Envista Holdings Corp (NVST) Faces Headwinds: A Look at Q4 and Full Year 2023 Results

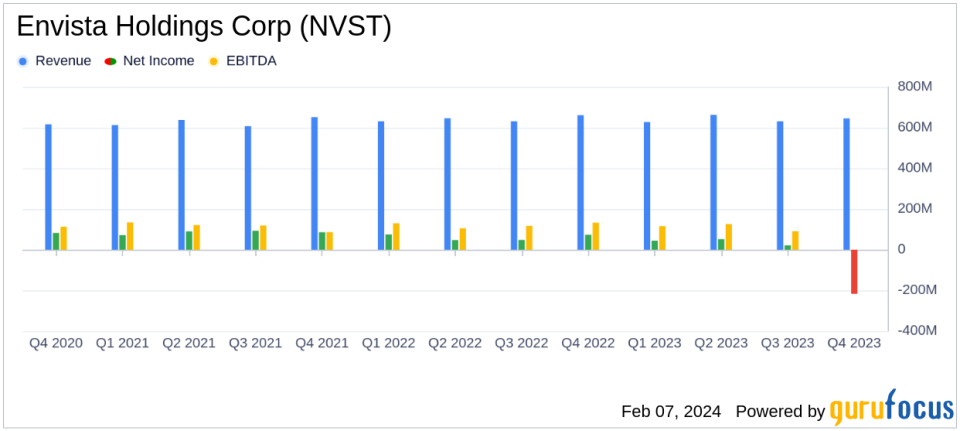

Reported Sales: Q4 sales reached $645.6 million, with a core sales decline of 2.0% year-over-year.

Net Loss: Q4 net loss stood at $217.4 million, influenced by a significant non-cash goodwill impairment charge.

Adjusted Net Income: Adjusted net income for Q4 was $49.7 million, a decrease from $91.9 million in the prior year.

Adjusted EBITDA: Q4 adjusted EBITDA fell to $100.5 million from $138.3 million year-over-year.

Free Cash Flow: Full year free cash flow increased by over $100 million to $223.6 million.

2024 Outlook: Envista forecasts low-single digit core sales growth and adjusted EBITDA margins of 16%-17% for 2024.

On February 7, 2024, Envista Holdings Corp (NYSE:NVST) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a prominent player in the dental products industry, faced a challenging quarter with reported sales of $645.6 million, marking a 2.0% core sales decline compared to the same quarter in the previous year. The net loss for the quarter was substantial at $217.4 million, or $1.27 per diluted share, primarily due to a $258.3 million non-cash charge related to the impairment of goodwill and intangible assets. However, when adjusted for specific non-GAAP items, the net income was $49.7 million, or $0.29 per diluted share, a decrease from the adjusted net income of $91.9 million, or $0.52 per diluted share, in the fourth quarter of 2022.

Envista Holdings Corp operates through two segments: Specialty Products and Technologies, and Equipment and Consumables. The company's portfolio includes dental implants, orthodontic bracket systems, aligners, and digital imaging systems. Despite the macroeconomic headwinds, Envista's Orthodontic business showed resilience, growing double digits for the full year 2023, with its Spark Aligner product line growing over 50%. This growth is a testament to the company's strength in innovation and market presence.

Envista's CEO, Amir Aghdaei, commented on the results, stating,

Despite a volatile macro backdrop in 2023, the Envista team delivered full year results in line with our expectations."

He also highlighted the company's commitment to improving dental care and outlined the focus for 2024, which includes enhancing Spark profitability, accelerating the North American implant business, and optimizing operations.

Financial Highlights and Analysis

The company's financial achievements in 2023, particularly the significant increase in free cash flow, reflect its operational efficiency and ability to generate cash in a challenging environment. This is crucial for Envista as it allows for reinvestment in growth initiatives and provides flexibility in capital allocation decisions. The full year free cash flow of $223.6 million, an increase of over $100 million from 2022, underscores the company's strong cash generation capabilities.

Envista's balance sheet shows a strong cash position with cash and cash equivalents of $940.0 million as of December 31, 2023. This financial stability is important for the company's ability to invest in growth opportunities and navigate economic uncertainties. The company's guidance for 2024, with expected low-single digit core sales growth and adjusted EBITDA margins of between 16% and 17%, reflects cautious optimism amidst ongoing macroeconomic challenges.

Envista's performance in 2023 and its outlook for 2024 will be further discussed during an investor conference call, providing stakeholders with an opportunity to gain deeper insights into the company's strategies and expectations.

For value investors and potential GuruFocus.com members, Envista Holdings Corp's latest earnings report provides a mixed picture. While the impairment charge has impacted the bottom line, the company's ability to grow in key areas and generate strong free cash flow may present opportunities for long-term value creation. Investors will likely monitor the company's progress in 2024 closely, particularly in improving profitability and executing its strategic initiatives.

For more detailed financial information and future updates on Envista Holdings Corp, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Envista Holdings Corp for further details.

This article first appeared on GuruFocus.