Enphase Energy Inc (ENPH) Reports Q4 Earnings: Revenue and Margins Reflect Market Challenges

Quarterly Revenue: Q4 revenue fell to $302.6 million from $551.1 million in Q3.

Gross Margin: Non-GAAP gross margin stood at 50.3%, benefiting from net IRA contributions.

Net Income: GAAP net income was $20.9 million, with non-GAAP net income at $73.5 million.

Earnings Per Share: GAAP diluted EPS at $0.15, non-GAAP diluted EPS at $0.54.

Free Cash Flow: Generated $15.4 million in free cash flow with $1.70 billion in liquidity.

Operational Efficiency: Streamlined manufacturing with a focus on U.S. production.

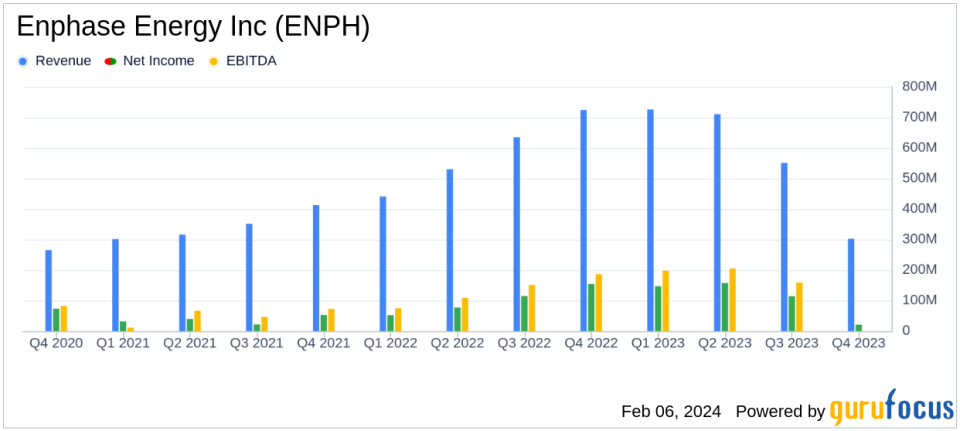

On February 6, 2024, Enphase Energy Inc (NASDAQ:ENPH), a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, released its 8-K filing, detailing the financial results for the fourth quarter of 2023. The company, known for its innovative solar generation and storage solutions, faced a challenging quarter with a significant decrease in revenue compared to the previous quarter and the same quarter in the previous year.

Financial Performance Overview

Enphase Energy's revenue for Q4 2023 was $302.6 million, a sharp decline from $551.1 million in Q3 2023 and $724.7 million in Q4 2022. This decrease was attributed to reduced shipments aimed at managing high inventory levels at distribution partners and a softening in demand, particularly in the United States and Europe.

Despite the revenue downturn, Enphase Energy maintained a strong non-GAAP gross margin of 50.3%, which includes a net benefit from the Inflation Reduction Act (IRA). Excluding this benefit, the non-GAAP gross margin was 41.8%, reflecting the company's ability to sustain profitability amidst market fluctuations. The GAAP gross margin was reported at 48.5%.

Enphase Energy reported a GAAP operating loss of $10.2 million, while non-GAAP operating income stood at $65.6 million. The GAAP net income for the quarter was $20.9 million, translating to a GAAP diluted earnings per share (EPS) of $0.15. The non-GAAP net income was significantly higher at $73.5 million, with a non-GAAP diluted EPS of $0.54.

Balance Sheet and Cash Flow Highlights

The company ended the quarter with a robust balance sheet, boasting $1.70 billion in cash, cash equivalents, and marketable securities. Free cash flow generated during the quarter was $15.4 million, and cash flow from operations was $35.5 million. Capital expenditures decreased to $20.1 million, down from $23.8 million in the previous quarter, as a result of reduced manufacturing spending in the U.S.

Operational and Business Highlights

Enphase Energy continued to innovate and expand its product offerings, with new shipments of IQ8P Microinverters and the introduction of IQ8 Microinverters in additional European countries. The company also launched its third generation of IQ Batteries, the IQ Battery 5P, in various global markets.

In an effort to streamline operations, Enphase announced the cessation of manufacturing in Romania and Wisconsin, focusing on U.S. production with existing partners in South Carolina and Texas. This strategic move is expected to increase global microinverter production capacity while emphasizing domestic manufacturing.

Looking Ahead

For Q1 2024, Enphase Energy forecasts revenue to be in the range of $260.0 million to $300.0 million, including shipments of 70 to 90 megawatt hours of IQ Batteries. The company anticipates a GAAP gross margin between 42.0% to 45.0% and a non-GAAP gross margin between 44.0% to 47.0%, both inclusive of net IRA benefits.

Enphase Energy's performance in Q4 2023 reflects the resilience of its business model in the face of market headwinds. The company's ability to maintain strong gross margins and generate positive free cash flow, despite a downturn in revenue, demonstrates its operational efficiency and strategic focus on value creation for shareholders.

For a detailed analysis of Enphase Energy's financial results and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Enphase Energy Inc for further details.

This article first appeared on GuruFocus.