EnLink Midstream LLC (ENLC): Is It Truly Worth Its Current Market Price?

EnLink Midstream LLC (NYSE:ENLC) is currently trading at $12.7, marking a 3.25% gain for the day and a 31.57% gain over the last three months. The company's Earnings Per Share (EPS) is 0.74. However, the question remains: Is the stock significantly overvalued? This analysis delves into the company's valuation, aiming to provide a clear answer. Read on for a comprehensive evaluation of EnLink Midstream LLC.

Company Overview

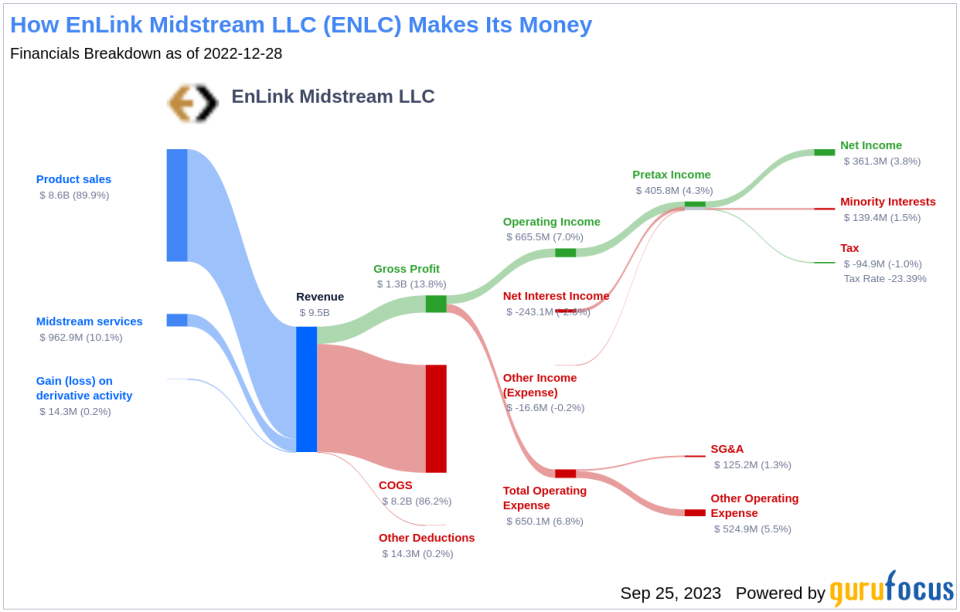

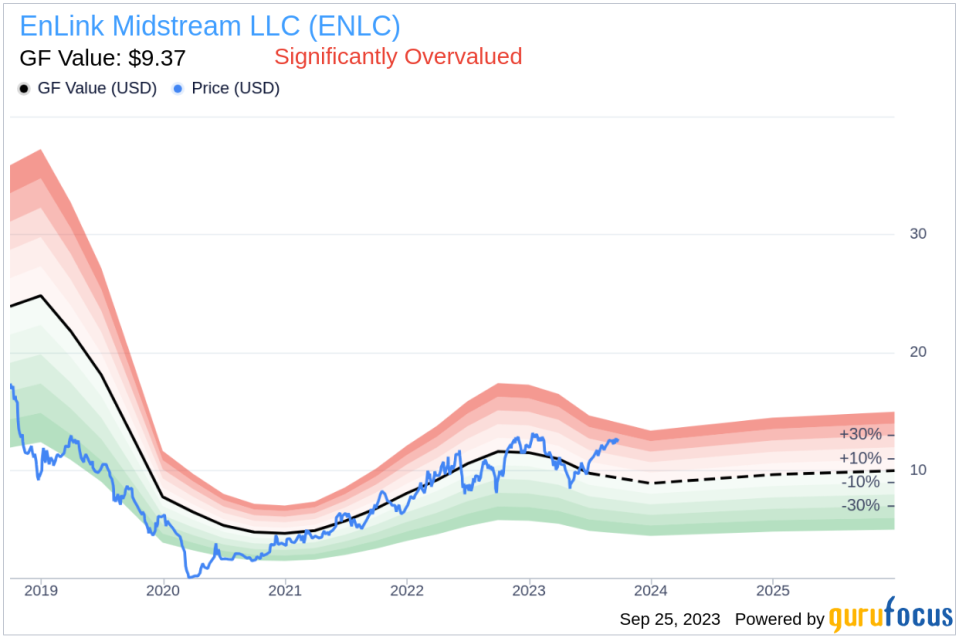

EnLink Midstream LLC is an integrated midstream company with primary operating segments in Permian, North Texas, Oklahoma, and Louisiana. The company generates the majority of its revenue from the Louisiana segment, which includes natural gas pipelines, processing plants, storage facilities, fractionation facilities, and NGL assets. Despite its current stock price of $12.7, its GF Value, an estimate of fair value, stands at $9.37. This discrepancy suggests that the stock might be significantly overvalued.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical multiples, an adjustment factor from GuruFocus based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

EnLink Midstream LLC's stock appears to be significantly overvalued based on the GF Value. This suggests that the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

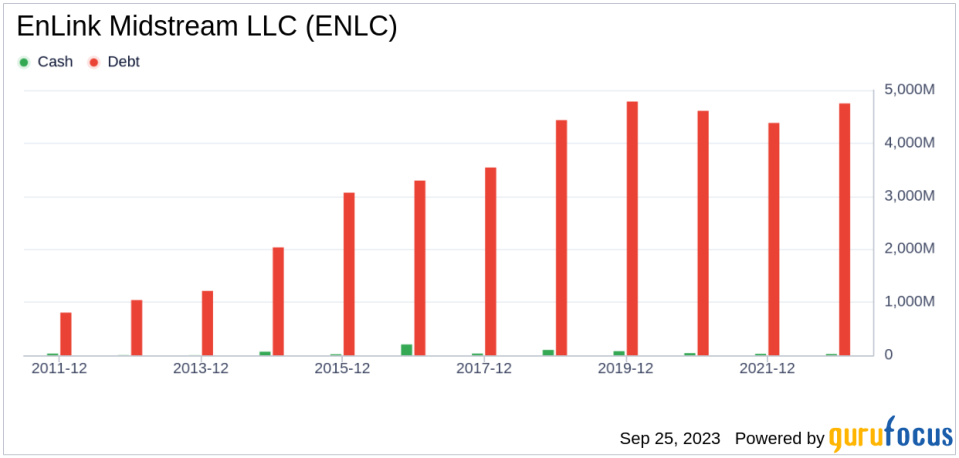

Financial Strength

It's crucial to check a company's financial strength before investing. Companies with poor financial strength pose a higher risk of permanent loss. EnLink Midstream LLC's cash-to-debt ratio of 0.01 is worse than 95.45% of 1034 companies in the Oil & Gas industry. This results in an overall financial strength score of 4 out of 10, indicating poor financial strength.

Profitability and Growth

Companies with consistent profitability over the long term offer less risk to investors. EnLink Midstream LLC has been profitable 5 times over the past 10 years. It has an operating margin of 8.31%, ranking worse than 50.41% of 984 companies in the Oil & Gas industry. Consequently, EnLink Midstream LLC's profitability is ranked 5 out of 10, indicating fair profitability.

Growth is one of the most important factors in a company's valuation. EnLink Midstream LLC has an average annual revenue growth of 14.7%, ranking better than 58.58% of 862 companies in the Oil & Gas industry. However, its 3-year average EBITDA growth is 6.1%, ranking worse than 61.16% of 829 companies in the same industry.

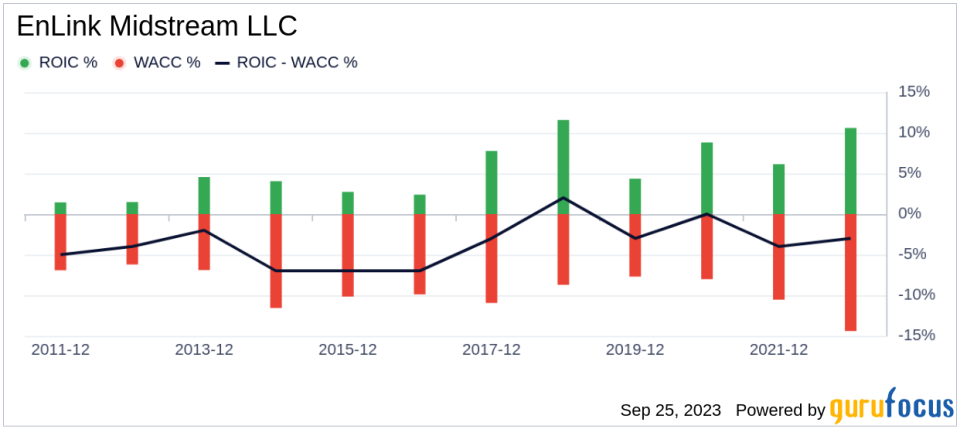

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can also help evaluate its profitability. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. Over the past 12 months, EnLink Midstream LLC's ROIC was 9.82, while its WACC was 9.17.

Conclusion

In conclusion, EnLink Midstream LLC's stock appears to be significantly overvalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks worse than 61.16% of 829 companies in the Oil & Gas industry. To learn more about EnLink Midstream LLC stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.