Enphase Energy (ENPH) Expands Partnership With Semper Solaris

Enphase Energy, Inc. ENPH recently announced an expansion in its partnership with Semper Solaris for deploying Enphase’s IQ8 Microinverters and the IQ Battery 5P. Through the new agreement, Semper Solaris will now offer the third generation of Enphase Energy Systems in the State of California.

The recent partnership will also allow Semper Solaris to use Enphase’s cloud-based software platform, Solargraf. Impressively, solar installers in California can use this software to build optimized solar and battery systems, which will help them offset bills under the new net energy metering 3.0 tariff.

Rationale Behind the Partnership

With the gradual wearing down of pandemic effects since the beginning of 2023, improved supply chain stability and installation volumes across the nation have bolstered solar demand in the United States. Consequently, in 2023, the U.S. solar market installed 32.4 GWdc of capacity, reflecting a remarkable 51% increase from 2022’s tally (as reported by the Solar Energy Industries Association).

Naturally, this has set the stage for more solar installations in the near future. Consequently, the latest partnership expansion of Enphase Energy with a solar installer like Semper Solaris seems to be strategically appropriate to tap the benefits of the growing solar installation demand.

Notably, with increased power, resilient wired communication and an improved commissioning experience, the third generation of the Enphase Energy System will allow customers to easily install it and reduce their electricity costs.

Enphase’s Prospects in U.S. Solar Market

The U.S. solar market provides significant growth opportunities, primarily driven by increased investment and deployment of solar plants and various government policies favoring development. To this end, a report from the Mordor Intelligence firm estimates that the U.S. solar energy market will reach 352 gigawatts (GWs) by 2029, registering a CAGR of more than 16.5% during the 2024-2029 period.

To reap the benefits of such solid growth opportunities offered by the U.S. solar market, Enphase Energy has been expanding its footprint through manufacturing maximization. Impressively, Enphase Energy’s revenue generation from the United States comprised 64% of the total revenue during 2023. Considering such abounding growth prospects offered by the U.S. solar market, the agreement with Semper Solaris should aid the company in generating solid revenues in the coming years.

Peers to Benefit

Other solar players in the industry that are undertaking expansion strategies to meet the growing demand of the U.S. solar market are as follows:

Canadian Solar CSIQ: Canadian Solar has been ramping up its manufacturing facility in the United States. On Feb 6, 2024, Canadian Solar secured financing for its 127 MWdc Bayou Galion Solar project in Northeast Louisiana. Recently, CSIQ partnered with Sol Systems to supply its latest high-efficiency N-Type TOPCon solar modules.

The Zacks Consensus Estimate for CSIQ’s 2023 earnings implies a rise of 7% over the prior-year figure. The stock delivered an average earnings surprise of 67.89% in the last four quarters.

Emeren Group SOL: Emeren has developed, sold and constructed multiple community and utility solar projects in the United States. Some of the notable projects are the 3 megawatt (MW) facility in Winsted, CT and the 5 MW facility in St Cloud, MN. As of Sep 30, 2023, it had 1,603 MW of solar development project pipeline in this nation.

The Zacks Consensus Estimate for SOL’s 2024 sales implies a rise of 48.8% over 2023’s estimated figure. Its share price has surged 30.4% in the past month.

First Solar FSLR: First Solar expects to exit 2026 with a 14 GW capacity in the United States. On Jan 19, 2024, FSLR acquired a 1.2 million square foot facility in Ohio to be repurposed into a new distribution center.

FSLR boasts a long-term earnings growth rate of 43%. The Zacks Consensus Estimate for 2024 sales implies a rise of 35.5% over 2023.

Price Performance

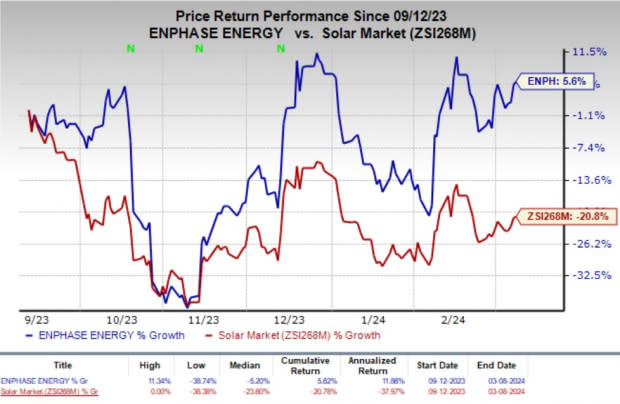

In the past six months, shares of ENPH have rallied 5.6% against the industry’s 20.8% decline.

Image Source: Zacks Investment Research

Zacks Rank

Enphase currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emeren Group Ltd. Sponsored ADR (SOL) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report