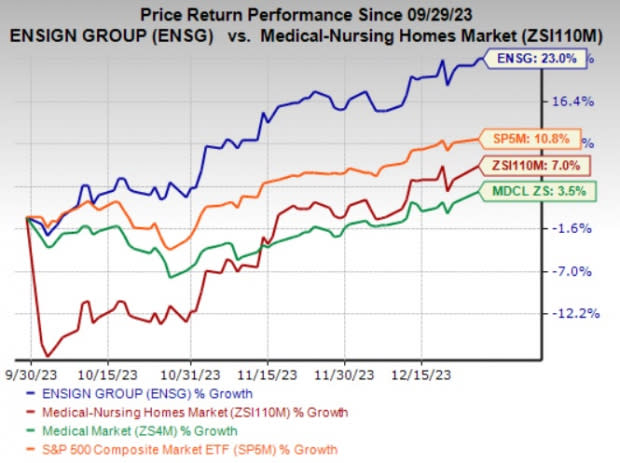

Ensign Group (ENSG) Rises 23% in 3 Months: More Room to Run?

The Ensign Group, Inc.'s ENSG shares have risen 23% in the past three months compared with the industry’s 7% growth. The Medical sector and the S&P 500 Composite Index rallied 3.5% and 10.8%, respectively, in the same time frame. With a market capitalization of $6.5 billion, the average volume of shares traded in the last three months totaled 0.3 million.

Improved skilled service revenues, an expanding healthcare facility portfolio as a result of continuous facility buyouts as well as a commendable financial position continue to drive Ensign Group.

The leading healthcare service provider, presently carrying a Zacks Rank #3 (Hold), has a decent track record of beating on estimates in three of the trailing four quarters and meeting the same once, delivering an average surprise of 1.54%.

Image Source: Zacks Investment Research

Return on equity in the trailing 12 months is currently 19.4%, which stands higher than the industry’s negative average of 8.5%. This substantiates the company’s efficiency in utilizing shareholders’ funds.

Can ENSG Retain the Momentum?

The Zacks Consensus Estimate for Ensign Group’s 2023 earnings is pegged at $4.76 per share, indicating a 15% increase from the 2022 reported figure. The consensus mark for revenues is pinned at $3.7 billion, implying 23.1% growth from the year-ago figure. It has witnessed two upward earnings estimate revisions for 2023 over the past 60 days.

The Zacks Consensus Estimate for 2024 earnings is pegged at $5.23 per share, implying a 9.7% improvement from the 2023 estimate. The consensus mark for revenues is $4 billion, indicating a 7.8% increase from the 2023 estimate.

Revenues of Ensign Group continue to benefit on the back of higher skilled service revenues derived from offering high-quality skilled nursing, senior living and rehabilitative care services at its facilities. It currently operates an extensive network of 297 healthcare facilities across 13 U.S. states. Management anticipates revenues in the $3.72-$3.73 billion range for 2023, the midpoint of which indicates an improvement of 23.1% from the 2022 figure.

An aging U.S. population is likely to keep the demand for ENSG’s senior living services high in the days ahead, while the dire need for effective rehabilitation services that empower individuals to resume daily life activities is expected to provide an impetus to its service revenues.

In its Standard Bearer unit, Ensign Group derives rental revenues from entering into triple-net lease agreements under which it leases acquired post-acute care properties to healthcare operators. ENSG stands out as a gainer in such agreements for not only does the company receive rental revenues but also the tenant bears costs related to the abovementioned properties. Presently, it owns 113 real estate assets. Also, it generated rental revenues of $15.6 million in the first nine months of 2023, which improved 24.6% from the prior-year comparable period.

Ensign Group boasts a successful track record of acquiring real estate or post-acute care operations, which in turn, has expanded its reach across several U.S. communities. It follows a collaborative approach with a local team of caregivers of the acquired facilities and gets a better understanding of the medical needs, thereby serving patients more effectively. Noteworthy, acquisitions remain a top priority for the management while deploying capital.

Over the past decade (2012-2022), ENSG purchased 223 facilities, which added 18,443 operational skilled nursing beds and 5,000 senior living units to its healthcare portfolio. The last facility added to the portfolio through acquisition was Champions Healthcare at Willowbrook, a healthcare campus based in Texas, in November 2023.

To continue its buyout spree, significant business investments are a dire need and the financial strength of Ensign Group takes care of that purpose. Growing cash reserves and solid cash-generating abilities bear testament to ENSG’s commendable financial position. It generated operating cash flows of $291.4 million in the first nine months of 2023, which climbed 31.1% from the prior-year comparable period. It also believes in returning capital to shareholders, attributable to a sound financial stand. This month itself, management sanctioned a 4% quarterly dividend hike, thereby marking a solid record of increasing dividends for consecutive 21 years.

Ensign Group boasts an impressive VGM Score of B. VGM Score helps identify stocks with the most attractive value, the best growth and the most promising momentum.

Stocks to Consider

Some better-ranked stocks in the Medical space are Insulet Corporation PODD, Merit Medical Systems, Inc. MMSI and The Pennant Group, Inc. PNTG. While Insulet currently sports a Zacks Rank #1 (Strong Buy), Merit Medical Systems and Pennant carry a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

Insulet’s earnings surpassed the Zacks Consensus Estimate in each of the last four quarters, the average beat being 105.14%. The consensus estimate for PODD’s 2023 earnings is pegged at $1.91 per share, which increased more than 27 fold from the year-ago reported figure. The consensus mark for revenues indicates growth of 25.9% from the year-ago reported figure.

The Zacks Consensus Estimate for PODD’s 2023 earnings has moved 18.6% north in the past 60 days. Shares of Insulet have risen 38.8% in the past three months.

Merit Medical Systems’ earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 14.41%. The consensus estimate for MMSI’s 2023 earnings indicates a rise of 9.6% from the year-ago reported number. The consensus mark for revenues indicates an improvement of 8.4% from the year-ago recorded actual.

The Zacks Consensus Estimate for MMSI’s 2023 earnings has moved 0.3% north in the past 60 days. Shares of Merit Medical Systems have risen 11.2% in the past three months.

Pennant’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, met the mark once and missed in the other, the average surprise being 1.11%. The consensus estimate for PNTG’s 2023 earnings indicates an improvement of 26.3% from the year-ago reported figure. The consensus mark for revenues indicates growth of 12.3% from the year-ago recorded actual.

The Zacks Consensus Estimate for PNTG’s 2023 earnings has moved 1.4% north in the past 60 days. Shares of Pennant have rallied 29.1% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report

The Pennant Group, Inc. (PNTG) : Free Stock Analysis Report