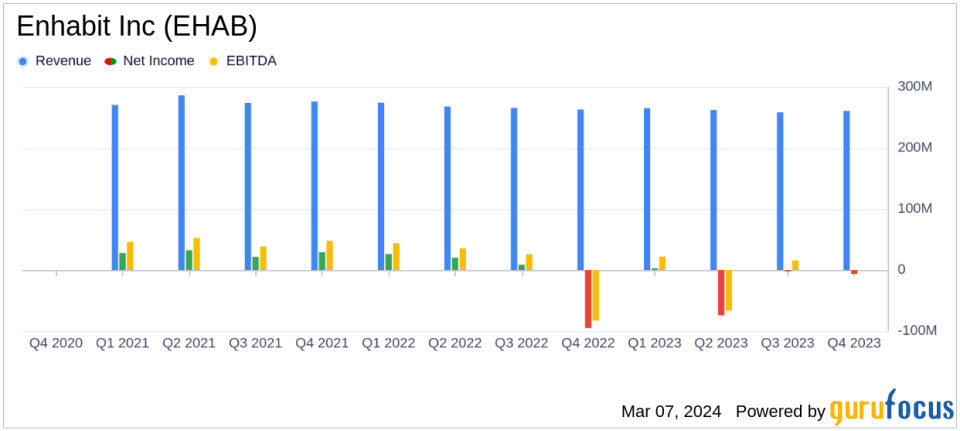

Enhabit Inc (EHAB) Reports Q4 Earnings: Net Loss Narrows, Adjusted EBITDA Declines

Net Service Revenue: Q4 net service revenue slightly decreased by 1.0% to $260.6 million.

Net Loss: Net loss attributable to Enhabit Inc narrowed significantly to $6.4 million from $95.2 million in the prior year.

Adjusted EBITDA: Adjusted EBITDA declined by 16.8% to $25.2 million.

Earnings Per Share (EPS): Loss per share improved to $0.13, while adjusted EPS was $0.06.

Operational Metrics: Home health segment saw a 34.2% increase in non-episodic admissions, while hospice segment improved in average daily census and cost per day.

2024 Guidance: Enhabit Inc projects net service revenue between $1,076 and $1,102 million and adjusted EBITDA between $98 and $110 million for the full year.

On March 6, 2024, Enhabit Inc (NYSE:EHAB) released its 8-K filing, detailing the financial outcomes for the fourth quarter ended December 31, 2023. The company, a leading provider of home health and hospice care services in the United States, operates in two segments: home health and hospice. Enhabit Inc's home health agencies offer a range of Medicare-certified skilled services, while its hospice services focus on compassionate end-of-life care.

Despite a challenging environment, Enhabit Inc reported a net service revenue of $260.6 million, a slight decrease of 1.0% compared to the same period last year. The company experienced a net loss attributable to Enhabit Inc of $6.4 million, which is a significant improvement from the $95.2 million loss reported in the previous year. Adjusted EBITDA for the quarter was $25.2 million, a decrease of 16.8% year over year. The loss per share stood at $0.13, while adjusted earnings per share were reported at $0.06.

Enhabit Inc highlighted several operational achievements, including a 34.2% increase in non-episodic admissions in the home health segment and a reduction in hospice cost per day to $76. The company also noted a 53.2% better performance than the national average for hospice patient visits in the last days of life. Recruitment and retention efforts led to a 21.5% increase in the full-time nursing candidate pool year over year, resulting in 119 net new full-time home health nursing hires in the fourth quarter.

The company's financial results reflect the impact of a shift to more non-episodic admissions in home health, which affected consolidated revenue and Adjusted EBITDA by approximately $8 million, net of the impact from improved pricing of payor innovation contracts. The home health segment saw a decrease in net service revenue by 2.9% to $209.5 million, while the hospice segment's net service revenue increased by 7.8% to $51.1 million.

For the full year of 2024, Enhabit Inc has provided guidance with net service revenue expected to be between $1,076 and $1,102 million, and adjusted EBITDA projected to be between $98 and $110 million. Adjusted EPS is anticipated to range from $0.12 to $0.43.

Enhabit Inc's President and CEO Barb Jacobsmeyer commented on the results:

"Persistent focus on our Companys strategies drove our positive fourth quarter results. Payor innovation success, including the finalization of another new national contract, continued success with our people strategy and strong performance in our quality outcomes are but a few of our high points for the end of 2023 and our start to 2024. We are excited about our future and our ability to meet the growing demand for home health and hospice services."

The company will host a conference call to further discuss the fourth quarter results and provide more insights into the 2024 guidance.

Enhabit Inc's balance sheet as of December 31, 2023, shows total assets of $1,433.6 million and total liabilities and stockholders' equity of the same amount. The company's cash and cash equivalents stood at $27.4 million, with a net cash provided by operating activities for the year ended December 31, 2023, detailed in the supplemental information provided.

Investors and stakeholders are encouraged to review the detailed financial statements and reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures, as provided in the supplemental information of the filing.

For more information on Enhabit Inc's financial performance and future outlook, visit the investor relations section of the company's website at http://investors.ehab.com.

Explore the complete 8-K earnings release (here) from Enhabit Inc for further details.

This article first appeared on GuruFocus.