EnerSys (ENS) Q2 Earnings and Revenues Surpass Estimates

EnerSys ENS reported impressive results for second-quarter fiscal 2023 (ended Oct 2, 2022). ENS’ earnings beat the Zacks Consensus Estimate of $1.09 by 1.8% and sales beat the same by 1.1%.

The bottom line increased 9.9% from the year-ago figure of $1.01 driven by higher sales generation across all segments.

Revenue Details

In the quarter under review, EnerSys’ revenues were $899.4 million, up 13.7% from the year-ago quarter. Organic sales in the quarter grew 10% on the back of strengthening markets. Pricing positively impacted sales by 9%, while forex woes left a negative impact of 5%.

While exiting the reported quarter, EnerSys had a backlog of $1.4 billion.

ENS’ revenues beat the Zacks Consensus Estimate of $890 million.

Geographically, ENS' net sales increased 20% year over year to $661 million in the Americas, while the metric witnessed a decline of 1% to $178 million in Europe, the Middle East and Africa. Sales in Asia were $61 million, in line with the year-ago quarter.

Segmental performance for the fiscal second quarter is briefly discussed below:

Energy Systems' sales were $437 million, contributing 48.6% to net revenues in the quarter under review. On a year-over-year basis, the segment's revenues increased 18%. Volume was up 14%, while pricing had a positive impact of 9%. Adverse foreign currency translations hurt 5%.

The Motive Power segment generated revenues of $338 million, contributing 37.6% to net revenues in the reported quarter. The figure increased 17% year over year based on 3% growth in volumes and a 9% contribution from pricing. Forex woes left a negative impact of 7%.

Specialty sales were $124 million, contributing 13.8% to net revenues in the quarter under review. On a year-over-year basis, the segment's revenues increased 23%. Volume and pricing had a positive impact of 19% and 7%, respectively, on the quarter, while foreign currency translations had a negative impact of 3%.

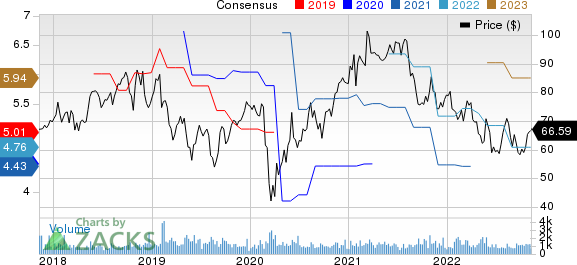

Enersys Price and Consensus

Enersys price-consensus-chart | Enersys Quote

Margin Profile

In the reported quarter, EnerSys' cost of sales increased 14.8% year over year to $703 million. The cost of sales was 78.2% of the quarter's net sales. The gross profit in the quarter increased 9.6% year over year to $194.8 million, while the gross margin decreased 80 basis points (bps) year over year to 21.7%.

Operating expenses increased 9.7% year over year to $137.4 million. The metric represented 15.3% of net sales in the reported quarter compared with 15.8% in the year-ago quarter. Adjusted operating earnings were $65.4 million, increasing 6.6% year over year. The margin decreased 50 bps year over year to 7.3%.

ENS' performance in the quarter suffered cost inflation and supply-chain constraints. However, pricing actions provided relief.

Balance Sheet and Cash Flow

While exiting the second quarter of fiscal 2023, EnerSys had cash and cash equivalents of $294.4 million, down 26.9% from $402.5 million recorded in the fourth quarter of fiscal 2022. Long-term debt increased 4.2% to $1,295.8 million from $1,243 million recorded in the fourth quarter of fiscal 2022.

In the first six months of fiscal 2023, ENS repaid short-term debt of $17.1 million and revolving credit borrowings of $184.1 million. However, proceeds for revolving credit borrowings were $244.1 million in the first six months of fiscal 2023.

EnerSys used net cash of $70.3 million for its operating activities in the first six months of fiscal 2023 compared with $65.6 million used in the year-ago period. Capital expenditure totaled $39.7 million compared with $34.6 million in the previous year’s period.

ENS rewarded its shareholders with a dividend payout of $14.2 million in the first six months of fiscal 2023. Share repurchased amounted to $22.9 million. ENS is left to buy back shares worth $185 million.

Dividend

EnerSys’ board of directors approved a quarterly cash dividend of 17.5 cents per share to its shareholders of record as of Dec 16, 2022. The disbursement will be made on Dec 30, 2022.

Outlook

EnerSys anticipates gaining from robust order level. The company expects to benefit from a slowdown as large portions of its business are cycle-independent and its significant cash flow generation during past recessionary periods in the quarters ahead.

However, microeconomic conditions, forex woes and the European utility inflation are worrisome. Earnings for the third quarter of fiscal 2023 are expected to be $1.20-$1.30 per share. The gross margin is expected to be in the range of 21-23%. Capital expenditure is anticipated to be approximately $100 million for fiscal 2023.

Zacks Rank & Stocks to Consider

EnerSys currently has a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

EPAC’s earnings estimates have increased 9.1% for fiscal 2023 (ending August 2023) in the past 60 days. The company’s shares have gained 32.2% in the past six months.

Applied Industrial Technologies, Inc. AIT presently has a Zacks Rank #1 and a trailing four-quarter earnings surprise of 24.8%, on average.

AIT’s earnings estimates have increased 3% for fiscal 2023 (ending June 2023) in the past 60 days. The company’s shares have risen 23% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank of 2 (Buy). IEX’s earnings surprise in the last four quarters was 5.7%, on average.

In the past 60 days, IDEX’s earnings estimates have increased 1.8% for 2022. The stock has rallied 21.5% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research