EnerSys (ENS) Reports Q3 Fiscal 2024 Earnings: Gross Margin and EPS Surge Amid Market Challenges

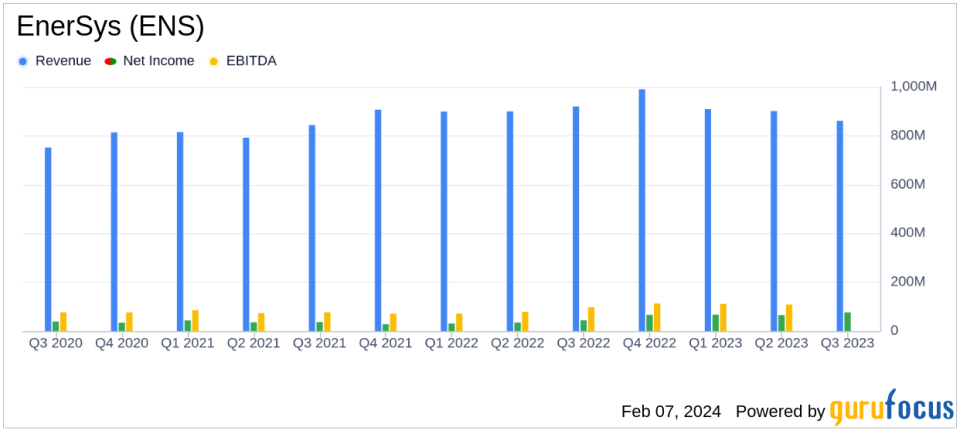

Net Sales: $861.5 million, a decrease of 6.4% from the previous year.

Gross Margin (GM): Improved to 28.9%, up 570 basis points year-over-year.

Operating Earnings: Increased to $93 million, up 18% from the prior year.

Diluted EPS (GAAP): Rose to $1.86, a 72% increase year-over-year.

Adjusted Diluted EPS (Non-GAAP): $2.56, marking a 102% increase.

Net Leverage: Reduced to 1.1x EBITDA based on operating cash flow of $135 million.

Capital Returned to Stockholders: $44.1 million, including share repurchases and dividends.

On February 7, 2024, EnerSys (NYSE:ENS), a global leader in stored energy solutions for industrial applications, released its 8-K filing, detailing financial results for the third quarter of fiscal year 2024. Despite a 6% decline in net sales, primarily due to temporary spending pauses in telecom and broadband, the company achieved a significant gross margin improvement and a substantial increase in earnings per share (EPS).

Financial Performance and Challenges

EnerSys (NYSE:ENS) reported net sales of $861.5 million for the third quarter, a 6.4% decrease compared to the same period last year. This decline was attributed to a temporary reduction in demand within the telecom and broadband markets, as well as a normalization of Motive Power orders. However, the company saw strength in Specialty, services, and data centers, particularly in the Americas.

The company's gross margin expanded to 28.9%, up 570 basis points from the prior year, benefiting from $59 million in Inflation Reduction Act / IRC 45X tax credits. Excluding these benefits, the adjusted gross margin still improved by 80 basis points to 23.9%. Operating earnings grew by 18% to $93 million, and adjusted operating earnings surged by 53% to $130 million. Diluted EPS increased by 72% to $1.86, and adjusted diluted EPS soared by 102% to $2.56.

Financial Achievements and Importance

The improvement in gross margin is a critical indicator of EnerSys (NYSE:ENS)'s ability to manage costs and optimize pricing strategies effectively. The robust increase in EPS reflects the company's operational efficiency and the strategic benefit of tax credits. These financial achievements are particularly noteworthy in the context of the industrial products industry, where margins can be pressured by raw material costs and economic cycles.

Key Financial Metrics

The company's balance sheet showed a healthy liquidity position, with cash and cash equivalents of $332.7 million. EnerSys (NYSE:ENS) also demonstrated strong cash flow management, with operating cash flow conversion of 177% and adjusted free cash flow conversion of 106%, contributing to a reduction in net leverage to 1.1x EBITDA.

"We remain highly confident in EnerSyss position as a global leader in electrification and energy storage applications, with demand driven by critical global megatrends," said David M. Shaffer, President and Chief Executive Officer, EnerSys.

Analysis of Company Performance

Despite the sales headwinds, EnerSys (NYSE:ENS) managed to deliver a strong financial performance, with significant margin expansion and earnings growth. The company's strategic actions to reduce costs and rebalance production lines have paid off, as evidenced by the improved profitability metrics. The additional tax credits have provided a substantial boost to the gross margin, showcasing the company's ability to capitalize on legislative changes.

Looking ahead, EnerSys (NYSE:ENS) remains optimistic about its business trajectory, with a focus on maintaining pricing power and capitalizing on market opportunities aligned with secular trends. The company's diversified end markets and strong customer relationships position it well for future growth.

For a more detailed analysis and to stay updated on EnerSys (NYSE:ENS)'s financial journey, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from EnerSys for further details.

This article first appeared on GuruFocus.