Envestnet (ENV) Surges 35% in a Month: Here's What to Know

Envestnet, Inc.’s ENV shares have gained an impressive 34.5% in the past month, outperforming the 4.1% rally of the industry it belongs to and the 4.4% rise of the Zacks S&P 500 composite.

What’s Behind the Rally

ENV put on an impressive earnings performance in the past four quarters. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and matched once, delivering an average surprise of 3.3%.

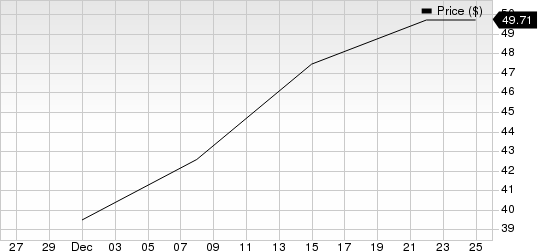

Envestnet, Inc Price

Envestnet, Inc price | Envestnet, Inc Quote

Envestnet remains focused on increasing its share of the addressable market consisting of enterprise clients in wealth management, financial advisors, financial technology providers and financial institutions through its technology platforms. The company has made prudent investments toward enhancing and expanding its technology platforms.

Envestnet continues to focus on technology development to improve operational efficiency, increase market competitiveness, address regulatory demands and cater to client-driven requests for new capabilities. The company’s technology design facilitates significant scalability.

Envestnet’s business model ensures solid asset-based and subscription-based recurring revenue generation capacity. Recurring revenues have displayed consistent growth, with a 4.5% year-over-year increase in 2022, following impressive gains of 20.2% in 2021 and 10.2% in 2020.

Zacks Rank and Stocks to Consider

ENV currently carries a Zacks Rank #3 (Hold).

Investors can consider the following better-ranked stocks:

Rollins ROL currently carries a Zacks Rank #2 (Buy). For the fourth quarter of 2023, the Zacks Consensus Estimate for earnings is pegged at 20 cents, indicating year-over-year growth of 17.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ROL has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and matching once, the average surprise being 7.2%.

FTI Consulting FCN also carries a Zacks Rank #2. The consensus mark for fourth-quarter 2023 earnings is pegged at $1.57 per share, indicating 3.3% year-over-year growth.

FCN has an impressive earnings surprise history, beating the consensus mark in three of the four trailing quarters and missing once, the average surprise being 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Envestnet, Inc (ENV) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report