EPAM Systems (EPAM) Beats on Q2 Earnings and Revenue Estimates

EPAM Systems EPAM reported better-than-expected second-quarter 2023 results. The company’s second-quarter non-GAAP earnings of $2.64 per share beat the Zacks Consensus Estimate of $2.34. The figure increased by 10.9% year over year.

Revenues were $1.71 billion, which surpassed the consensus mark of $1.16 billion. However, the top line declined 2.1% year over year. On a constant-currency (cc) basis, the top line was down 2.4%. The year-over-year decline in revenues reflects the negative impacts of a slowdown in IT spending amid the ongoing uncertain macroeconomic environment.

Geography-wise, EPAM generated 58% of the total revenues from the Americas, down 5.9% year over year. However, revenues from the EMEA, contributing 39.2% to total revenues, jumped 8.5% year over year.

Sales in the Asia Pacific region declined 19.7% year over year and accounted for 2.1% of revenues. Central and Eastern Europe, representing 0.7% of revenues, plunged 61.1% year over year.

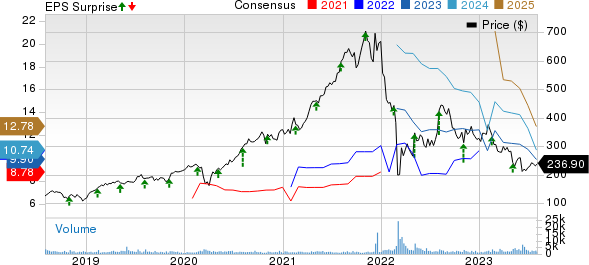

EPAM Systems, Inc. Price, Consensus and EPS Surprise

EPAM Systems, Inc. price-consensus-eps-surprise-chart | EPAM Systems, Inc. Quote

Quarterly Details

Segment-wise, Business Information & Media declined 4.1% year over year to $189.7 million and accounted for 16.2% of the company’s revenues.

Financial Services increased 3.2% on a year-over-year basis to $259 million and accounted for 22.1% of revenues.

While Software & Hi-Tech was down 10.3% to $175.2 million, Travel & Consumer declined 1% to $273.5 million. Software & Hi-Tech and Travel & Consumer accounted for 15% and 23.4% of revenues, respectively.

Life Science & Healthcare fell by 10.9% year over year to $114.4 million and accounted for 9.8% of revenues. The Emerging Verticals segment improved by 8.6% year over year to $158.4 million and contributed 13.5% to revenues.

EPAM’s non-GAAP gross profit increased 1.6% to $381.8 million, while the gross margin expanded 110 basis points (bps) to 32.6%. The non-GAAP operating income increased 7.5% year over year to $190.8 million. The non-GAAP operating margin expanded by 140 bps to 16.3%.

Balance Sheet and Cash Flow

As of Jun 30, 2023, EPAM had cash, cash equivalents and restricted cash of $1.78 billion, up from $1.75 billion as of Mar 31, 2023.

As of Jun 30, 2023, the long-term debt was $25.9 million, down from $27.7 million as of Mar 31, 2023.

In the second quarter, EPAM generated operating and free cash flows of $89.1 million and $82.2 million, respectively. In the first half of 2023, the company generated operating and free cash flows of $176.4 million and $161.6 million, respectively.

Guidance

EPAM provided guidance for the third quarter of 2023. The company estimates reporting revenues between $1.14 billion and $1.15 billion, suggesting a year-over-year decline of 0.7% at the midpoint of the guidance range.

Management projects the non-GAAP operating margin in the 15.5-16.5% range. Non-GAAP earnings are expected in the range of $2.52-$2.60 per share.

For 2023, the company projects revenues in the range of $4.65-$4.70 billion, suggesting a decline of 3% at the midpoint. EPAM set non-GAAP earnings guidance in the $9.90-$10.10 per share range. The company forecast its non-GAAP operating margin guidance between 15% and 16% for 2023.

Zacks Rank & Stocks to Consider

Currently, EPAM carries a Zacks Rank #4 (Sell). Shares of EPAM have plunged 27.7% year to date (YTD).

Some better-ranked stocks from the broader technology sector are NVIDIA NVDA, Fortinet FTNT and Salesforce CRM. NVIDIA and Fortinet each sport a Zacks Rank #1 (Strong Buy), while Salesforce carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA's second-quarter fiscal 2024 earnings has been revised upward by a couple of cents to $2.06 per share in the past 30 days. For fiscal 2024, earnings estimates have increased by 13 cents to $7.79 per share in the past 30 days.

NVIDIA’s earnings beat the Zacks Consensus Estimate twice in the preceding four quarters while missing the same on two occasions, the average surprise being 0.3%. Shares of NVDA have surged 202.9% YTD.

The Zacks Consensus Estimate for Fortinet’s second-quarter 2023 earnings has remained unchanged at 34 cents per share in the past 60 days. For 2023, earnings estimates have remained unchanged at $1.46 per share in the past 60 days.

Fortinet’s earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 16.4%. Shares of FTNT have rallied 52% YTD.

The Zacks Consensus Estimate for Salesforce's second-quarter fiscal 2024 earnings has been revised upward by a penny to $1.90 per share in the past 60 days. For fiscal 2024, earnings estimates have moved upward by a couple of cents to $7.44 per share in the past 60 days.

Salesforce's earnings beat the Zacks Consensus Estimate in the preceding four quarters, the average surprise being 15.5%. Shares of CRM have surged 66.3% YTD.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

EPAM Systems, Inc. (EPAM) : Free Stock Analysis Report