Ensign Group (ENSG) Beats on Q2 Earnings, Raises '23 EPS View

The Ensign Group, Inc. ENSG reported second-quarter 2023 adjusted operating earnings per share (EPS) of $1.16, which outpaced the Zacks Consensus Estimate by 1.8%. The bottom line climbed 14.9% year over year.

Operating revenues amounted to $921.4 million, which rose 25.8% year over year in the quarter under review. The top line beat the consensus mark by 1.3%. The metric benefited from improved skilled services and rental revenues.

The company’s shares gained 2.9% on Jul 28. Its better-than-expected earnings reflected solid skilled mix, growth in occupancy and improving service and rental revenues. However, an elevated expense level acted as a drag on ENSG’s results.

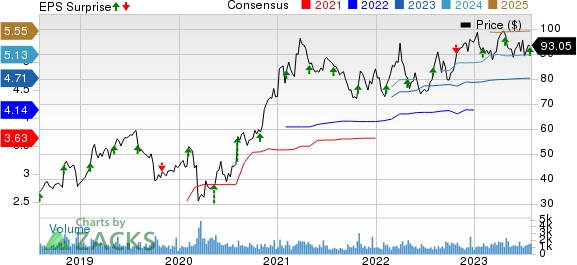

The Ensign Group, Inc. Price, Consensus and EPS Surprise

The Ensign Group, Inc. price-consensus-eps-surprise-chart | The Ensign Group, Inc. Quote

Q2 Update

ENSG reported an adjusted net income of $66.3 million in the second quarter, which improved 15.4% year over year.

Same-store occupancy grew 4.0% year over year, while transitioning occupancy increased 3.3% year over year.

Total expenses of $843.5 million escalated 28.9% year over year in the quarter under review and surpassed our estimate by 2.9%. The year-over-year increase resulted from the higher cost of services, rent-cost of services, general and administrative expenses and depreciation and amortization.

Segmental Update

Skilled Services: The segment’s revenues of $884.2 million climbed 25.9% year over year. The metric outpaced our estimate by 1.6%. Segmental income grew 14.4% year over year to $117 million in the second quarter.

Skilled nursing and campus operations of the segment totaled 253 and 26, respectively, at the second-quarter end.

Standard Bearer: Rental revenues were $19.9 million in the segment, which rose 13.2% year over year and surpassed our estimate by 0.5%. Segmental income of $7.1 million increased 4.3% year over year.

Funds from Operationsgrew 10.1% year over year to $13.3 million in the quarter under review.

Financial Update (as of Jun 30, 2023)

Ensign Group exited the second quarter with cash and cash equivalents of $420 million, which increased from $316.3 million at 2022-end.

Total assets of $3,952.4 million at the second-quarter end were up from $3,452 million at 2022-end.

Long-term debt-less currentmaturities amounted to $147.4 million. The figure fell from $149.3 million at 2022-end. Short-term debt totaled $3.9 million.

Total equity of $1,393.4 million rose from $1,248.8 million at 2022-end.

In the first half of 2023, ENSG generated operating cash flows of $168.1 million, which increased 29.5% year over year.

Capital-Deployment Update

Ensign Group did not buy back shares in the first half of 2023 as part of the share repurchase program authorized by management in July 2022.

The company paid out a quarterly dividend of 5.75 cents per share.

2023 Outlook Raised

Revenues are anticipated to be between $3.69 billion and $3.73 billion, up from the prior estimated $3.68-$3.73 billion. The mid-point of the revised guidance indicates an improvement of 22.8% from the 2022 figure.

EPS is forecasted to be in the range of $4.70-$4.78 for the year, higher than the previously projected $4.64-$4.77. The mid-point of the updated outlook suggests 14.5% growth from the reported figure of 2022.

The weighted average common shares outstanding is estimated at 57.7 million.

Zacks Rank

Ensign Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported second-quarter results so far, the bottom lines of Elevance Health, Inc. ELV, UnitedHealth Group Incorporated UNH and Universal Health Services, Inc. UHS beat the Zacks Consensus Estimate.

Elevance Health reported second-quarter 2023 adjusted net income of $9.04 per share, which outpaced the Zacks Consensus Estimate by 2.5%. The bottom line improved 13.4% year over year.

ELV’s operating revenues, which amounted to $43,377 million, rose 12.7% year over year in the second quarter. The top line surpassed the consensus mark by 4.5%.

UnitedHealth Group reported second-quarter 2023 adjusted EPS of $6.14, which outpaced the Zacks Consensus Estimate by 3.7%. The bottom line advanced 10.2% year over year.

Revenues improved 16% year over year to $92.9 billion in the second quarter, attributable to sound contributions made by the UnitedHealthcare and Optum business lines. The top line surpassed the consensus mark by 2.5%.

Universal Health reported second-quarter 2023 adjusted EPS of $2.53, which outpaced the Zacks Consensus Estimate by 2%. The bottom line advanced 15% year over year.

UHS’s operating revenues, which amounted to $3.6 billion, rose 6.9% year over year in the second quarter. The top line surpassed the consensus mark by 1.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report