Eni (E) Reports Y/Y Declines in Earnings & Revenues in Q4

Eni SpA E reported fourth-quarter 2023 diluted earnings per share of 5 cents, which declined from the year-ago quarter’s 21 cents.

Total quarterly revenues of €25 billion declined from the €31.8 billion recorded a year ago.

Quarterly earnings resulted from lower average realized commodity prices.

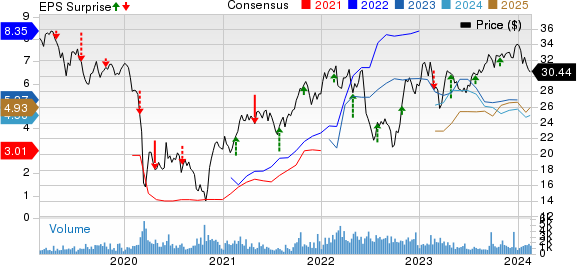

Eni SpA Price, Consensus and EPS Surprise

Eni SpA price-consensus-eps-surprise-chart | Eni SpA Quote

Operational Performance

The company operates through four business segments — Exploration & Production, Global Gas & LNG Portfolio, Enilive Refining and Chemicals, and Plenitude & Power.

Exploration & Production

The total oil and gas production in the fourth quarter was 1,708 thousand barrels of oil equivalent per day (MBoe/d), up 6% from the 1,617 recorded in the prior-year quarter.

Liquids production totaled 781 thousand barrels per day (MBbl/d), up 1% from the year-ago quarter’s 776 MBbl/d. Natural gas production increased to 4,851 million cubic feet per day from the 4,426 recorded a year ago.

The average realized price of liquids was $77.53 per barrel, marginally down from the $77.60 reported a year ago. The realized natural gas price was $7.21 per thousand cubic feet, down 17% from the $8.72 registered in the year-ago period.

Lower liquid and natural gas price realization hurt the company’s Exploration & Production segment. The segment reported a profit of €2.4 billion, down from the €2.9 billion recorded in the December-end quarter of 2022.

Global Gas & LNG Portfolio

Eni’s worldwide natural gas sales in the reported quarter totaled 13.61 billion cubic meters (bcm), down 12% year over year.

The integrated energy major’s Global Gas & LNG Portfolio business segment reported an adjusted operating profit of €677 million, marking a significant increase from the year-ago quarter’s €63 million. This increase was primarily due to a positive outcome of an arbitration procedure. The regular business performance, excluding one-time events, was largely as expected, considering the current market conditions with less fluctuation in gas prices and spreads.

Enilive, Refining and Chemicals

For the fourth quarter, total refinery throughputs were 6.92 million tons (mmtons) compared with 6.59 in the corresponding period of 2022. Petrochemical product sales declined 3% year over year to 0.80 mmtons.

For the quarter under review, the segment reported an adjusted operating loss of €87 million, turning around from a profit of €379 million reported in the year-ago quarter. This was primarily due to lower demand across all parts of the Chemicals business. This was because of a slower overall economy and higher costs for energy supplies in Europe, which made Versalis productions less competitive than companies in the United States and Asia. The market had a surplus supply, which further impacted the situation.

Plenitude & Power

Retail gas sales managed by Plenitude declined 6% year over year to 1.74 bcm. Power sales in the open market declined 2% year over year.

The company reported a profit of €111 million from this segment, marking a 6% year-over-year decline.

Financials

As of Dec 31, Eni had a long-term debt of €21.7 billion, and cash and cash equivalents of €10.2 billion.

For the reported quarter, net cash generated by operating activities was €4.2 billion. Capital expenditure totaled €2.7 billion.

Zacks Rank & Stocks to Consider

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Equitrans Midstream ETRN owns, operates, acquires and develops midstream assets, primarily in the Appalachian Basin. It manages natural gas transmission, storage and gathering systems, and high and low-pressure gathering lines.

The Zacks Consensus Estimate for ETRN’s 2024 EPS is pegged at 90 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ETRN’s 2024 earnings are expected to rise 34.3% year over year.

Energy Transfer ET is a publicly traded limited partnership focused on diverse energy assets in the United States. Its core operations involve natural gas midstream services, transportation, storage, crude oil facilities and marketing assets.

The Zacks Consensus Estimate for ET’s 2024 EPS is pegged at $1.45. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. ET’s 2024 earnings are expected to rise 12.4% year over year.

Subsea 7 S.A. SUBCY helps build underwater oil and gas fields. It is a top player in the Oil and Gas Equipment and Services market, which is expected to grow as oil and gas production moves further offshore.

The Zacks Consensus Estimate for SUBCY’s 2024 EPS is pegged at 91 cents. It has witnessed upward earnings estimate revisions for 2024 in the past 30 days. SUBCY’s 2024 earnings are expected to soar 277% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

Subsea 7 SA (SUBCY) : Free Stock Analysis Report

Equitrans Midstream Corporation (ETRN) : Free Stock Analysis Report