EnerSys (ENS) Gains From Business Strength Amid Headwinds

EnerSys (ENS) has been benefiting from its solid product offerings, a firm focus on product innovation and strengthening demand. The company strengthened its position as a leading provider of NexSys Thin Plate Pure Lead (“TPPL”) products in the past few years. The global megatrends, including 5G expansion, rural broadband build-outs, electrification, automation and decarbonization, have been driving its growth.

The company has been strengthening its business through acquisitions. It acquired the U.K.-based battery service and maintenance provider Industrial Battery and Charger Services Limited (“IBCS”) in April 2023. The addition of IBCS bolstered the company’s motive power service offerings and strengthened its presence in the U.K. market. It also augmented ENS’ comprehensive range of battery-related services, including installation and maintenance.

ENS has been committed to rewarding shareholders through dividend payouts. The company paid out dividends of $16.3 million and bought back shares worth $47.3 million in the first six months of fiscal 2024. Also, it hiked its quarterly dividend 29% to 22.5 cents per share in August 2023.

ENS also recently updated its third-quarter fiscal 2024 outlook, considering the impacts of the U.S. Department of the Treasury’s proposed regulations regarding the Advanced Manufacturing Production Credit - Section 45X of the Internal Revenue Code. It anticipates generating adjusted diluted earnings per share between $2.50 and $2.60 for third-quarter fiscal 2024. The figure compares favorably with the previously mentioned $1.80-$1.90.

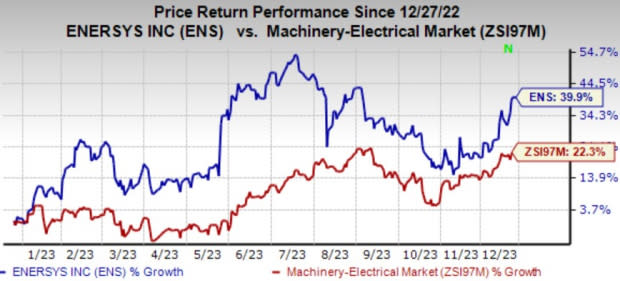

Image Source: Zacks Investment Research

In the past year, the Zacks Rank #3 (Hold) company has gained 39.9% compared with the industry’s growth of 22.3%.

However, decreased capital spending by telecommunication and broadband customers has been affecting EnerSys’ Energy Systems segment. The segment’s revenues were down 3.3% year over year in the second quarter of fiscal 2024. TPPL capacity constraints and the closure of the Sylmar plant are affecting the Specialty segment.

The company has been making multiple investments for a while to boost growth. For instance, over the last few quarters, ENS made significant investments to expand the TPPL manufacturing capability. Although its investments hold good for long-term growth, high capital expenditure is likely to hurt the company’s bottom line in the short term. For fiscal 2024, ENS expects a capital expenditure of $100-$120 million.

3 Promising Stocks

We have highlighted three better-ranked stocks from the Zacks Industrial Products sector, namely Crane Company CR, Flowserve Corporation FLS and Kadant Inc. KAI. All these companies currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Crane delivered a trailing four-quarter average earnings surprise of 29.8%. In the past 60 days, the Zacks Consensus Estimate for CR’s 2023 earnings has been unchanged. The stock has rallied 46.8% in the past year.

Flowserve has a trailing four-quarter average earnings surprise of 27.3%. The consensus estimate for FLS’ 2023 earnings has increased 1.5% in the past 60 days. Shares of the company have gained 36% in the past year.

Kadant delivered a trailing four-quarter average earnings surprise of 17.3%. In the past 60 days, the consensus estimate for KAI’s 2023 earnings has improved 5.2%. The stock has risen 57.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Kadant Inc (KAI) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report