Eni (E) Signs Deal to Divest Nigeria Onshore Assets to Oando

Eni SPA E entered an agreement to divest its Nigeria-based subsidiary, Nigerian Agip Oil Company (“NAOC”), to local energy solutions provider Oando.

NAOC plays a leading role in the Nigerian energy sector, with a primary focus on onshore oil and gas operations, and power generation. NAOC has participating interests in four onshore blocks and two onshore exploration leases, and runs two power facilities in Nigeria.

The transaction excludes NAOC’s interest in Shell Production Development Company. Eni will hold on to its 5% stake in the joint venture, indicating that the latest move does not imply a complete departure from the Nigeria energy sector. With the divestment, Eni gets closer to its long-term strategy to reduce oil exposure in favor of natural gas.

The acquisition will double Oando’s reserves to 996 million barrels of oil equivalent. The synergies created will unlock exceptional opportunities for Oando to realign expectations, enhance efficiency, optimize resource allocation and significantly increase production.

The acquisition aligns with Oando’s strategy to acquire, enhance, appraise and efficiently develop reserves. It highlights the important roles that indigenous actors will play in the future of the Nigeria upstream sector.

International oil majors are seeking to divest their onshore assets in Nigeria due to oil theft from pipelines and more focused exploration budgets. However, Eni will continue to operate in the country, focusing on offshore operations.

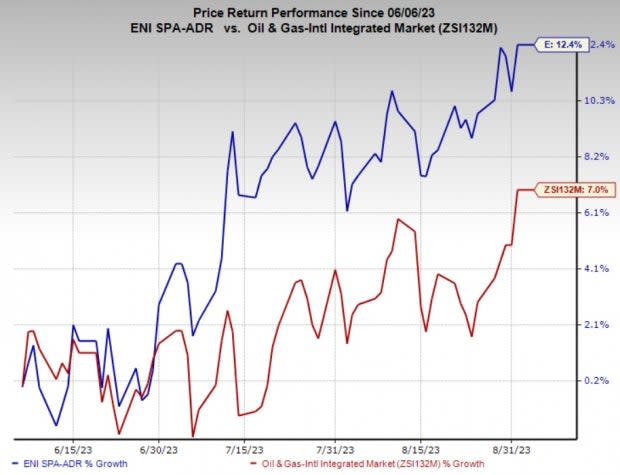

Price Performance

Shares of Eni have outperformed the industry in the past three months. The stock has gained 12.4% compared with the industry’s 7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Evolution Petroleum Corporation EPM is an independent energy company. EPM has a Zacks Style Score of A for Growth and B for Value.

Evolution Petroleum has witnessed upward earnings estimate revisions for 2023 and 2024 in the past 60 days. The consensus estimate for EPM’s 2023 and 2024 earnings per share is pegged at $1.11 and $1.08, respectively.

Core Laboratories N.V.’s CLB strong presence in the emerging shale plays and its global footprint will provide for steady growth rates, going forward. CLB’s technology-heavy portfolio of proprietary products and services gives it the opportunity to optimize production from new and existing fields.

Core Labs has witnessed upward earnings estimate revision for 2023 and 2024 in the past 30 days. The consensus estimate for CLB’s 2023 and 2024 earnings per share is pegged at 88 cents and $1.17, respectively.

Sunoco LP SUN is among the biggest motor fuel distributors in the United States wholesale market in terms of volumes. For 2023, the partnership expects an adjusted EBITDA of $865-$915 million.

Over the past 30 days, Sunoco has witnessed upward earnings estimate revisions for 2023 and 2024, respectively. The Zacks Consensus Estimate for SUN’s 2023 and 2024 earnings per share is pegged at $4.37 and $3.81, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Evolution Petroleum Corporation, Inc. (EPM) : Free Stock Analysis Report