Envista (NVST) Q2 Earnings Top Estimates, Margins Expands

Envista Holdings Corporation NVST reported second-quarter 2023 adjusted earnings per share (EPS) of 43 cents, down 10.4% year over year. The bottom line topped the Zacks Consensus Estimate by 4.9%.

The adjustments include charges and benefits related to the amortization of acquired intangible assets, certain asset impairment charges and asset impairments, among others.

The company’s earnings from continuing operations were 29 cents in the quarter compared with the year-ago quarter’s 25 cents, up 16%.

Revenues in Detail

Revenues totaled $662.4 million in the reported quarter, up 2.6% year over year. The metric topped the Zacks Consensus Estimate by 1.8%.

The upside was driven by continuing growth in the Specialty Products & Technologies segment and a return to growth in the Equipment & Consumables segment.

Segments in Detail

In the second quarter, Speciality Products & Technologies totaled $417 million, up 2.3%. Within Speciality Products & Technologies, the company’s combined Orthodontics business increased more than 12% with Spark Aligner business continuing to expand rapidly.

Revenues in the Equipment & Consumables segment rose 3.1% year over year to $245.5 million in the quarter under review. The upside was driven by strong performance in consumables and DEXIS IOS businesses.

Operational Update

Gross profit for the reported quarter rose 14.5% year over year to $423.6 million. Gross margin expanded 669 basis points (bps) to 63.9%.

Selling, general and administrative expenses were down 2.4% year over year to $272.9 million. Research and development expenses rose 6.8% year over year to $26.8 million.

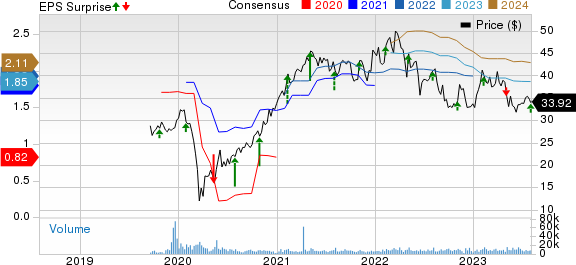

Envista Holdings Corporation Price, Consensus and EPS Surprise

Envista Holdings Corporation price-consensus-eps-surprise-chart | Envista Holdings Corporation Quote

Operating profit of $123.9 million surged 90% year over year. The operating margin expanded 861 bps to 18.7%.

Financial Update

Envista ended second-quarter 2023 with cash and cash equivalents of $651.7 million compared with $585.2 million at the end of first-quarter 2023. Total long-term debt was $875.6 million at the end of the second quarter compared with $873.8 million at the end of the first quarter of 2023.

Net cash provided by operating activities at the end of the second quarter was $78.2 million compared with $25.7 million a year ago.

Our Take

Envista ended second-quarter 2023 with better-than-expected revenues and earnings. In the second quarter, the company witnessed the Equipment & Consumables segment return to growth, driven by strong performance in consumables and DEXIS IOS businesses. In the Specialty Products & Technologies segment, Spark continues to deliver strong growth, offsetting the impact of US sanctions on Russia and a slowdown in higher-end specialty procedures in the developed markets. The company continues to improve its operational capabilities across the businesses by using the Envista Business System (EBS) to streamline its operations and improve customer centricity. Further, the expansion of both margins looks encouraging. However, the solutions for implant-based tooth replacements declined low single digits in the quarter impacted by declines in Russia and pockets of weakness in North America.

Zacks Rank and Key Picks

Envista currently carries Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Abbott Laboratories ABT, Elevance Health, Inc. ELV and Intuitive Surgical, Inc. ISRG.

Abbott, carrying a Zacks Rank of 2, reported second-quarter 2023 adjusted EPS of $1.08, beating the Zacks Consensus Estimate by 3.8%. Revenues of $9.98 billion outpaced the consensus mark by 2.9%.You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abbott has a long-term estimated growth rate of 5.1%. ABT’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 12.4%.

Elevance Health reported second-quarter 2023 adjusted EPS of $9.04, beating the Zacks Consensus Estimate by 2.5%. Revenues of $43.38 billion surpassed the Zacks Consensus Estimate by 4.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12.1%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 2.8%.

Intuitive Surgical reported second-quarter 2023 adjusted EPS of $1.42, beating the Zacks Consensus Estimate by 7.6%. Revenues of $1.76 billion surpassed the Zacks Consensus Estimate by 1.4%. It currently carries a Zacks Rank #2.

Intuitive Surgical has a long-term estimated growth rate of 14.5%. ISRG’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 4.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Envista Holdings Corporation (NVST) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report