period.

In first-quarter fiscal 2024, ENS rewarded its shareholders with a dividend payout of $7.17 million, up nearly 1% year over year.

Dividend Hike

EnerSys’ board raised its quarterly dividend by 29% to 22.5 cents per share (annually: 90 cents). The first installment of the dividend is payable to shareholders on Sep 29, of record as of Sep 15.

Fiscal Q2 Guidance

For the second quarter of fiscal 2024, EnerSys, carrying a Zacks Rank #3 (Hold), expects adjusted earnings of $1.77-$1.87 per share. The Zacks Consensus Estimate for the same stands at $7.67. Gross margin is expected to be 25-27%. The company expects capital expenditures of approximately $120 million. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Performance of Other Industrial Companies

A. O. Smith Corporation’s AOS second-quarter 2023 adjusted earnings (excluding 3 cents from non-recurring items) of $1.01 per share surpassed the Zacks Consensus Estimate of adjusted earnings of 91 cents per share. The bottom line jumped 23.2% year over year.

A. O. Smith’s net sales of $960.8 million underperformed the consensus estimate of $971 million. The top line dipped 0.5% year over year.

Allegion plc’s ALLE second-quarter 2023 adjusted earnings of $1.76 per share surpassed the Zacks Consensus Estimate of $1.69. The bottom line increased 28.5% year over year.

Allegion’s revenues of $912.5 million missed the Zacks Consensus Estimate of $927 million. However, the top line jumped 18% from the year-ago quarter.

IDEX Corporation’s IEX second-quarter 2023 adjusted earnings of $2.18 per share surpassed the Zacks Consensus Estimate of adjusted earnings of $2.12 per share. On a year-over-year basis, the bottom line increased 7.9%.

IDEX’s net sales of $846.2 million underperformed the Zacks Consensus Estimate of $847 million. However, the top line increased 6.3% year over year. Organic sales in the quarter increased 3% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Allegion PLC (ALLE) : Free Stock Analysis Report