EnerSys (ENS) Clinches $92M Long-Term Contract From USN

EnerSys ENS has recently secured a contract to deliver its proprietary Thin Plate Pure Lead (TPPL) batteries to the United States Navy (USN). The TPPL batteries will be used as the primary storage batteries on all four classes of USN Nuclear Submarines. This multiyear contract has been valued at $91.8 million.

TPPL batteries use thinner electrodes than traditional batteries. These batteries are of higher purity as well. EnerSys strengthened its position as a leading provider of TPPL products in the past few years.

This five-year deal between EnerSys and USN is a continuation of a supplier relationship. ENS has provided TPPL batteries for USN’s submarines for more than fifteen years now from the company’s Warrensburg, MO based automated facility. EnerSys aims to cater to a diverse range of applications within the military domain with its state-of-the-art lithium cobalt and proprietary lithium ion-chemistries.

In the quarters ahead, EnerSys is likely to benefit from its solid product offerings, a firm focus on product innovation (including lithium, Touch-Safe, CPUC and DC fast charge) and strengthening demand. The global mega trends, including 5G expansion, rural broadband build-outs, electrification, automation and decarbonization, are aiding the company.

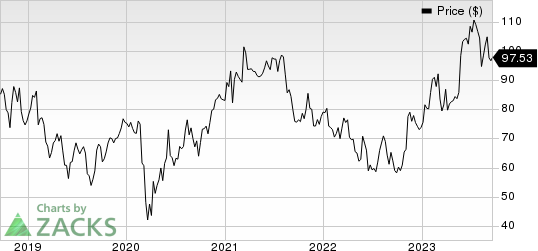

Enersys Price

Enersys price | Enersys Quote

Also, in the long run, EnerSys is positioned to benefit from the Inflation Reduction Act. The company expects most of its TPPL products and some portion of the high-density traditional flooded lead acid batteries to qualify for the proposed tax credits.

Zacks Rank & Other Stocks to Consider

EnerSys currently carries a Zacks Rank #2 (Buy). Some other top-ranked companies from the Industrial Products sector are discussed below:

Caterpillar Inc. CAT presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

CAT’s earnings surprise in the last four quarters was 17.8%, on average. In the past 60 days, estimates for Caterpillar’s earnings have increased 10.6% for 2023. The stock has gained 54.3% in the past year.

Ingersoll Rand Inc. IR presently sports a Zacks Rank of 1. IR’s earnings surprise in the last four quarters was 14.9%, on average.

In the past 60 days, estimates for Ingersoll Rand’s earnings have increased 3% for 2023. The stock has gained 37% in the past year.

Eaton Corporation plc ETN currently carries a Zacks Rank of 2. The company delivered a trailing four-quarter earnings surprise of approximately 3%, on average.

In the past 60 days, estimates for Eaton’s earnings have increased 4% for 2023. The stock has soared 56.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report