Ensign Group Inc (ENSG) Reports Strong Revenue Growth and Issues Positive 2024 Earnings Guidance

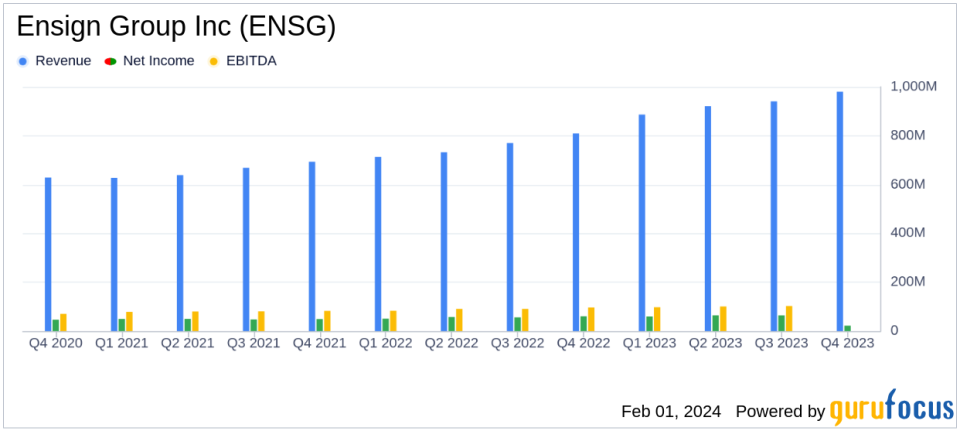

Annual Revenue: $3.73 billion, a 23.3% increase year-over-year.

Quarterly Revenue: $980.4 million, up 21.1% from the prior year quarter.

Annual Adjusted EPS: $4.77, representing a 15.2% increase year-over-year.

Quarterly Adjusted EPS: $1.28, a 16.4% increase from the prior year quarter.

Net Income: Annual GAAP net income of $209.4 million; Quarterly GAAP net income of $21.7 million.

2024 Earnings Guidance: ENSG issues guidance of $5.29 to $5.47 per diluted share and annual revenue of $4.13 billion to $4.17 billion.

Acquisitions: ENSG added three new operations and one real estate asset during the quarter, bringing the total number of operations acquired since 2022 to 54.

On February 1, 2024, Ensign Group Inc (NASDAQ:ENSG) released its 8-K filing, detailing its financial performance for the fiscal year and fourth quarter of 2023. The company, a leading provider of post-acute healthcare services in the United States, operates through its regional subsidiaries overseeing a range of services including skilled nursing, assisted living, and more. Medicare and Medicaid programs are significant contributors to Ensign's revenue, with the majority generated from the services segment.

Financial Performance and Operational Highlights

Ensign Group Inc reported a robust increase in both annual and quarterly revenues, with GAAP and adjusted revenues for the year reaching $3.73 billion, a 23.3% increase over the prior year. The quarterly revenues also saw a significant rise to $980.4 million, marking a 21.1% increase over the same quarter in the previous year. Adjusted earnings per share for the year stood at $4.77, up by 15.2%, and $1.28 for the quarter, a 16.4% increase over the prior year's figures. These financial achievements underscore the company's ability to grow its revenue streams and manage its operations effectively in the competitive healthcare providers and services industry.

Challenges and Future Outlook

Despite the positive financial results, Ensign Group Inc faced challenges including litigation matters that impacted GAAP net income, which was reported at $209.4 million for the year and $21.7 million for the quarter. Adjusted net income, which excludes these litigation impacts, showed a stronger performance with a 16.0% and 17.5% increase over the prior year and quarter, respectively. The company's CEO, Barry Port, expressed confidence in the company's momentum and the opportunities ahead, citing a same store occupancy growth and an increase in skilled mix during the quarter.

Looking forward, Ensign Group Inc is optimistic about its prospects for 2024, issuing earnings guidance that suggests a 13% increase over 2023 results at the midpoint. This positive outlook is supported by the company's strong liquidity position, with approximately $509.6 million of cash on hand and $593.7 million of available capacity under its line-of-credit.

Acquisitions and Expansion

Ensign's growth strategy includes a disciplined approach to acquisitions, as evidenced by the addition of three new operations and one real estate asset during the quarter. These acquisitions are part of the company's ongoing efforts to expand its portfolio, which now consists of 299 healthcare operations across 14 states. Ensign's Chief Investment Officer, Chad Keetch, highlighted the potential for these new operations to reach 'same store' caliber, indicating room for further operational improvements and financial gains.

The company's real estate segment, Standard Bearer, also reported revenue growth, with $82.5 million for the year and $21.9 million for the quarter. This segment's FFO increased by 9.7% for the year and 9.4% for the quarter, reflecting the strength of Ensign's property investments.

Conclusion

Ensign Group Inc's financial results for the fiscal year and fourth quarter of 2023 demonstrate the company's resilience and strategic growth in the healthcare industry. With a strong financial foundation, a growing portfolio of operations, and a positive outlook for the coming year, Ensign is well-positioned to continue its trajectory of success. Investors and stakeholders can anticipate further developments as the company leverages its operational fundamentals and acquisition strategy to drive performance in 2024.

For more detailed information, readers are encouraged to review the full earnings report and financial statements available on the SEC's website and Ensign Group Inc's investor relations page.

Explore the complete 8-K earnings release (here) from Ensign Group Inc for further details.

This article first appeared on GuruFocus.