Entravision Communications Corp (EVC) Reports Mixed Financial Results Amid Digital Partnership ...

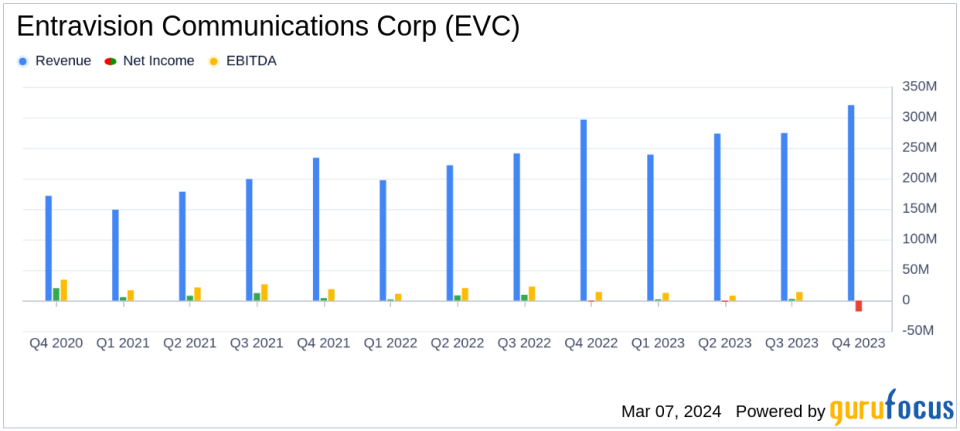

Revenue Increase: EVC reported an 8% year-over-year increase in Q4 net revenue and a 16% increase for the full year.

EBITDA Decline: Consolidated EBITDA fell by 56% in Q4 and 44% for the full year, reflecting challenges in the digital partnerships business.

Net Loss: The company experienced a net loss of $18.2 million in Q4 and $15.4 million for the full year.

Dividend Declaration: EVC declared a quarterly cash dividend of $0.05 per share, payable on March 29, 2024.

Cost Structure Review: In response to the ending of Meta's ASP program, EVC is reviewing its operating strategy and cost structure.

Balance Sheet Strength: EVC reported $118.9 million in cash and marketable securities, with a solid balance sheet to navigate upcoming changes.

On March 5, 2024, Entravision Communications Corp (NYSE:EVC) released its 8-K filing, detailing its financial results for the fourth quarter and full year of 2023. The company, a global media entity with a focus on advertising solutions and digital media, reported an increase in net revenue but faced a significant decline in consolidated EBITDA, primarily due to challenges in its digital partnerships business.

Entravision's operations span television, radio, and digital media segments, including a portfolio of over 45 radio stations across the U.S. and digital advertising solutions targeting online Hispanic audiences globally. The company's digital segment, which is its largest by revenue, has been significantly impacted by the recent announcement from Meta Platforms to end its Authorized Sales Partner (ASP) program by July 1, 2024. This program accounted for approximately $23.8 million of EVC's $57.7 million total consolidated EBITDA and $586.4 million of the company's $1,106.9 million of total consolidated revenue for the full year 2023.

Financial Performance and Challenges

For the fourth quarter of 2023, EVC reported net revenue of $320.1 million, an 8% increase from the same period in 2022. Full-year net revenue rose by 16% to $1.1 billion. The revenue growth was attributed to an increase in advertising revenue from digital commercial partners and various acquisitions. However, the company faced a decrease in political advertising revenue in its television and audio segments.

Despite the revenue growth, EVC's consolidated EBITDA for the fourth quarter plummeted by 56% to $16.2 million, and by 44% to $57.7 million for the full year. The net loss for the fourth quarter was $18.1 million, and $15.6 million for the full year. These results reflect the challenges faced by the company, particularly in its digital partnerships business.

Strategic Review and Dividend Announcement

In response to the upcoming termination of the ASP program with Meta, Entravision has initiated a review of its operating strategy and cost structure. CEO Michael Christenson expressed confidence in the company's long-term opportunities and emphasized the strength of Entravision's advertising and marketing platforms. The company's balance sheet remains solid, with $118.9 million in cash and marketable securities, and compliance with all debt covenants under its current credit facility.

Additionally, EVC declared a quarterly cash dividend of $0.05 per share, showcasing its commitment to shareholder returns despite the current challenges.

Analysis and Outlook

The loss of Meta's ASP program presents a significant challenge for Entravision, requiring a strategic pivot to maintain its market position. The company's focus on reviewing its cost structure and operating strategy is a critical step in adapting to the changing landscape of digital advertising partnerships. With a strong cash position and a diversified portfolio, Entravision is poised to navigate through this transition period, although the full impact on future financial performance remains to be seen.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Entravision Communications Corp (NYSE:EVC) continues to adapt to the evolving media and advertising landscape, and value investors will be watching closely to see how the company's strategic adjustments will drive future growth and profitability.

Explore the complete 8-K earnings release (here) from Entravision Communications Corp for further details.

This article first appeared on GuruFocus.