EPAM Systems Inc (EPAM) Reports Decline in Q4 and Full Year 2023 Earnings Amid Cost ...

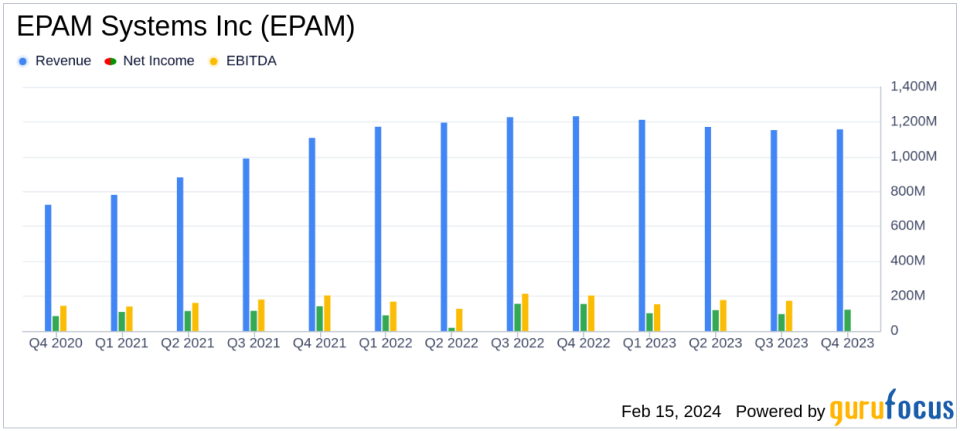

Revenue: Q4 revenue decreased by 6.0% year-over-year to $1.157 billion; full-year revenue down 2.8% to $4.691 billion.

Net Income: Q4 GAAP net income fell to $97.6 million; full-year net income slightly decreased to $417.1 million.

Earnings Per Share (EPS): Q4 GAAP diluted EPS dropped 36.4% to $1.66; non-GAAP diluted EPS decreased by 6.1% to $2.75.

Operating Margin: GAAP income from operations was 10.6% of revenues in Q4; non-GAAP income from operations was 17.3%.

Cash Flow: Operating cash flow for Q4 was $171.4 million, with a full-year increase to $562.6 million.

Share Repurchase: EPAM repurchased 143 thousand shares for $36.5 million in Q4; 686 thousand shares for $164.9 million in the full year.

Headcount: Total headcount decreased to approximately 53,150, with delivery professionals down 10.4% year-over-year.

On February 15, 2024, EPAM Systems Inc (NYSE:EPAM), a leading global provider of digital transformation services and product engineering, released its 8-K filing, disclosing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its expertise in platform engineering, software development, and consulting services, with a significant presence in North America, reported a decrease in revenues and earnings per share for both the quarter and the year.

EPAM's CEO & President, Arkadiy Dobkin, commented on the company's resilience in the face of a challenging economic climate and its strategic focus on leveraging Generative AI opportunities.

EPAM's performance in 2023 reflects our ability to successfully navigate a volatile demand and macro-economic environment," said Dobkin. "After rebalancing the majority of our delivery platforms across Europe, India, Asia and Latin America, and refining our growth strategy, we are now focused on harmonizing our delivery quality, optimizing cost-effectiveness, and proactively leveraging our extensive data, engineering and consulting experience to capitalize on Generative AI opportunities."

The decrease in revenue for Q4 was attributed to a combination of factors, including the impact of the company's exit from Russia and a volatile macro-economic environment. The company's GAAP income from operations was also impacted by costs incurred in connection with the Company's Cost Optimization Program.

Despite the downturn, EPAM's cash position improved significantly, with cash, cash equivalents, and restricted cash totaling $2.043 billion as of December 31, 2023, marking a 21.4% increase from the previous year. This reflects the company's strong balance sheet and liquidity, which are crucial for navigating uncertain economic times and investing in growth opportunities.

Looking ahead, EPAM provided guidance for 2024, projecting a modest revenue growth rate of 1% to 4% for the full year. The company also expects GAAP income from operations to be between 9.5% to 10.5% of revenues and non-GAAP income from operations to be between 14.5% to 15.5% of revenues. For the first quarter, EPAM anticipates revenues in the range of $1.155 billion to $1.165 billion, reflecting a year-over-year decline at the midpoint of the range.

EPAM's financial stability and strategic initiatives, including its focus on Generative AI, position the company to potentially benefit from the evolving technological landscape. However, the reported decline in key financial metrics such as revenue and EPS, and the reduction in headcount, highlight the challenges faced by the company in a competitive and changing market.

Investors and stakeholders will be closely monitoring EPAM's performance in the coming quarters to assess the effectiveness of its cost optimization measures and its ability to capitalize on new technology trends.

For a more detailed analysis of EPAM Systems Inc's financial results, including the full income statement and balance sheet, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from EPAM Systems Inc for further details.

This article first appeared on GuruFocus.