Enpro Inc (NPO) Reports Mixed 2023 Results and Introduces 2024 Outlook

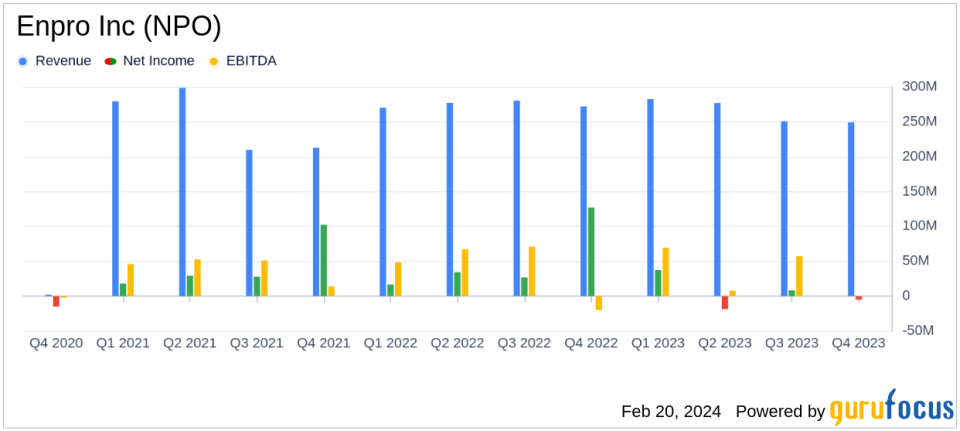

Revenue: 2023 sales decreased by 3.6% to $1.06 billion, with organic sales down 3.3%.

Net Income: GAAP income from continuing operations improved to $10.8 million, a 61.2% increase from the previous year.

Earnings Per Share (EPS): Adjusted diluted EPS decreased by 3.7% to $6.54 in 2023.

Adjusted EBITDA: Saw a 7.5% decrease to $238.0 million with a margin of 22.5%.

2024 Guidance: Enpro Inc (NYSE:NPO) projects revenue growth in the low to mid-single-digit range and adjusted EBITDA between $260 million to $280 million.

Dividend: Quarterly dividend increased by 3.4% to $0.30 per share, marking the ninth consecutive year of dividend growth.

Acquisitions: Completed the acquisition of Advanced Micro Instruments, Inc. (AMI) for $210 million, enhancing its portfolio.

On February 20, 2024, Enpro Inc (NYSE:NPO) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full fiscal year of 2023. The company, known for its engineered industrial products across multiple segments, faced a challenging year with a decrease in sales and adjusted earnings. However, the firm demonstrated financial resilience with an improved GAAP income and a robust balance sheet.

Enpro Inc operates through three segments: Sealing Technologies, Advanced Surface Technologies, and Engineered Materials, serving a diverse range of geographical markets including the United States, Europe, and other foreign countries.

Financial Performance and Challenges

The company's sales for 2023 stood at $1.06 billion, marking a 3.6% decrease from the previous year, with organic sales also declining by 3.3%. The GAAP income from continuing operations attributable to Enpro Inc saw a notable improvement, rising to $10.8 million, a 61.2% increase from the previous year. Despite these gains, adjusted EBITDA fell by 7.5% to $238.0 million, with the adjusted EBITDA margin contracting by 90 basis points to 22.5%.

Enpro Inc faced headwinds, particularly in the Advanced Surface Technologies segment, due to the ongoing weakness in the global semiconductor industry. This challenge was reflected in the segment's sales, which decreased by 15.7% to $401.2 million for the year. The Sealing Technologies segment, however, showed resilience with a 5.5% increase in sales to $658.4 million, driven by strategic pricing initiatives and strength in nuclear energy.

Strategic Moves and 2024 Outlook

Despite the challenges, Enpro Inc remained proactive, completing the acquisition of AMI, which is expected to enhance its product offerings and market position. The company also maintained a strong balance sheet, ending the year with a net leverage ratio of 2.0x, inclusive of the AMI transaction.

Looking ahead, Enpro Inc has introduced its 2024 guidance, projecting revenue growth in the low to mid-single-digit range and adjusted EBITDA between $260 million to $280 million. The adjusted diluted earnings per share are expected to be in the range of $7.00 to $7.80. This outlook reflects the company's confidence in its strategic growth initiatives and its ability to navigate market uncertainties.

In a statement, President and CEO Eric Vaillancourt expressed satisfaction with the company's performance and execution in 2023, highlighting the record profitability in Sealing Technologies and the strong operating cash flow generated. He also emphasized the company's focus on driving growth and value in the semiconductor business over a multi-year period.

"We are well positioned to build on the progress achieved in 2023 by continuing to execute on our strategic growth initiatives in both Sealing Technologies and AST. While the timing of a broader semiconductor capital equipment recovery remains uncertain, the industry is showing early signs of an uptick, and we remain focused on driving growth and value in our semiconductor business over a multi-year period," said Vaillancourt.

Enpro Inc's commitment to shareholder returns was evident with the increase in its quarterly dividend to $0.30 per share, marking the ninth consecutive year of dividend growth.

The company's financial flexibility, underscored by its strong balance sheet and robust free cash flow, positions it well to pursue further organic growth initiatives and strategic acquisitions, thereby offering potential value to investors.

For a detailed analysis of Enpro Inc's financial results and forward-looking guidance, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Enpro Inc for further details.

This article first appeared on GuruFocus.