Enterprise's (EPD) Q3 Earnings & Revenues Beat Estimates

Enterprise Products Partners LP EPD reported third-quarter 2022 adjusted earnings per limited partner unit of 63 cents, beating the Zacks Consensus Estimate of 61 cents. The bottom line improved from the year-ago quarter’s 52 cents per share.

Total quarterly revenues of $15,468 million surpassed the Zacks Consensus Estimate of $13,847 million. The top line significantly increased from $10,831 million in the prior-year quarter.

The strong results were driven by higher contributions from the NGL Pipelines & Services business.

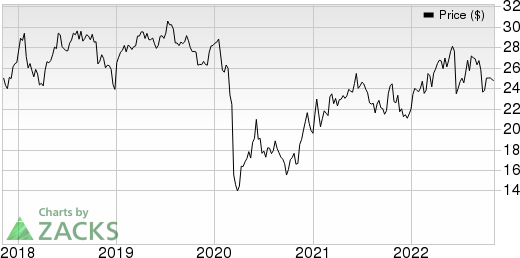

Enterprise Products Partners L.P. Price, Consensus and EPS Surprise

Enterprise Products Partners L.P. price-consensus-eps-surprise-chart | Enterprise Products Partners L.P. Quote

Segmental Performance

Pipeline volumes in NGL, crude oil, refined products and petrochemicals were recorded at 6.7 million barrels per day (bpd), slightly higher than the year-ago quarter’s 6.3 million bpd. Natural gas pipeline volumes were 17.5 trillion British thermal units per day (TBtus/d), up from 14.6 TBtus/d a year ago. Also, marine terminal volumes increased to 1.7 million bpd from 1.5 million bpd.

Gross operating income at NGL Pipelines & Services increased from $1,023 million in the year-ago quarter to $1,296 million, primarily due to higher NGL pipeline transportation volumes.

Natural Gas Pipelines and Services’ gross operating income increased to $278 million from $223 million in the year-ago quarter. The upside was due to an increase in natural gas pipeline transportation volumes.

Crude Oil Pipelines & Services recorded a gross operating income of $415 million, which decreased from $423 million in the prior-year quarter.

Gross operating income at Petrochemical & Refined Products Services amounted to $353 million compared with $411 million a year ago, primarily due to lower gross operating margin from propylene production and related activities.

Cash Flow

Adjusted distributable cash flow was $1,868 million, up from $1,613 million a year ago, and provided coverage of 1.8X. The partnership retained $826 million of distributable cash flow in the September quarter. It generated an adjusted free cash flow of $1,476 million compared with $1,191 million in the year-ago quarter.

Financials

For third-quarter 2022, Enterprise’s total capital investment was $474 million.

As of Sep 30, 2022, its outstanding total debt principal was $29.5 billion. Enterprise’s consolidated liquidity amounted to $3.3 billion. The total liquidity amount included unrestricted cash on hand and available borrowing capacity under its revolving credit facility.

Zacks Rank & Stocks to Consider

Enterprise currently carries a Zacks Rank #4 (Sell). Better-ranked players in the same space include Magellan Midstream Partners MMP, EQT Corporation EQT and Shell plc SHEL. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Being a midstream energy player, Magellan Midstream’s business model is less exposed to volatility in oil and gas prices. In fact, contributions from core fee-based transportation and terminals activities have aided MMP’s results in the third quarter of this year.

In the core of gas-rich Marcellus and Utica Shales, EQT Corporation has a strong foothold. Being a leading producer of natural gas, EQT is benefiting from high natural gas prices. For 2022, it is likely to witness earnings growth of 369.6%.

Being a leading player in liquefied natural gas across the globe, Shell’s business prospects seem bright. In the energy transition front, it is playing a crucial role, setting an ambitious goal of becoming a net-zero-emissions energy business by 2050 or before. For 2022, SHEL is likely to see earnings growth of almost 115%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Magellan Midstream Partners, L.P. (MMP) : Free Stock Analysis Report

EQT Corporation (EQT) : Free Stock Analysis Report

Shell PLC Unsponsored ADR (SHEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research