EPAM Systems Is a Significant Value Opportunity

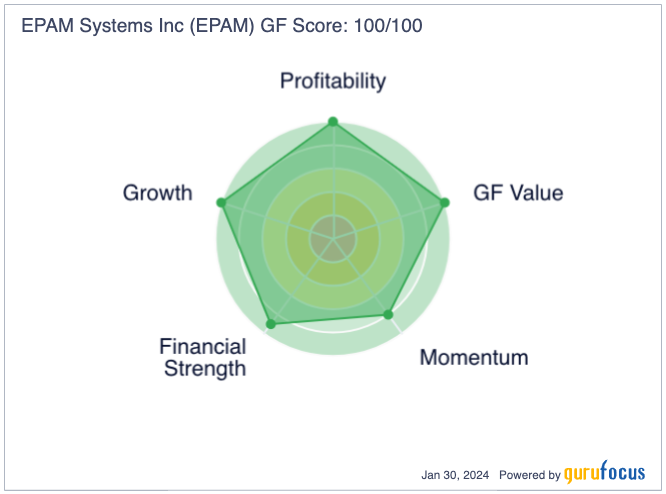

EPAM Systems Inc. (NYSE:EPAM) is perfectly positioned to buy based on my analysis. The company is a high-growth investment that has few risks. Its valuation looks like a momentary opportunity as its share price is currently down almost 60% from its high. With a GF Score of 100 out of 100 and an adequate margin of safety based on my discounted cash flow analysis, my analyst rating for the stock is a strong buy.

Overview

The company provides digital platform engineering and software development around the world. Its core areas of expertise include cloud computing, consumer and enterprise software, cybersecurity and information technology. Operating across various industries, it provides services that include strategy optimization for almost all advanced technology developments, including the metaverse, the internet of things and open-source solutions.

EPAM has been named on Forbes' list of the 25 Fastest Growing Public Tech Companies and on Fortune's 100 Fastest-Growing Companies list multiple times. It joined the S&P 500 in December 2021.

In the third quarter of 2023, the company reported revenue of $1.20 billion and net income of $97 million. It has a market cap of $16.75 billion and an enterprise value of $15 billion

Recent developments in 2024 include EPAM releasing a customizable suite of retail media accelerators in partnership with Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Cloud. Known as EPAM's Retail Media Orchestration Toolkit, it primarily assists with driving efficiency, scale and functionality in the retail media sector.

Financial considerations

The company is very strong all around. This is made immediately evident by a GF Score of 100 that is supported by robust ratings for all five performance categories.

Significantly, it has a 27% revenue growth rate and a 20% earnings per share without nonrecurring items growth rate over the last three years on average. Its balance sheet is strong with 79% of its assets balanced by equity. Additionally, it has a net margin of 9.96%, significantly stronger than the industry median of 1.32%.

However, its gross margin of 30.92% is the lowest it has ever been over the last 10 years, a significant drop from its median gross margin of 36.03% over the period. The industry median is 41.92%. EPAM's gross margin has been in long-term decline.

Such a high net margin, as opposed to a relatively weak gross margin, shows the high cost of goods sold for the company while remaining incredibly operationally efficient. This is further evidenced by its 12.07% operating margin, much higher than the industry median of 2.65%. It shows significant expenditures on quality for its products and services for clients, while also knowing how to maximize earnings by proper organization internally.

To understand the stability of the company's growth over the long term, historically, its total equity has been circa 70% 5o 80% of assets since 2012. Over the last 10 years, as an annual average, its revenue growth rate has been 23.10% and its earnings per share without NRI growth rate has been 24%.

There are concerns over whether EPAM will be able to keep up its high growth rates. Recently, it has been moving away from low-cost locations such as Russia and Belarus. Bellasooa Research elucidates that, as a result, there have been increased average costs of delivery, a potential detriment to the company's pricing competitiveness. Utilization rates have also decreased recently; a smaller portion of employees' time is billable to clients. Unfortunately, this is largely the result of customers transitioning work to other vendors. As a result, the company has been looking at workforce reductions; this could impact its ability to expand its offerings in the near term.

Value opportunity

EPAM's price-earnings ratio is around 36 right now, but that improves on a forward basis down to around 29. As such, the growth in earnings is particularly notable and promising for the present valuation.

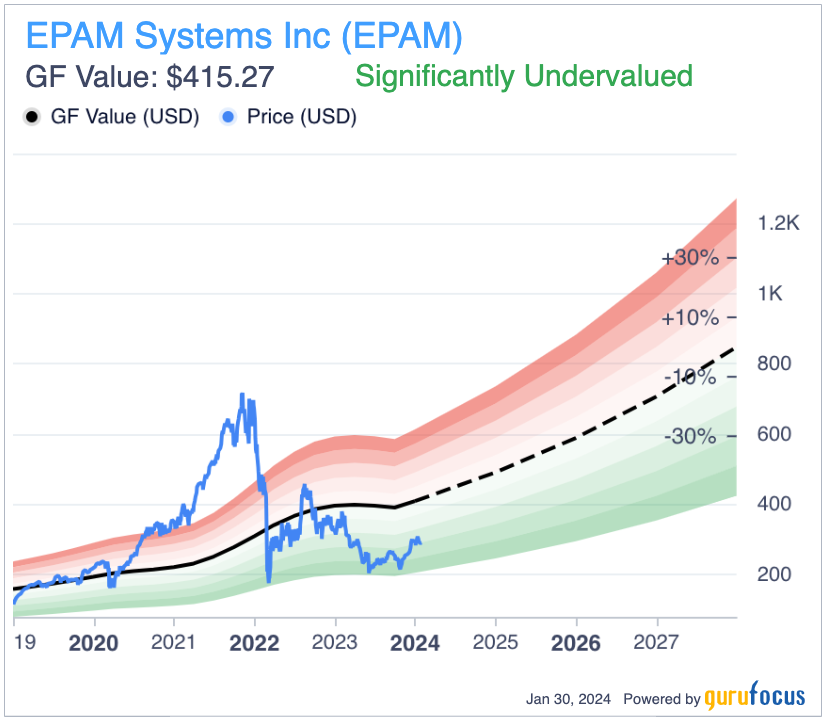

The shares are almost 60% below their high of $717.49, currently trading at around $290. GuruFocus proposes a GF Value of around $415, a potential 30% margin of safety if bought now.

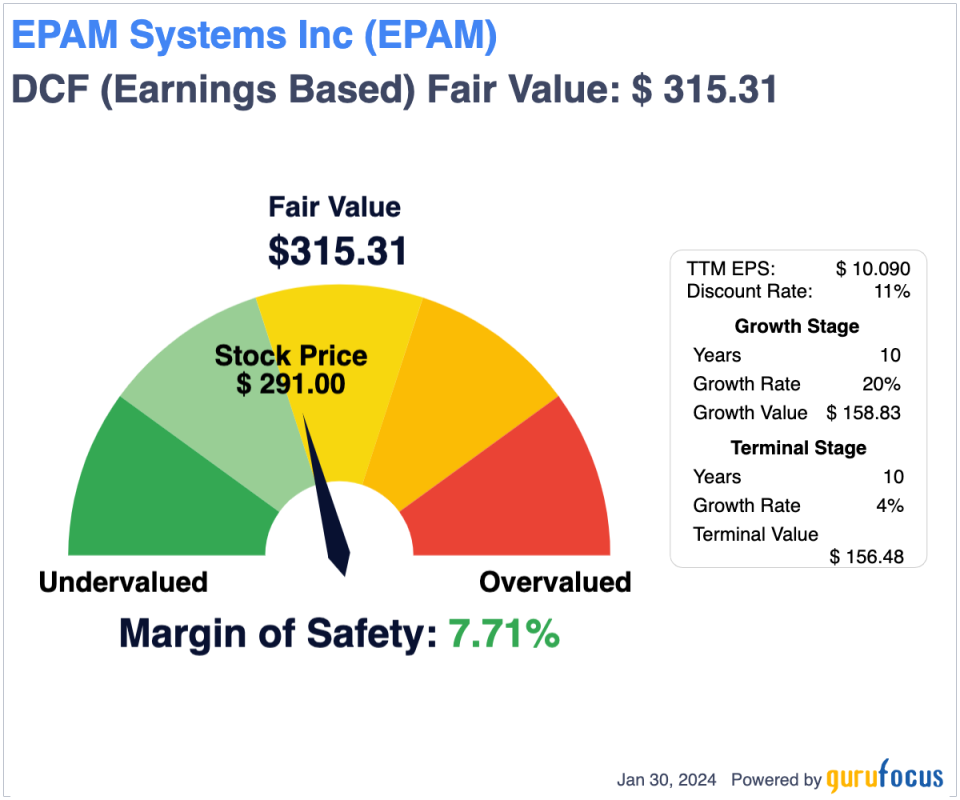

By using a standard and conservative discounted cash flow analysis, I can also consider a traditional understanding of a more moderate margin of safety that could be attributed to EPAM shares at this time. Using the last three-year earnings per share growth average of 20% and projecting this forward for the 10-year growth stage gives a fair value of around $315, an 8% margin of safety.

Based on measures like its price-earnings ratio, EPAM's stock does not look like a value opportunity. However, its PEG ratio of around 1 provides much of the potential here. With the current price so low compared to historically and stability on its balance sheet to support continued top and bottom line growth, this seems like an obvious value investment at the moment when the whole valuation profile is considered.

My highly conservative fair value estimate of $315 is what I am comfortable allocating with this in mind. The more optimistic $415 fair value proposed by GuruFocus adds potential upside to consider.

Risks

As mentioned above, EPAM moved over 10,000 employees out of Eastern Europe, including Russia and Belarus, due to geopolitical pressures. The significance of this and lower utilization rates at present, which could lead to reduced employee count and less ability to scale its capabilities, are two major risks I would like to reiterate. These events could have an effect on the company's profitability and revenue growth in the short-to-medium term.

EPAM is also going to face significant competition from peers, including Accenture (NYSE:ACN), who have a strong focus on cloud services and emerging advanced technology like artificial intelligence. Additionally, Cognizant Technology Solutions (NASDAQ:CTSH), Infosys (NYSE:INFY) and Tata Consultancy Services (NSE:TCS) are all large and low-risk players that offer significant opportunities for investors and are highly competitive. Accenture, as a prime example, has a market cap of around $234 billion. Compared to EPAM's $16.75 billion market cap, Accenture can potentially adopt new market trends faster due to higher financing ability.

Conclusion

This stock will likely be added to my portfolio in February. I have rated the company a strong buy based on its exceptional financials, including a historically and present stable balance sheet. The valuation is appealing right now, and the risks related to operational slowdown and recent challenges, as well as competition concerns, present no immediately severe threats.

This article first appeared on GuruFocus.