EOG Resources Is Returning Cash to Shareholders

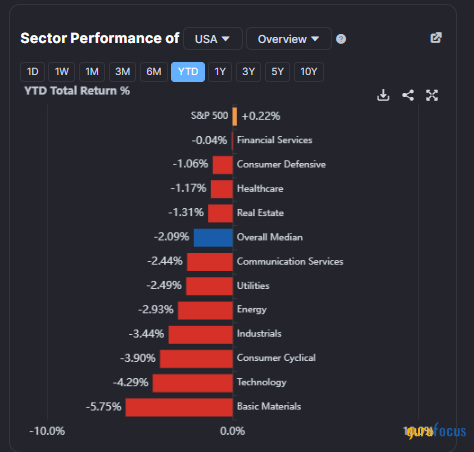

The energy sector has gotten off to a slow start in 2024. Despite oil's bounce off the $70 mark amid geopolitical tensions in the Red Sea and domestic natural gas prices that have risen with cold weather moving through, investors have reverted to mega-cap tech to start the year. That leaves some domestic oil and gas companies as attractively valued, particularly after weakness late in 2023.

I see shares of EOG Resources Inc. (NYSE:EOG) as undervalued. The company remains committed to returning capital to shareholders while the stock's valuation is attractive given a forward price-earnings ratio under of 10 and a high free cash flow yield.

Year-to-date sector performances: Energy underperforming

Company description

According to Bank of America Global Research, EOG is among the largest oil and gas exploration and production companies in the United States. It has proven reserves of about 3 billion barrels of oil equivalent. The company, along with its subsidiaries, explores for, develops, produces and markets crude oil, natural gas and natural gas liquids NGLs. Its primary assets are in New Mexico and Texas with foreign assets in the Republic of Trinidad and Tobago.

EOG was formerly known as enron oil and gas company.

Key data

With a $67.1 billion market cap, the Houston-based company within the energy sector trades at a low 9.7 forward non-GAAP price-earnings ratio and pays an above-market 3.2% forward dividend yield (the company also pays special dividends depending on operational performance). Ahead of earnings next month, shares trade with a moderate 26% implied volatility percentage, while short interest on the stock is low at just 1.3% as of Jan. 11.

Color on the quarter

Back in November, EOG reported a strong quarter of operating results. The company posted third-quarter non-GAAP earnings of $3.44 per share, which topped the Wall Street consensus forecast of just $2.99, while revenue of $6.2 billion, down 18% from year-ago levels, was also above expectations. The company's management team remains committed to returning cash to shareholders a quarterly dividend of 91 cents, up from 82.5 cents previously, was announced along with a $1.50 special dividend, which was paid out in late December. EOG also reported $1.5 billion of free cash flow and cash flow before working capital was $3.04 billion, topping estimates.

Its capital expenditure of $1.52 billion was below guidance, indicating potential deflation in the industry. I will be watching what the management team has to say about capital expenditures in its upcoming report. On the plus side, EOG sports among the highest yields in the industry and aims to return 70% of free cash flow to shareholders, subject to discretionary spending. As a somewhat low-beta stock in a volatile sector, and with no net debt, the company is set up well if oil prices were to tick higher this year.

Peer comparison

Compared to its peers, EOG features a decent valuation while its growth outlook is less sanguine given uncertainty for 2025. Still, profitability trends and free cash flow are some of the best figures you will come across in the oil patch. Earnings per sharerevisions have also been positive in the last three months. Share price momentum, however, has turned south not surprising given how energy commodities have traded.

Risks

Key risks include weaker oil and gas prices which could hurt margins, delays to key projects, poor capex trends and negative regulatory changes.

Valuation

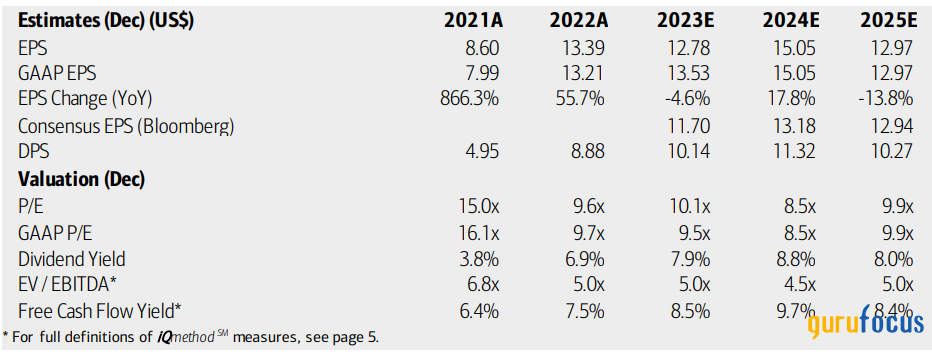

On valuation, analysts at Bank of America see earnings having fallen about 5% in the year that just ended with per-share profits then rebounding in the current fiscal year. 2025 could be another tough period, however. The current consensus outlook calls for earnings just shy of $12 per share in 2023 with near $13 of non-GAP earnings per share in 2024 and 2025. Revenue is expected to have fallen 7% last year following 2022's period of unusually high global oil and gas prices. Net sales are forecasted to grow 7% in 2024 with a 5% increase in the out year. Dividends, meanwhile, are expected to rise above $11 over the coming 12 months, but then a possible dip in 2025.

While the earnings outlook is cloudy, EOG shares trade quite attractively with an operating price-earnings ratio in the high single digits. Moreover, the company's enterprise value/Ebitda ratio is less than half that of the S&P 500. Considering that EOG has produced nearly $10 of free cash flow per share over the last 12 months, its free cash flow yield is high at 8.5%, which tells me there is plenty of opportunity for shareholder-accretive activities like buybacks and perhaps further special dividends over the coming years.

If we apply a modest 11 price-earnings multiple, significantly below the stock's five-year average, and assume normalized earnings of $12.70 per share, then shares should trade near $140, making the stock significantly undervalued right now. Given lower oil and gas prices today compared to the average of last year, the company's comments and outlook in its upcoming quarterly report will be important.

EOG: Earnings, valuation, dividend yield and free cash flow forecasts

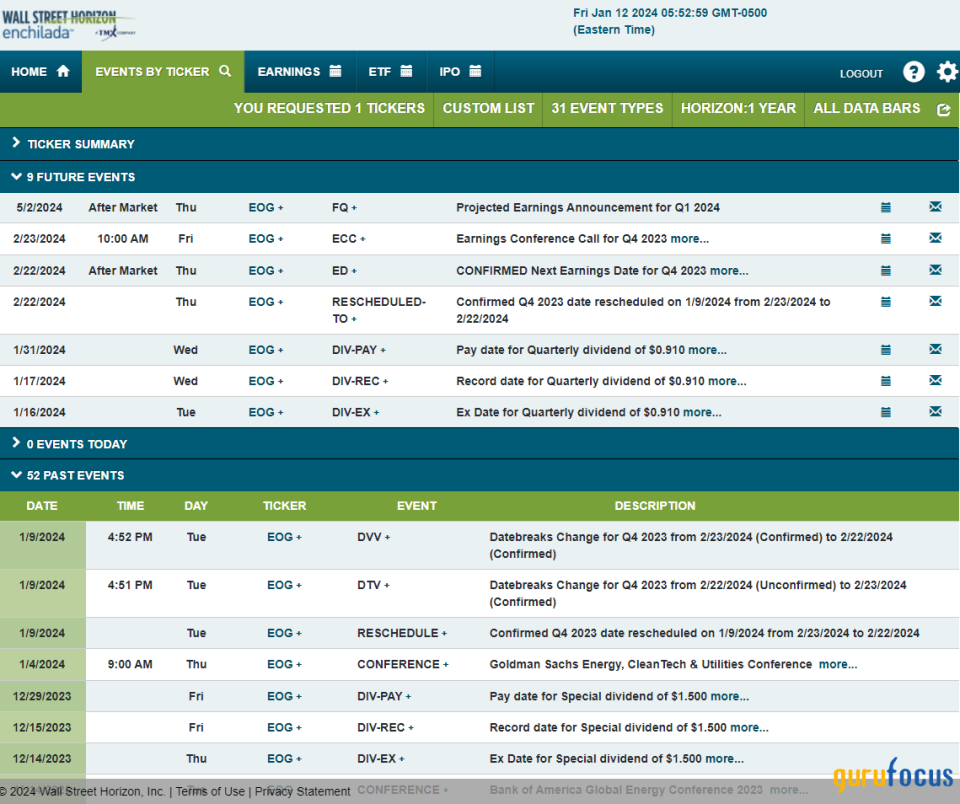

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed fourth-quarter 2023 earnings date of Thursday, Feb. 22 after market close with a conference call the following morning, You can listen live here. Before that, EOG shares trade ex. a 91-cent dividend on Tuesday, Jan. 16.

Corporate Event Risk Calendar

The technical take

While energy prices have fallen over the past several months, EOG sports an attractive valuation in my view. The stock's momentum, however, has taken a hit since mid-October. Notice in the chart below that a trading range has persisted between the mid-$90s (support) and about the $150 mark (resistance). As a result, there is a high amount of volume by price centered around $120. Since shares now trade slightly below that point, the onus is on the bulls to bring the stock above the current area of congestion.

What's more, EOG's long-term 200-day moving average, used to identify the primary trend, is merely flat in its slope, suggesting that neither the bulls nor the bears have a firm hold on the stock. Additionally, the relative strength index momentum gauge at the bottom of the graph has dipped to near technical oversold levels, but it is not there yet, so there is the risk of further downside before we can call a near-term low. Amid this frustrating range, I would not be surprised to see EOG retest the $90s given the breakdown below an intermediate level of support that was around $117.

Overall, the chart is unimpressive right now, and some technical downside risk to below $100 is possible over the coming weeks and months while a broad trading range is ongoing.

EOG: A stubborn trading range, key support under $100

The bottom line

I see shares of EOG Resources as undervalued fundamentally. Its high dividend yield and strong free cash flow are positive traits, but the technical picture is unimpressive as oil and gas prices remain low relative to recent history.

This article first appeared on GuruFocus.