Enovis (ENOV) to Strengthen Portfolio Via Its Latest Buyout

Enovis Corporation ENOV recently closed its earlier-announced acquisition of privately-held LimaCorporate S.p.A. (Lima). The buyout is expected to add Lima’s complementary surgical solutions and customers to Enovis’ Reconstructive portfolio.

The buyout was initially announced in September 2023.

The latest acquisition is expected to significantly boost Enovis’ Reconstructive portfolio and provide it with the opportunity to expand its global presence.

Rationale Behind the Acquisition

Per Enovis, the latest buyout will likely strengthen its position in the global orthopedic reconstruction market with a complementary portfolio of surgical solutions and technologies. This, in turn, is expected to accelerate global growth and margin expansion for Enovis.

Lima's portfolio includes 3D-printed Trabecular Titanium implants and a comprehensive revision offering for shoulders. This is expected to further strengthen Enovis’ position in the fast-growing extremities market.

Enovis’ management commented that the buyout will likely establish an orthopedic reconstruction business worth approximately $1 billion, with approximately 50% of revenues in the fast-growing extremities markets.

Financial Implications

Enovis believes that the acquisition will likely create robust cross-selling opportunities and approximately $40 million in cost synergies to be fully realized by the third year after closing via supply-chain optimization and cost consolidation. Management also believes that the buyout would support Enovis’ long-term goals of high-single-digit organic revenue growth and sustainable EBITDA margin expansion.

Enovis expects Lima to generate sales of $290-$300 million and $70-$75 million of adjusted EBITDA in 2024.

Industry Prospects

Per a report by Data Bridge Market Research, the global orthopedic joint reconstruction market was valued at $17.77 billion in 2021 and is anticipated to reach $24.13 billion by 2029 at a CAGR of 3.9%. Factors like technological advancement in the orthopedic joint reconstruction sector, focus on developing surgical robots, and a rise in research and development activities are expected to drive the market.

Given the market potential, the recent acquisition is expected to provide a significant impetus to Enovis’ business globally.

Notable Developments

In November 2023, Enovis announced its third-quarter 2023 results, wherein it registered a robust uptick in its overall net sales, including strong organic sales per day growth. Sales in the Reconstructive segment were strong both on a reported and organic basis.

In October, Enovis announced its plans to showcase the latest technologies from its Surgical business at the American Association of Hip and Knee Surgeons annual meeting between Nov 2 and 5, 2023. The items displayed included an updated ARVIS Augmented Reality System, EMPOWR blade stem and EMPOWR 3D Knee.

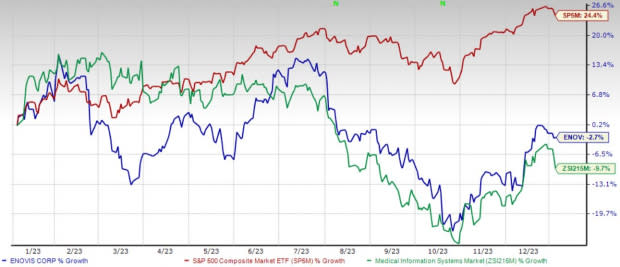

Price Performance

Shares of the company have lost 2.7% in the past year compared with the industry’s 9.7% decline. The S&P 500 has witnessed 24.4% growth in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, Enovis Medical carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are DaVita Inc. DVA, Merit Medical Systems, Inc. MMSI and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 34.1% compared with the industry’s 9.1% rise in the past year.

Merit Medical, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 11.5%. MMSI’s earnings surpassed estimates in each of the trailing four quarters, with the average being 14.4%.

Merit Medical has gained 6.2% compared with the industry’s 11.7% rise in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 41.2% against the industry’s 0.5% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Enovis Corporation (ENOV) : Free Stock Analysis Report