EOG Resources Inc (EOG) Reports Mixed Results Amidst Market Challenges

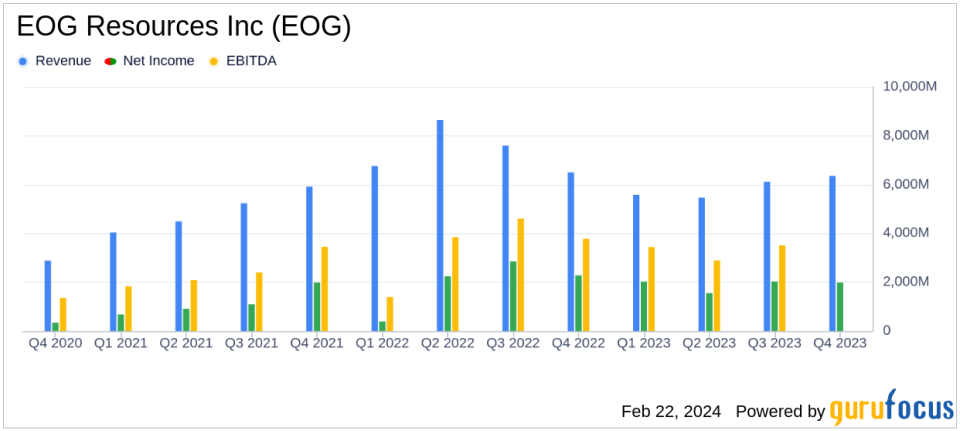

Net Income: EOG Resources Inc (NYSE:EOG) reported a net income of $1.988 billion for Q4 2023, contributing to a total of $7.594 billion for the year.

Revenue: Total operating revenues for Q4 2023 were $6.357 billion, with a yearly total of $24.186 billion.

Operating Expenses: Q4 2023 saw operating expenses of $3.853 billion, totaling $14.583 billion for the year.

Free Cash Flow: EOG generated substantial free cash flow, maintaining financial flexibility and shareholder returns.

Production Volumes: Crude oil equivalent volumes averaged 1,026.2 MBoed in Q4 2023, with a yearly average of 984.8 MBoed.

Dividends: The company declared dividends of $2.4100 per common share in Q4 2023, with a total of $5.8850 for the year.

On February 22, 2024, EOG Resources Inc (NYSE:EOG) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. EOG Resources, a leading oil and gas producer with significant acreage in key U.S. shale plays, reported net proved reserves of 4.2 billion barrels of oil equivalent at the end of 2022. With net production averaging 908 thousand barrels of oil equivalent per day in 2022, the company's portfolio is heavily weighted towards oil and natural gas liquids, comprising 73% of its production mix.

The company's financial results for the fourth quarter of 2023 showed resilience in the face of market volatility. EOG reported a net income of $1.988 billion for the quarter, contributing to a robust annual net income of $7.594 billion. This performance was underpinned by total operating revenues of $6.357 billion for the quarter and $24.186 billion for the year. However, operating expenses also rose to $3.853 billion in Q4 and totaled $14.583 billion for the year, reflecting the cost pressures faced by the industry.

EOG's financial achievements, including substantial free cash flow, are critical for maintaining its competitive edge and ensuring the company can continue to invest in growth opportunities while returning value to shareholders. The company's ability to generate free cash flow also provides the financial flexibility needed to navigate the cyclical nature of the oil and gas industry.

Production volumes remained strong, with crude oil equivalent volumes averaging 1,026.2 MBoed in the fourth quarter, leading to an annual average of 984.8 MBoed. This level of production underscores EOG's operational efficiency and the quality of its asset base. Additionally, the company declared dividends of $2.4100 per common share in Q4, with a total of $5.8850 for the year, demonstrating its commitment to shareholder returns.

EOG's balance sheet remains solid, with cash and cash equivalents of $5.278 billion at the end of December 2023. The company's disciplined approach to capital allocation and its focus on cost management are evident in its financial statements, which show a strong position to weather market uncertainties.

Despite the positive aspects of EOG's financial performance, the company faces challenges such as market volatility, fluctuating commodity prices, and operational risks. These factors can impact profitability and growth prospects. However, EOG's strategic focus on high-quality assets, operational excellence, and financial discipline positions it well to manage these challenges effectively.

In conclusion, EOG Resources Inc (NYSE:EOG) has demonstrated a mixed financial performance in its latest earnings report. While net income and revenue figures show a strong market position, the company must continue to navigate the challenges inherent in the oil and gas sector. Investors and stakeholders will be watching closely to see how EOG leverages its strengths to maintain momentum in the coming quarters.

Explore the complete 8-K earnings release (here) from EOG Resources Inc for further details.

This article first appeared on GuruFocus.