Enterprise Financial Services Corp (EFSC) Reports Mixed Results for Q4 and Full Year 2023

Net Income: Q4 net income was $44.5 million, steady from the linked quarter but down from the prior year quarter.

Net Interest Margin (NIM): NIM decreased by 10 basis points quarterly to 4.23%.

Total Loans: Grew by $267.3 million in Q4, marking a 10% annualized increase.

Total Deposits: Increased by $266.5 million in Q4, with a 12% rise over the year.

Return on Average Assets (ROAA): Stood at 1.23% for Q4, adjusted to 1.28% excluding FDIC special assessment.

Tangible Book Value Per Share: Increased by 9% quarterly to $33.85.

Asset Quality: Nonperforming assets to total assets was 0.34% at the end of 2023, up from 0.08% at the end of 2022.

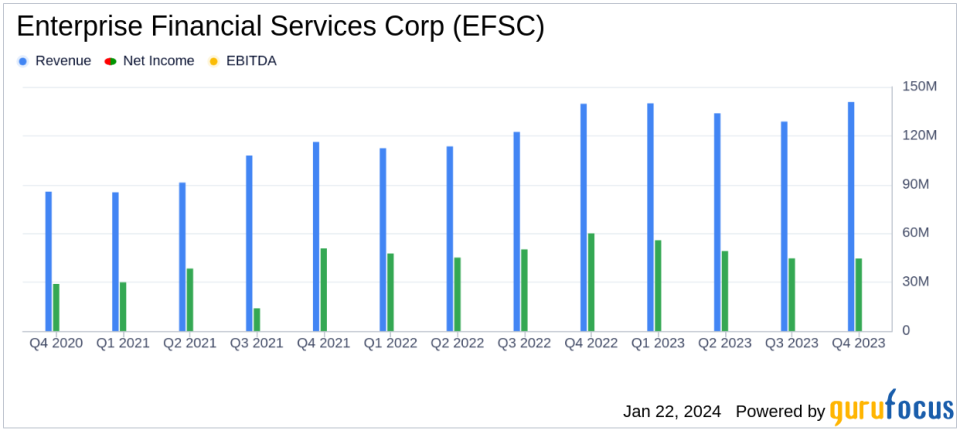

On January 22, 2024, Enterprise Financial Services Corp (NASDAQ:EFSC) released its 8-K filing, detailing its fourth quarter and full-year financial performance for 2023. EFSC, a financial holding company offering a range of banking and wealth management services, reported a net income of $44.5 million for the fourth quarter, equating to $1.16 per diluted common share. Adjusting for a $2.4 million FDIC special assessment, earnings were $1.21 per diluted common share.

Despite a stable quarter-over-quarter net income, the company experienced a decline from the previous year's quarter, primarily due to an elevated level of charge-offs, including a significant one related to a single agricultural relationship. President and CEO Jim Lally noted this as an isolated issue, expressing overall satisfaction with the company's strong finish to the year.

Annual Performance and Challenges

For the full year, EFSC reported a net income of $194.1 million, or $5.07 per diluted share, a slight decrease from $203.0 million, or $5.31 per diluted share, in 2022. The company's net interest income rose by $88.7 million, and total loans and deposits each grew by 12%. The ROAA for the year was 1.41%, with an adjusted figure of 1.42% when excluding the FDIC special assessment. The Return on Average Tangible Common Equity (ROATCE) was reported at 16.25%, or 16.40% adjusted for the FDIC special assessment.

Despite these positive indicators, EFSC faced challenges, including an increase in nonperforming assets to 0.34% of total assets, up from 0.08% at the end of 2022. Net charge-offs also rose to 0.37% of average loans in 2023, compared to 0.04% in 2022. The allowance for credit losses declined to 1.24% of total loans at the end of 2023, from 1.41% at the end of 2022, primarily due to the charge-off of certain nonperforming loans and an improvement in forecasted economic factors.

Financial Highlights and Metrics

EFSC's net interest margin contracted slightly to 4.23% in the fourth quarter, with net interest income decreasing by $0.9 million to $140.7 million. The company's total loans reached $10.9 billion, reflecting a quarterly increase of $267.3 million, or an annualized growth rate of 10%. Total deposits followed suit, increasing by $266.5 million to $12.2 billion. The tangible common equity to tangible assets ratio stood at 8.96%, and the tangible book value per share increased by 9% to $33.85.

These metrics are crucial for assessing EFSC's financial health and operational efficiency, particularly in the competitive banking industry where margins, asset quality, and capital ratios are key indicators of performance.

Looking Forward

Looking ahead to 2024, CEO Jim Lally expressed optimism about capitalizing on growth opportunities and strengthening the company. The company's focus on organic asset growth and managing net interest income amidst market interest rate changes has positioned it for continued success.

EFSC's earnings report reflects a company navigating a challenging environment with a strong focus on growth and asset quality management. The full-year increase in net interest income and loan and deposit growth are positive signs for investors, while the rise in nonperforming assets and charge-offs will be areas to monitor in the coming year.

For a detailed analysis of EFSC's financial performance, including reconciliations of non-GAAP financial measures, readers can refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Enterprise Financial Services Corp for further details.

This article first appeared on GuruFocus.