EOG Resources (EOG) Q3 Earnings Top on Higher Production

EOG Resources, Inc. EOG reported third-quarter 2023 adjusted earnings per share of $3.44, which beat the Zacks Consensus Estimate of $2.95. However, the bottom line declined from the year-ago quarter’s level of $3.71.

Total quarterly revenues of $6,212 million beat the Zacks Consensus Estimate of $5,909 million. The top line, however, declined from $7,593 million reported in the prior-year quarter.

Better-than-expected quarterly results were primarily driven by higher oil equivalent production volumes. The positives were partially offset by lower realizations of commodity prices.

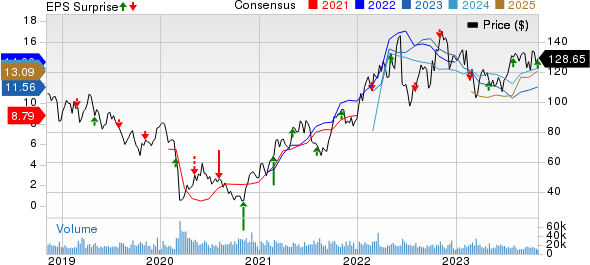

EOG Resources, Inc. Price, Consensus and EPS Surprise

EOG Resources, Inc. price-consensus-eps-surprise-chart | EOG Resources, Inc. Quote

Operational Performance

In the quarter under review, EOG Resources’ total volumes increased 8.6% year over year to 91.9 million barrels of oil equivalent (MMBoe) on higher U.S. production. The figure also came in higher than our estimate of 89 MMBoe.

Crude oil and condensate production totaled 483.3 thousand barrels per day (MBbls/d), up 3.9% from the year-ago quarter’s level and higher than our estimate of 471.6 MBbls/d. Natural gas liquids (NGL) volumes increased 10.4% to 231.1 MBbls/d, also higher than our estimate of 218.6 MBbls/d. Natural gas volume increased to 1,704 million cubic feet per day (MMcf/d) from the year-earlier quarter’s level of 1,469 MMcf/d. The reported figure was higher than our estimate of 1665.2 MMcf/d.

The average price realization for the company’s crude oil and condensates declined 12.95% year over year to $83.60 per barrel. Our estimate for the same was pinned at $82.75 per barrel. Natural gas was sold at $2.66 per Mcf, indicating a year-over-year decline of 70.9%. Quarterly NGL prices declined to $23.56 per barrel from $36.02.

Operating Costs

Lease and well expenses increased to $369 million from $335 million registered a year ago. The figure was also higher than our estimate of $354.8 million. Transportation costs declined from $257 million in the year-ago period to $240 million, also lower than our estimate of $243.7 million. The company reported gathering and processing costs of $166 million, lower than the year-ago quarter’s reported number of $167 million. The figure was also lower than our estimate of $170.7 million.

Exploration costs rose to $43 million from the year-ago quarter’s level of $35 million. As such, total operating expenses in the third quarter were $3,655 million, lower than $3,929 million registered a year ago.

Liquidity Position & Capital Expenditure

As of Sep 30, 2023, EOG Resources had cash and cash equivalents worth $5,326 million and long-term debt of $3,772 million. The current portion of the long-term debt totaled $34 million.

In the reported quarter, the company generated $1,519 million in free cash flow. Capital expenditure amounted to $1,519 million.

Guidance

For 2023, EOG expects total production in the range of 971.9-992.1 MBoe/d. It also anticipates production in the band of 1,000.1-1,029.8 MBoe/d for the fourth quarter.

Capital budget for the year is projected in the range of $5,900-$6,100 million. Out of this amount, $1,400-$1,500 million will likely be used in the fourth quarter.

Zacks Rank & Stocks to Consider

Currently, EOG Resources carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy sector are Liberty Energy Inc. LBRT, Matador Resources Company MTDR and Oceaneering International, Inc. OII, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Liberty reported third-quarter 2023 earnings of 85 cents per share, which beat the Zacks Consensus Estimate of 74 cents. The Denver-CO-based oil and gas equipment company’s outperformance reflects the impacts of strong execution and increased service pricing.

The company’s board of directors announced a cash dividend of 7 cents per common share, payable on Dec 20, 2023, to stockholders of record as of Dec 6, 2023. The dividend increased 40% from the previous quarter’s level.

Matador Resources reported third-quarter 2023 adjusted earnings of $1.86 per share, which beat the Zacks Consensus Estimate of $1.59. MTDR’s milestone led to better-than-expected third-quarter results, with the highest-ever total production averaging more than 135,000 barrels of oil and natural gas equivalent per day.

For the fourth quarter of 2023, MTDR expects an average daily oil equivalent production of 145,000 BOE. The recent guidance indicates a 2% upward revision from the previously mentioned 143,000 BOE/D.

Oceaneering International reported third-quarter 2023 adjusted earnings of 38 cents per share, which beat the Zacks Consensus Estimate of 27 cents. OII’s outperformance was largely due to robust results in certain segments.

For the fourth quarter of 2023, OII anticipates a decline in EBITDA on relatively flat revenues compared with the third-quarter results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report