Enterprise Bancorp Inc (EBTC) Reports Decline in Quarterly Net Income Amidst Rising Interest Rates

Net Income: Q4 net income fell to $7.9 million, a decrease from $12.3 million in Q4 2022.

Earnings Per Share (EPS): Diluted EPS for Q4 stood at $0.64, down from $1.01 year-over-year.

Net Interest Margin: Q4 net interest margin decreased to 3.29% from 3.81% in the same quarter last year.

Loan Growth: Total loans increased by 12% compared to December 31, 2022.

Deposit Dynamics: Total deposits saw a 1% decrease year-over-year.

Wealth Management: Wealth assets under management and administration grew by 21% compared to the previous year.

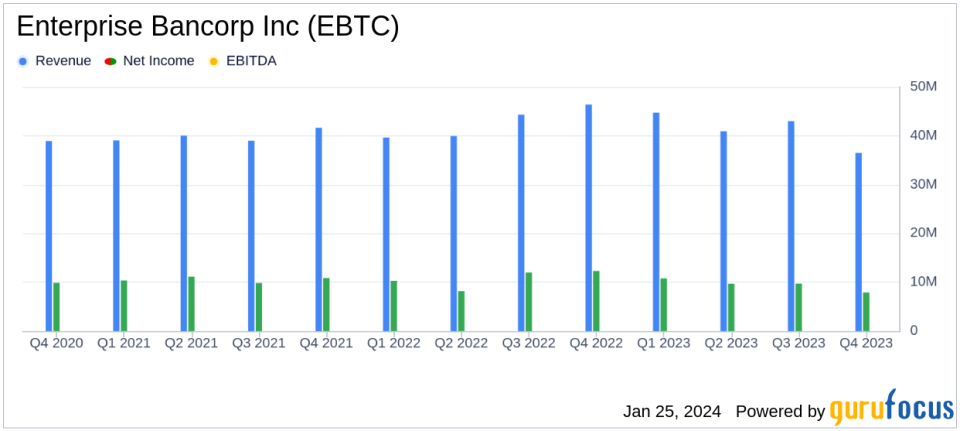

On January 25, 2024, Enterprise Bancorp Inc (NASDAQ:EBTC) released its 8-K filing, detailing the financial results for the fourth quarter and the full year ended December 31, 2023. The company, which operates primarily through Enterprise Bank and Trust Company, reported a decrease in net income for the quarter, attributing the decline to higher interest rates and an inverted yield curve which led to margin compression.

Financial Performance and Challenges

EBTC's net income for the fourth quarter amounted to $7.9 million, or $0.64 per diluted common share, a decrease from the $12.3 million, or $1.01 per share, reported in the same period of the previous year. For the full year, net income was $38.1 million, or $3.11 per diluted common share, compared to $42.7 million, or $3.52 per share, in 2022. The return on average assets and average equity for the quarter were 0.69% and 10.21%, respectively.

Despite the challenges, the bank achieved a 12% year-over-year loan growth, excluding Paycheck Protection Program (PPP) loans, for the second consecutive year. However, the bank faced margin pressure as the tax-equivalent net interest margin for the fourth quarter decreased to 3.29% from 3.81% in the prior year's quarter.

Financial Achievements and Industry Significance

EBTC's loan growth is a significant achievement in the banking industry, where lending is a core revenue driver. The bank's ability to grow its loan portfolio in a challenging interest rate environment demonstrates the strength of its commercial lending practices and customer relationships.

The bank's wealth management division also saw a notable increase in assets under management and administration, reaching $1.3 billion, which is a testament to the bank's service quality and trust in its wealth management capabilities.

Income Statement and Balance Sheet Highlights

Net interest income for the quarter decreased by 13% year-over-year to $36.5 million. The decrease was primarily due to a significant rise in deposit interest expense, which increased by $12.8 million as a result of higher market interest rates and a change in deposit mix.

Non-interest income for the quarter increased by 32% to $5.5 million, while non-interest expense saw a marginal increase of $57 thousand to $28.2 million. The effective tax rate for the quarter was 30.3%, up from 24.7% in the prior year, mainly due to an increase in state taxes.

Total assets increased slightly by 1% to $4.47 billion, while total deposits decreased by 1% to $3.98 billion. Total shareholders' equity increased by 17% to $329.1 million, primarily due to an increase in retained earnings and a decrease in accumulated other comprehensive loss.

Management Commentary

"We performed well in a challenging year for the banking industry as higher interest rates and an inverted yield curve contributed to margin compression," said Chief Executive Officer Jack Clancy. He also highlighted the bank's solid net interest margin and favorable liquidity position.

Executive Chairman & Founder George Duncan expressed gratitude for the team's service and commitment to organic growth, noting the bank's recognition on the Boston Globes Top Places to Work list.

Analysis of EBTC's Performance

EBTC's performance in the fourth quarter reflects the broader challenges faced by the banking sector, including margin compression due to rising interest rates. However, the bank's strategic focus on loan growth and wealth management services has allowed it to maintain a solid financial position. The bank's emphasis on community investment and technology enhancements positions it well for future growth.

For a detailed analysis of Enterprise Bancorp Inc's financial results, please visit GuruFocus.com for comprehensive reports and investment insights.

Explore the complete 8-K earnings release (here) from Enterprise Bancorp Inc for further details.

This article first appeared on GuruFocus.